The process of identifying stocks with high growth potential often involves a dual approach: finding strong technical patterns and confirming solid underlying business momentum. One method for this joins Mark Minervini's recognized Trend Template with a look at high-growth fundamentals. Minervini's template offers a strict technical checklist to confirm a stock is in a strong, clear uptrend, while a high growth momentum screen looks for companies showing faster earnings and sales, the basic fuel that can push a trend forward. This joined filter tries to find leaders early in their growth period, matching price strength with business strength.

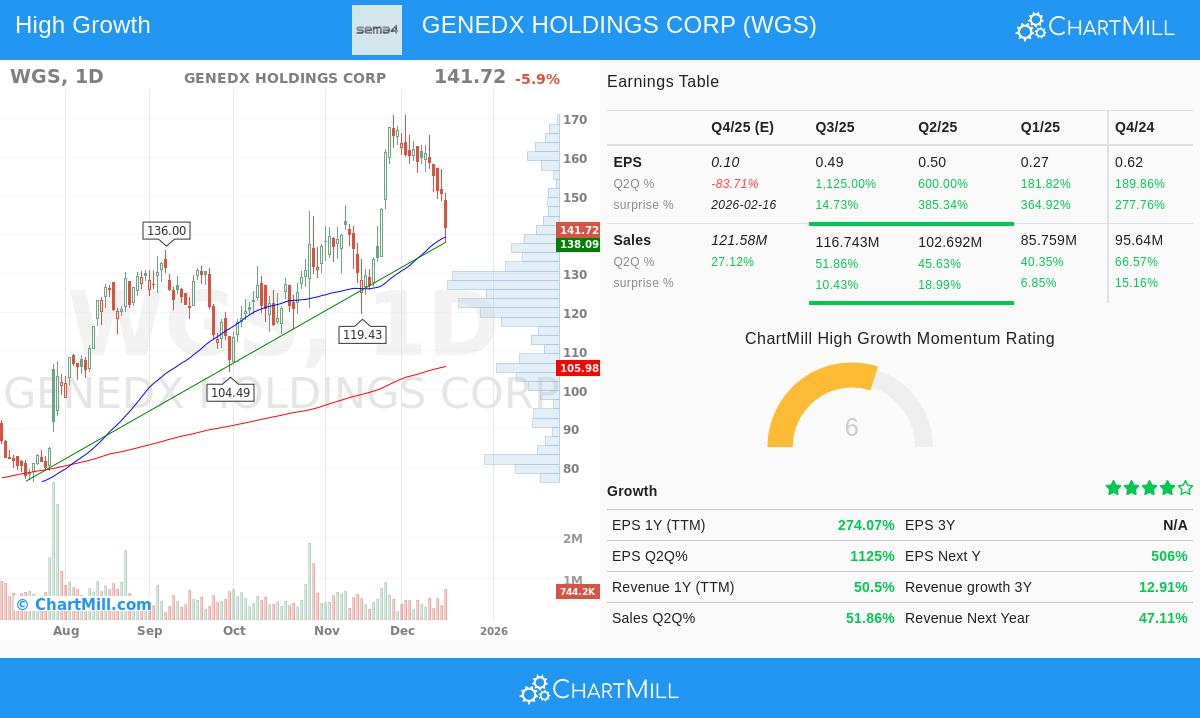

GeneDx Holdings Corp. (NASDAQ:WGS) appears as a present candidate that passes this strict joined screen. The company, a health intelligence firm working on genomic testing for pediatric and rare diseases, shows a chart and financial profile that matches the standards looked for by growth-focused investors using an organized trend-following method.

Technical Match with the Minervini Trend Template

Mark Minervini's Trend Template is made to filter for stocks showing clear, multi-timeframe strength, staying away from unclear or poor trends. A look at WGS's technical position shows it fits the main ideas of this method:

- Trading Above Key Averages: The stock's present price is above its rising 50-day, 150-day, and 200-day simple moving averages (SMAs). This order shows positive momentum across short, medium, and long-term periods.

- Correct Moving Average Order: The 50-day SMA ($139.39) is above both the 150-day SMA ($111.57) and the 200-day SMA ($105.98), while the 150-day SMA is also above the 200-day SMA. This step-like order is a known sign of a sound, speeding uptrend.

- Nearness to Highs: WGS trades within 25% of its 52-week high of $170.87, a main Minervini rule that focuses on strength instead of low price. Stocks near highs often have the momentum to keep leading.

- Better Relative Strength: With a ChartMill Relative Strength (CRS) score of 92.91, WGS does better than over 92% of the market. High relative strength is a key part of the Minervini plan, pointing out sector leaders that draw institutional money.

This technical view indicates WGS is in a clear Stage 2 climb, the phase Minervini's method aims for.

Basic Fuel for High Growth Momentum

A strong chart is most convincing when backed by getting better fundamentals. The High Growth Momentum (HGM) part of the screen looks for companies where business results are speeding up, a usual feature of stocks before large price gains. GeneDx shows several of these features:

- High Earnings Growth: The company has reported very large year-over-year earnings per share (EPS) growth in recent quarters, including 1125% in the newest quarter. This comes after a series of big beats, with the company topping analyst EPS guesses by an average of over 260% in the last four quarters.

- Strong Revenue Growth: Top-line growth is also solid, with trailing twelve-month revenue up over 50% and recent quarterly sales growth regularly above 45%. This shows wider market reach and demand for its genomic testing services.

- Positive Estimate Changes and Path: While future guesses can change, the company has seen analysts lift their next-year revenue estimates by almost 4% over the last three months, showing more belief in its business path.

For users of the Minervini SEPA (Specific Entry Point Analysis) method, these basic factors represent the possible "catalyst" and "fundamentals" parts. Strong earnings beats and faster revenue can work as the events that bring in new buyers and maintain a technical uptrend.

Present Technical Condition and Setup Points

According to ChartMill's own analysis, WGS gets a high Technical Rating of 9 out of 10, confirming its place as a technically sound stock in a positive long-term trend. The analysis states the stock is a top performer in the Health Care Providers & Services industry. However, the report also gives a lower Setup Rating of 3, showing that after its big climb, the stock may be stretched and not in a present, low-risk pause pattern good for a new entry. The report proposes waiting for a time of price pause to form a clearer support area before thinking about an entry.

For a full look at the support levels, trend study, and automated setup check, you can see the full technical report for WGS.

Finding Like Chances

Stocks that match both a strict trend template and high-growth fundamentals can be uncommon but strong finds. This specific study of GeneDx Holdings Corp. came from a systematic screen made to find such chances. Investors curious about using this joined Minervini and growth momentum method to the present market can run the "High Growth Momentum + Trend Template" screen themselves to see other possible candidates that meet these standards.

Disclaimer: This article is for information and learning only. It is not meant as investment advice, a suggestion, or an offer or request to buy or sell any securities. The analysis is based on given data and certain methods, but past results do not show future outcomes. Investors should do their own research and talk with a qualified financial advisor before making any investment choices. Please read our full disclaimer and terms of use for more information.