Investors looking for growth chances at fair prices often use screening methods that weigh several basic factors. The "Affordable Growth" method focuses on companies showing solid growth paths while keeping good financial condition and earnings, all without having overly high prices. This system tries to find businesses set for enlargement that are not yet valued as flawless, possibly presenting appealing risk-return setups for investors focused on growth.

Growth Path

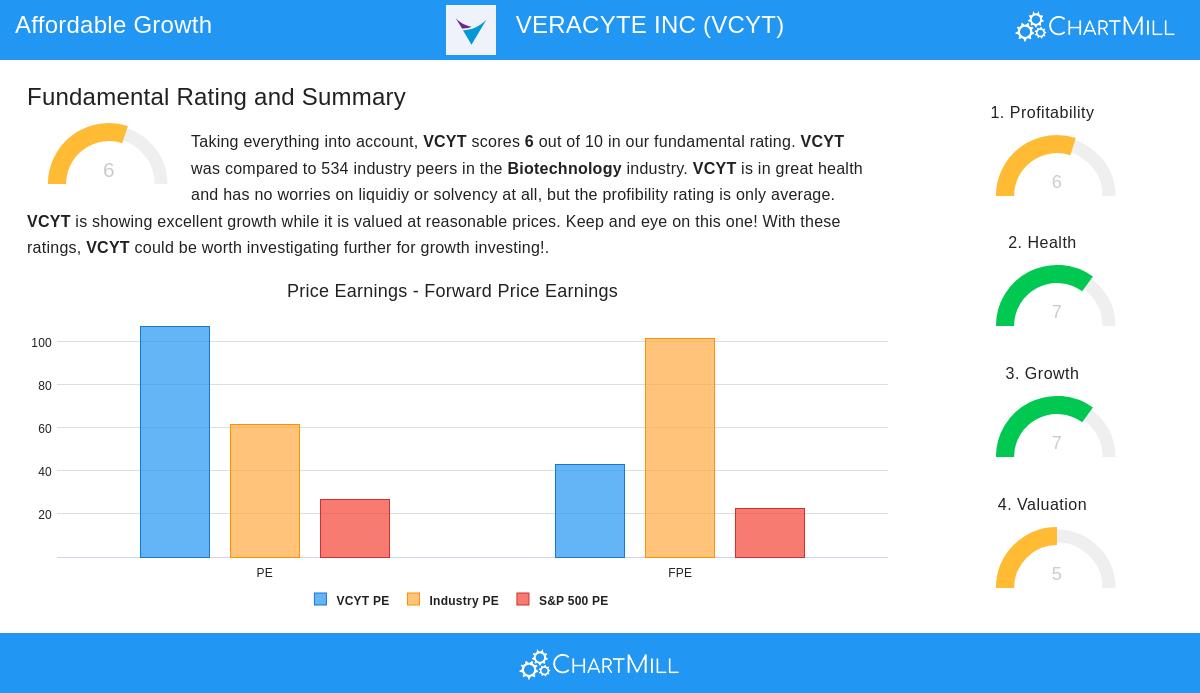

Veracyte Inc (NASDAQ:VCYT) shows notable growth traits that build the base of its attraction as a candidate for affordable growth. The company's recent results indicate important speed in main financial measures, with especially good outcomes in earnings growth. This strong growth outline is key for the affordable growth plan, as it supplies the basic force for future stock price gains without depending only on valuation increases.

- Earnings Per Share grew 144% over the last year

- Revenue rose 19.91% compared to the previous year

- Five-year average yearly revenue growth of 29.93%

- Future EPS growth estimated at 51.73% per year

- Anticipated revenue growth of 10.07% going forward

The company's growth score of 7 out of 10 shows this steady but notable expansion picture, joining good past results with solid future forecasts. This mix implies the company is keeping its growth path while changing to more maintainable growth speeds.

Valuation Review

Veracyte's valuation shows a detailed view that fits well with the affordable growth idea. While some standard measures seem high, the situation inside the biotechnology field shows a more fair placement. The company's valuation score of 5 out of 10 means it is in the middle area, not strongly cheap but not overly costly considering its growth chances and field setting.

- P/E ratio of 107.30 seems high by itself

- Yet, 90.82% of biotechnology similar companies trade at higher P/E ratios

- Future P/E of 42.75 stays lower than 90% of industry rivals

- Enterprise Value/EBITDA ratio places VCYT less expensive than 91.57% of biotech businesses

- Price/Free Cash Flow ratio is better than 93.26% of field equals

The valuation study gets especially important when thinking that growth investing often needs paying above-average multiples, but the affordable growth method tries to bypass the highest prices found in the field. Veracyte's place inside its industry suggests it gives growth contact without the most inflated prices seen in the sector.

Financial Condition and Earnings

Beyond growth and valuation, Veracyte shows good basic strength through its financial condition and earnings measures. The company keeps a health score of 7 out of 10, helped by several main points that lower business risk while supporting ongoing growth plans.

The company's balance sheet strength is clear in several parts:

- No current debt, removing interest cost and failure risk

- Current ratio of 5.43 shows good short-term cash availability

- Quick ratio of 5.10 means plenty of liquid assets

- Altman-Z score of 13.88 shows very low failure risk

Earnings measures show a company moving toward maintainable profits:

- Return on Assets of 1.96% does better than 90.26% of industry equals

- Return on Equity of 2.16% is higher than 91.20% of biotechnology firms

- Profit margin of 5.50% is in the top 8.8% of the field

- Operating margin of 7.78% beats 91.39% of rivals

These condition and earnings features give important support for the affordable growth idea, as they imply the company can pay for its growth plans from inside while keeping financial steadiness.

Investment Points

For investors using the affordable growth plan, Veracyte stands as an interesting example in weighing growth possibility against valuation questions. The company's good market place in diagnostic goods for cancer finding, joined with its no-debt balance sheet and getting-better earnings, makes a base for continued enlargement. The full fundamental analysis report gives more detailed looks into these separate parts.

While the company meets the normal tests of growth businesses, including the need to keep creating new things and widening its test menu, its financial picture suggests it has the means to handle these tests. The affordable growth screen specially looks for companies like Veracyte that show this mix of features, strong enough growth to push future gains, but not so overpriced that they have used up their valuation increase potential.

Investors curious to research similar chances can find other affordable growth picks through our screening tools, which allow changes based on specific growth, valuation, condition, and earnings settings.

Disclaimer: This study is based on fundamental data and screening systems for information reasons only. It does not form investment guidance, suggestion, or support of any security. Investors should do their own research and talk with financial consultants before making investment choices. Past results do not assure future outcomes, and all investments hold risk including possible loss of original money.