Veracyte Inc (NASDAQ:VCYT) has been identified as a candidate through an "Affordable Growth" screening method. This process finds companies showing solid expansion possibility while keeping acceptable valuations and good fundamental condition. The method looks for stocks with growth ratings above 7, valuation scores over 5, and satisfactory profitability and financial health numbers, trying to find companies that provide growth at sensible prices instead of pursuing costly momentum stocks.

Growth Path

Veracyte's growth profile is notable as especially strong, with the company showing solid expansion in several measures. The diagnostic company's recent results indicate notable momentum in both revenue creation and earnings increase. The company's revenue growth of 19.91% over the last year supports a longer-term yearly growth rate of almost 30%, showing continued business development. More significantly, earnings per share jumped by 144% in the last year, showing better operational effectiveness together with top-line growth.

Important growth measures include:

- 144% EPS growth over the last year

- 19.91% revenue growth in the most recent year

- 29.93% yearly revenue growth over several years

- Anticipated future EPS growth of 51.73% each year

- Estimated revenue growth of 10.07% going forward

Valuation Review

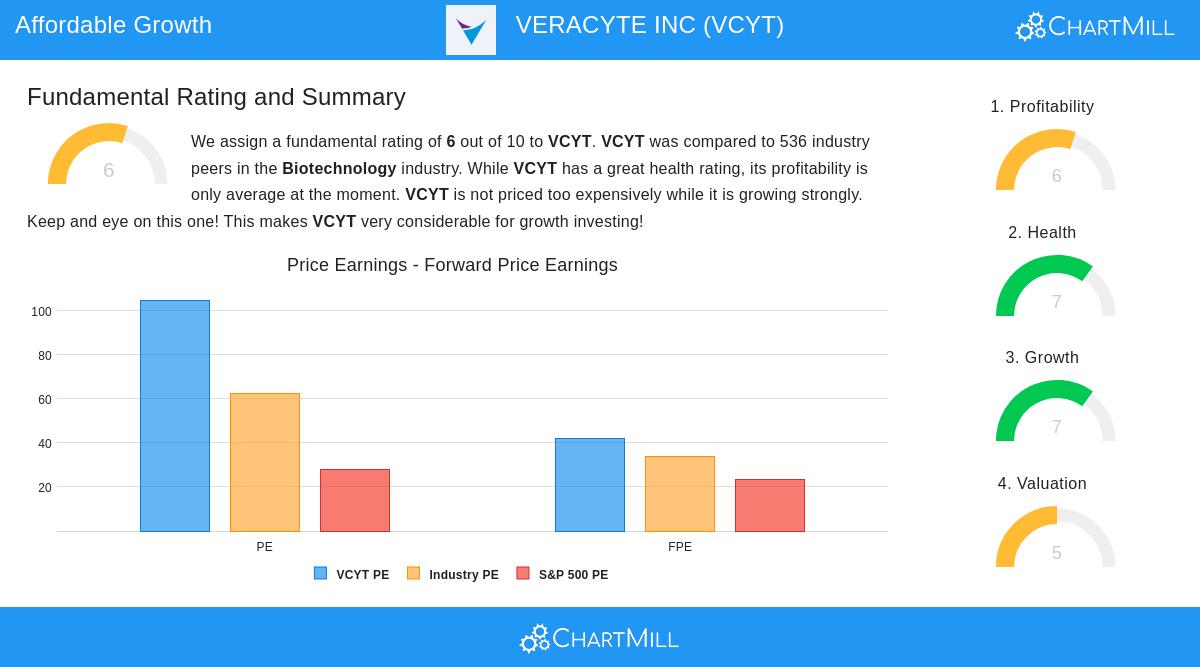

While Veracyte trades at higher multiples compared to general market averages, its valuation seems acceptable considering its biotechnology industry counterparts and growth outlook. The company's valuation numbers show a varied situation that needs thoughtful examination relative to industry norms and growth projections. The forward-looking valuation measures indicate better value than traditional past multiples, which is typical for growth companies spending significantly on future development.

Valuation points:

- P/E ratio of 104.88 seems high versus S&P 500 average of 27.76

- Forward P/E of 41.79 stays above market average but more acceptable

- Enterprise Value/EBITDA ratio makes VCYT less expensive than 91.6% of industry peers

- Price/Free Cash Flow ratio more appealing than 93.66% of biotechnology companies

- PEG ratio factors balanced against expected 59.49% earnings growth

Financial Condition and Profitability

The company keeps a solid financial standing with no debt, giving important operational adaptability and lowering financial risk. Veracyte's balance sheet strength is shown by very good liquidity ratios and solvency measures that do better than most industry rivals. The Altman-Z score of 13.57 shows very low bankruptcy risk and places the company in a good position for handling industry difficulties or seeking strategic options.

Profitability numbers display improvement, though this stays a field for ongoing progress:

- Return on Assets of 1.96% does better than 90.49% of industry peers

- Return on Equity of 2.16% is higher than 91.42% of biotechnology companies

- Profit margin of 5.50% places in the top group of the industry

- Operating margin of 7.78% shows operational effectiveness

- Gross margin of 68.26% gives a good base for profitability

Investment Points

For investors looking for affordable growth possibilities, Veracyte offers an interesting situation where solid growth measures are weighed against valuation questions. The company's place in cancer diagnostics represents an increasing market area with lasting demand features. The mix of solid revenue development, improving profitability, and clear balance sheet supports the growth-at-acceptable-price idea, though investors should watch valuation levels relative to performance on growth projections.

The company's fundamental traits match well with the affordable growth plan, which aims to prevent paying too much for growth while making sure companies have the financial steadiness to perform their expansion plans. Veracyte's solid growth ratings joined with acceptable valuation scores within its industry setting make it worth consideration for growth-focused portfolios.

For investors wanting to find similar possibilities, other affordable growth candidates are available through our stock screener using comparable standards.

Disclaimer: This analysis is based on fundamental data and ratings provided by ChartMill and is intended for informational purposes only. It does not constitute investment advice, and investors should conduct their own research and consider their individual financial circumstances before making investment decisions. Past performance does not guarantee future results, and all investments carry risk, including potential loss of principal.