Investors looking for growth chances often face the test of balancing a company's bright future with its present cost. The "Growth at a Reasonable Price" or "affordable growth" method tries to handle this by finding companies that show solid growth paths but are not priced at extreme levels. This method tries to sidestep the error of paying too much for future promise while still benefiting from upward movement. One way to find such stocks is by using basic ratings that evaluate important areas like growth, valuation, profitability, and financial soundness. A stock that performs well across these measured factors can make a strong argument for more study.

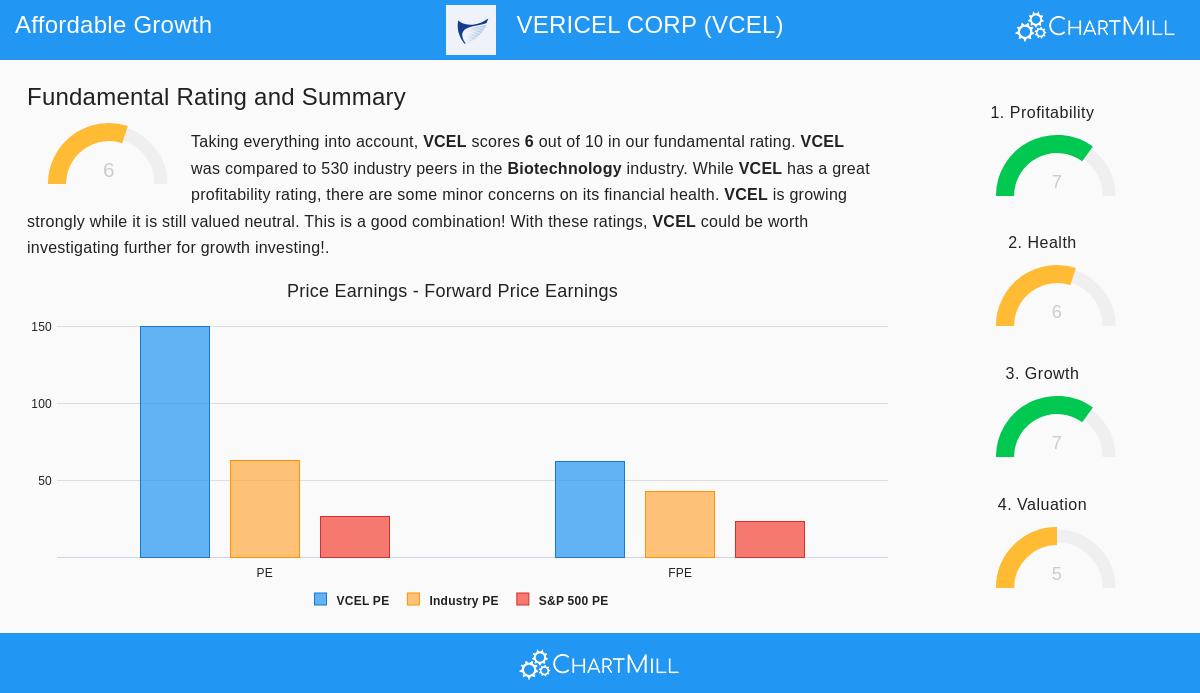

VERICEL CORP (NASDAQ:VCEL) recently appeared from an "Affordable Growth" filter that looks for stocks with a growth rating above 7, a valuation score above 5, and acceptable scores in profitability and financial soundness. This outline indicates the company, a supplier of advanced cellular therapies for sports medicine and severe burn care, may fit with the GARP idea. An examination of its basic report shows the positives and points to note behind this filter result.

Growth Profile: Solid Momentum and View

The center of any growth investment is the company's capacity to enlarge its business, and Vericel shows force in this part. Its ChartMill Growth Rating of 7 out of 10 is powered by firm past results and a positive future.

- Recent Results: Over the last year, the company has displayed notable enlargement, with Revenue increasing 14.05% and Earnings Per Share rising by 300%. This shows not only top-line growth but also major gain in bottom-line effectiveness.

- Long-Term Path: Looking back five years, Revenue has increased at an average yearly speed of 15.01%, showing steady performance in its specialized markets.

- Future Projections: Analyst forecasts indicate a speeding up of this pattern. Revenue is estimated to grow almost 18% each year, while EPS is predicted to rise over 60% per year on average. This forward growth is a vital piece for the affordable growth argument.

Valuation Check: A Relative Value in a High-Cost Field

While pure valuation measures can seem high for a growth company, setting within its industry is key. Vericel's Valuation Rating of 5 shows a varied image that tilts positive when measured against similar companies, which is a main idea of the filter method, staying clear of high cost.

- Industry Measurement: The biotechnology field is often marked by high valuation multiples. In this setting, Vericel seems somewhat fairly priced. Its Price/Earnings and Price/Forward Earnings ratios are lower than about 90% of its industry peers.

- Cash Flow and Enterprise Value: More persuasive are its valuations based on cash flow and operational earnings. The company's Price/Free Cash Flow and Enterprise Value/EBITDA ratios are also lower than over 89% of the industry, hinting the market may not be completely counting its cash-producing ability.

- Growth Payoff: The high PEG ratio, which includes earnings growth, points to a costly valuation alone. Yet, this is balanced by the company's solid projected growth rate and acceptable profitability, which the filter accepts can support a higher multiple.

Supporting Basics: Profitability and Financial Soundness

For growth to be lasting and "affordable," it must rest on a firm base. The filter rules call for acceptable scores in profitability and financial soundness, which Vericel provides with ratings of 7 and 6, in order.

Profitability Points: Vericel's profitability measures are notable within the contested biotech area. Its Return on Assets (2.89%), Return on Equity (4.06%), and Profit Margin (5.06%) all do better than nearly 90% of industry peers. Firm gross and operating margins further show the company has price control and operational command.

Financial Soundness Points: The company's balance sheet displays major positives but also small notes. On the good side, Vericel holds almost no debt, has a very high Altman-Z score showing low failure risk, and possesses strong liquidity with current and quick ratios above 4.0. These elements give a solid base for supporting future growth. The filter's mark of "acceptable" soundness is seen in some negative checks, including a recent rise in shares outstanding and a condition where its return on invested capital is below its cost of capital, showing space for better capital use.

Conclusion

Vericel Corp presents an outline that meets the goal of an affordable growth filter: it is a company showing solid and speeding growth, trading at valuations that are fair relative to its high-value industry, and backed by strong profitability and a mostly sound financial state. The filter process, which stresses a balance between these elements, helps find companies like VCEL that may provide growth possibility without the severe valuation danger often seen in the biotech field. Investors wanting a full split of these basic scores can examine the complete Fundamental Analysis Report for VCEL.

For those looking for other investment options that match this measured growth outline, more results from the "Affordable Growth" filter can be viewed here.

Disclaimer: This article is for information only and does not make up financial guidance, a suggestion to buy or sell any security, or a support of any investment plan. Investors should do their own complete study and think about their personal money situation and risk comfort before making any investment choices.