UNITED STATES ANTIMONY CORP (NYSEARCA:UAMY) has become a notable candidate through a screening process that combines Mark Minervini’s Trend Template with high-growth momentum criteria. This dual-filter method finds stocks showing both strong technical momentum and solid fundamental growth traits, key parts of Minervini’s methodology, which focuses on stocks in strong uptrends with improving earnings and sales.

The screening process looks for securities that meet Minervini’s strict technical checklist, confirming a stock is in a definite Stage 2 uptrend, while also rating well on growth metrics like earnings revisions, sales acceleration, and profit margin improvement. This method tries to find companies that not only show price strength but also have the fundamental drivers to maintain that momentum.

Technical Strength and Trend Template Alignment

UAMY meets all main parts of Minervini’s Trend Template, which is made to find stocks in strong and sustainable uptrends:

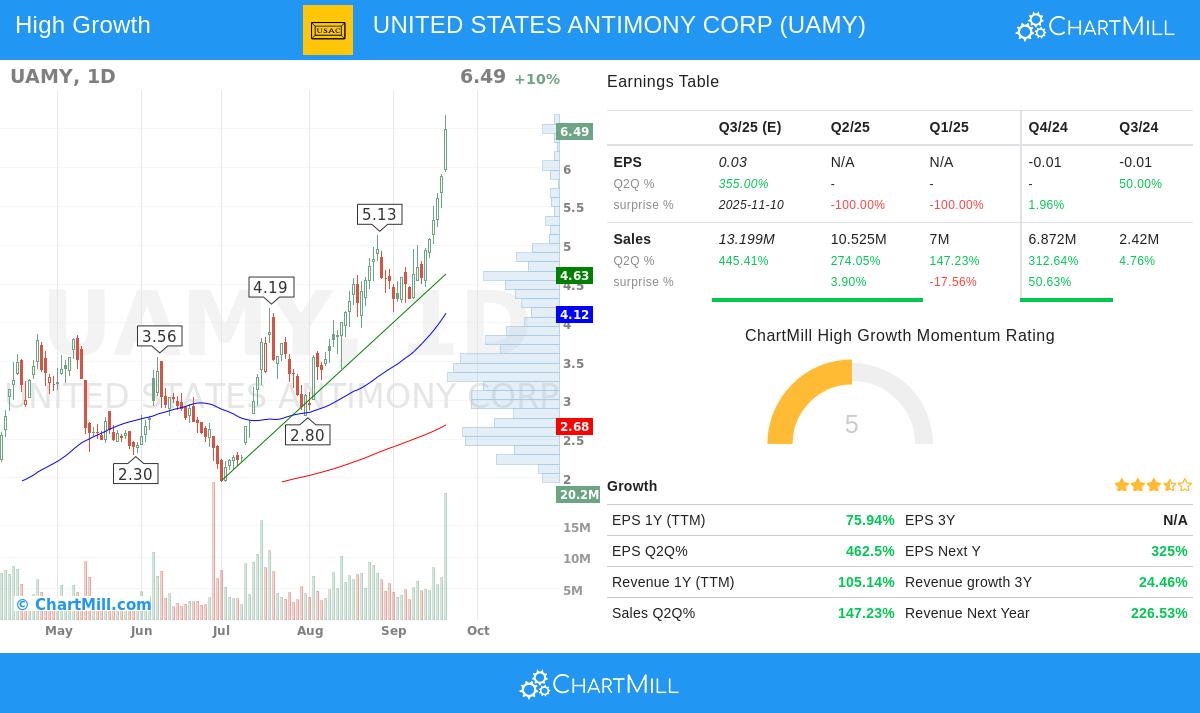

- The current price of $6.49 is trading well above all major moving averages:

- 50-day SMA: $4.12

- 150-day SMA: $3.00

- 200-day SMA: $2.68

- All moving averages are sloping upward, confirming continued bullish momentum.

- The 50-day SMA is above both the 150-day and 200-day averages, showing aligned strength across timeframes.

- With a 52-week low of $0.49, the current price reflects a gain of over 1,200%, far exceeding the template’s requirement of being at least 30% above the low.

- The stock is trading within 3% of its 52-week high of $6.68, meeting the condition that it should be within 25% of new highs.

- Its relative strength ranking of 99.4 indicates it is performing better than nearly all other stocks in the market.

These technical markers suggest UAMY is in a strong uptrend with good institutional support and little overhead resistance, a sign of Minervini’s ideal trade setups.

Fundamental Growth Momentum

Along with its technical strength, UAMY shows notable fundamental growth, matching the high-growth momentum filter used in the screen:

- Earnings Growth:

- EPS growth on a quarterly basis shows major improvement, with the most recent quarter up 462.5% year-over-year.

- Annual EPS growth (TTM) is at 75.9%, reflecting solid and improving profitability.

- Revenue Expansion:

- Quarterly sales growth is very strong at 147.2%.

- Annual revenue growth (TTM) is over 105%, indicating quickly growing operations.

- Analyst Revisions:

- EPS estimates for next year have been moved upward by 50% over the past three months, signaling increasing confidence in future earnings.

- Profitability Trends:

- The company has reached a positive profit margin of 7.78% in the last quarter, compared to a negative margin in prior periods, showing a major turnaround.

These metrics fit with Minervini’s focus on fundamental improvement, particularly in sales, earnings, and analyst expectations, which often come before further price gains.

Sector and Market Context

UAMY works in the metals and mining industry, a sector that has seen renewed investor interest amid wider economic trends. The stock’s exceptional relative strength, performing better than 99% of stocks in its sector, suggests it is a clear leader within its peer group. This matches Minervini’s focus on investing in market-leading stocks that show better price and fundamental performance relative to their competitors.

Technical Analysis Overview

A review of UAMY’s technical report further confirms its strength. The stock gets a perfect technical rating of 10/10, reflecting excellent trend health, strong momentum, and superior market-relative performance. Key observations include:

- Consistent outperformance versus the broader market.

- Recent volume growth supporting price advances.

- A clear support level near $4.63, providing a logical area for risk management.

However, the report notes that the stock may be overbought in the short term, suggesting that potential buyers should look for consolidation or pullbacks to better the risk/reward profile of new positions.

Conclusion

UNITED STATES ANTIMONY CORP represents a notable case of a stock that fits both the technical discipline of Mark Minervini’s trend-following strategy and the fundamental rigor of high-growth investing. Its strong price trend, combined with exceptional growth in earnings and sales, positions it as a noteworthy candidate for more analysis by momentum and growth-oriented investors.

For readers interested in finding similar high-growth, technically strong stocks, additional screening results can be accessed via this High Growth Momentum + Trend Template screen.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.