Tigo Energy Inc (NASDAQ:TYGO) has become a significant candidate through a screening method that joins Mark Minervini's strict Trend Template with high growth momentum standards. This two-part method finds companies displaying both solid technical momentum and increasing fundamental growth, traits that have often come before major price gains. The screening method confirms stocks are in clear uptrends while also showing the earnings and revenue growth that institutional investors prefer.

Technical Strength Through Minervini's Trend Template

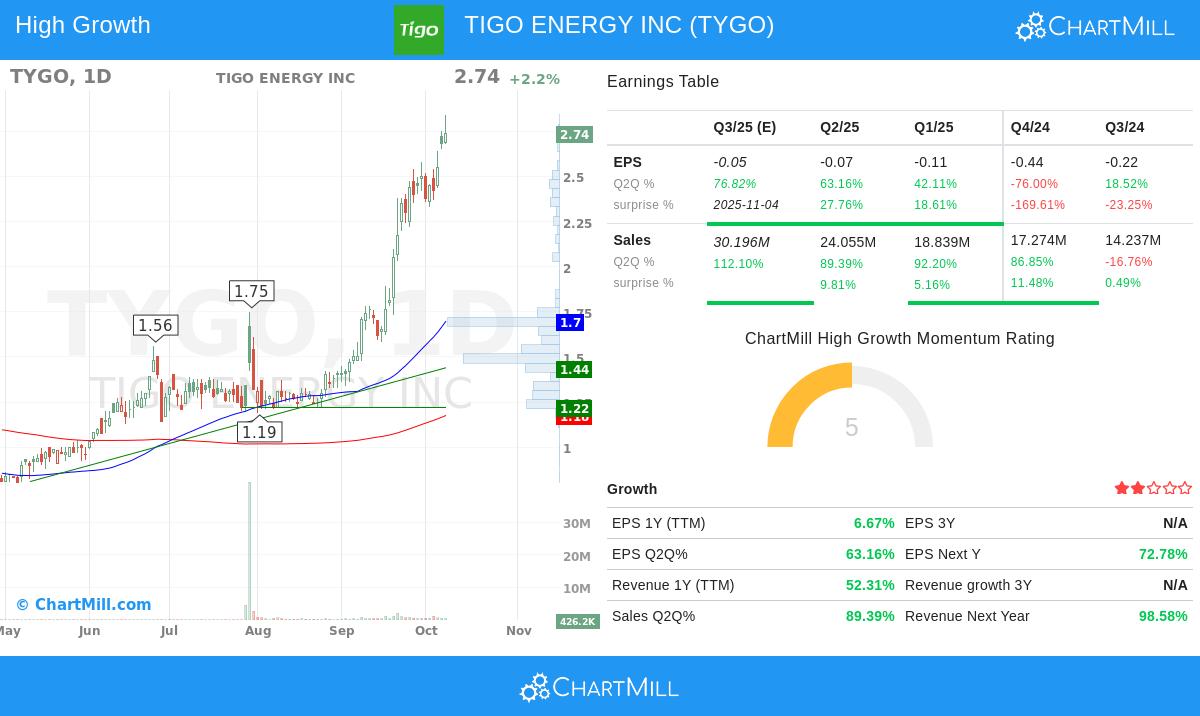

Tigo Energy shows very good technical health by meeting all main parts of Minervini's Trend Template, which aims to find stocks in clear stage 2 uptrends. The template's moving average rules confirm agreement across different time periods, and TYGO's present setup displays notable strength:

- Current price ($2.74) trades well above increasing 50-day ($1.70), 150-day ($1.25), and 200-day ($1.18) moving averages

- The 50-day MA is placed above both the 150-day and 200-day MAs, confirming growing momentum

- All moving averages show upward slopes, especially the 200-day MA which has moved higher for many months

- Price is 372% above its 52-week low of $0.58 while trading within 3.5% of its 52-week high of $2.84

- Relative strength ranking of 96.22 shows the stock performs better than 96% of the market

This technical setup matches Minervini's idea of buying stocks in definite uptrends that show leading traits. The high relative strength score is especially important, as Minervini states that market leaders usually show RS scores above 70, with the best performers often in the 80s or 90s.

Fundamental Growth Drivers

Beyond technical strength, Tigo Energy displays the fundamental growth that high growth investors look for. The company's recent results show major improvements in important measures:

- Quarterly earnings growth has increased notably, with the most recent quarter showing 63.2% year-over-year EPS growth

- Revenue growth shows even more notable momentum, with the latest quarter growing 89.4% year-over-year

- Analyst opinion has become clearly positive, with next-year EPS estimates raised upward by 24.5% over the past three months

- Revenue estimates for the next year have been increased by 14.9% during the same time

- The company has exceeded revenue estimates in all of the last four quarters, averaging a 6.7% surprise

These fundamental gains match Minervini's focus on "big earnings attract big attention." The mix of increasing growth and positive estimate changes usually draws institutional interest, creating support for continued price gains.

Industry Placement and Market Context

Working in the electrical equipment industry, Tigo Energy concentrates on solar power conversion and storage products, placing it in the increasing renewable energy sector. The company's module-level power electronics and cloud-based monitoring systems meet key needs in the residential solar market. With 96% relative strength, TYGO notably performs better than 85% of its industry peers, showing clear leadership in its sector.

The wider market situation stays positive, with the S&P500 showing good trends in both short and long-term time periods. This matches Minervini's view that the strongest stocks usually appear during times of general market strength.

Technical Analysis Summary

ChartMill's technical report gives TYGO a complete technical rating of 10 out of 10, showing very good strength across all checked time periods. The analysis notes steady performance in both short and long-term trends, with the stock showing constant better performance compared to the whole market. While the setup rating of 3 suggests the stock may be advanced in the short term, the basic technical health remains solid. Key support levels are found at $2.37, $1.44, and $1.22, giving possible entry points during declines.

Detailed technical analysis shows more understanding of TYGO's chart structure and possible trading levels.

Investment Considerations

For investors following the Minervini method, TYGO presents a notable case in growth momentum investing. The stock meets the main needs of the Trend Template while showing the fundamental growth that often comes before continued better performance. However, the recent strong price movement suggests possible short-term consolidation may give more favorable risk-adjusted entry points.

The mix of technical strength and fundamental gain creates a notable story, though investors should keep in mind position size and risk management rules central to Minervini's method. The stock's high volatility, shown by its 200%+ six-month performance, requires careful stop-loss placement and position size control.

Disclaimer: This analysis is for informational and educational purposes only and does not constitute investment advice. All investments involve risk, and past performance does not guarantee future results. Readers should conduct their own research and consult with a qualified financial advisor before making investment decisions.