For investors looking for dependable income, dividend investing stays a key method for creating lasting wealth. The process includes finding companies with good dividend traits and sound basic business operations. One useful way to find these chances uses filters for stocks with high ChartMill Dividend Ratings, while also checking for sufficient profit and financial condition scores. This measured method helps find companies able to maintain and possibly increase their dividend distributions over the long term.

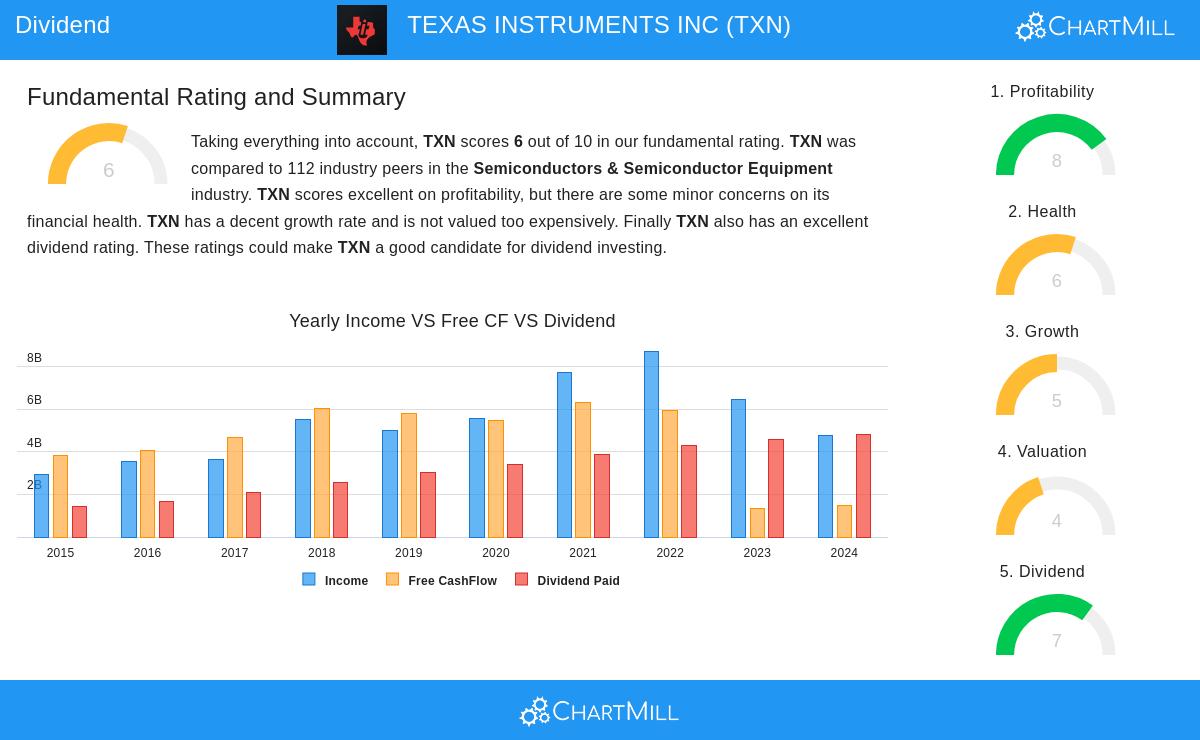

TEXAS INSTRUMENTS INC (NASDAQ:TXN) appears as a strong candidate using this filtering process, especially for investors concentrating on dividend continuity and expansion possibility.

Dividend Strength and Continuity

The company's dividend details show several features that dividend investors usually want. Texas Instruments presently provides a 3.50% dividend yield, which stands well next to both industry norms and wider market measures. Even more significant, the company has built a dependable history of dividend distributions and increases.

Important dividend numbers contain:

- 10-year history of steady dividend distributions without cuts

- 10.46% yearly dividend increase rate over the last five years

- Dividend yield performing better than 95% of semiconductor industry counterparts

- Upward dividend growth path backed by profit growth

While the present payout ratio of 98.66% seems high, this needs assessment with background. The ratio's height comes partly from recent stock price drops instead of basic weakening in dividend coverage. Also, the company's profit growth is forecast to grow faster than dividend growth, indicating the present payout level could become more maintainable in the future.

Profitability Foundations

Texas Instruments shows solid profit numbers that back its dividend abilities. The company's good profitability rating of 8/10 mirrors its capacity to create steady returns, which is vital for keeping dividend distributions through economic changes.

Notable profit strong points:

- Return on Equity of 30.17%, performing better than 92% of industry rivals

- Operating Margin of 34.82% placed in the top group of semiconductor firms

- Steady positive profits and operating cash flow over the last five years

- Good return on invested capital at 16.57%

These profit numbers show the company has the operational effectiveness and earning capacity needed to back its dividend promises while paying for future expansion projects.

Financial Condition Factors

With a condition rating of 6/10, Texas Instruments keeps acceptable financial steadiness, though investors should watch some debt measures. The company's cash position stays good, offering a buffer for operational costs and dividend distributions during possible downturns.

Financial condition key points:

- Current ratio of 4.45 shows strong short-term cash availability

- Quick ratio of 2.90 shows enough coverage for immediate debts

- Altman-Z score of 8.19 indicates low failure risk

- Debt-to-equity ratio of 0.81, while above some peers, stays workable

The company's free cash flow creation, though showing some strain next to debt levels, continues to back both operational needs and shareholder returns.

Valuation and Growth Perspective

From a value viewpoint, Texas Instruments trades at numbers generally similar to market averages. The company's P/E ratio of 28.72 compares fairly with the S&P 500 average, while its future P/E ratio indicates moderate expectations next to growth forecasts.

Growth possibilities seem positive:

- Expected EPS growth of 17.13% each year over coming years

- Projected sales growth of 10.11% per year

- Speeding growth path compared to past performance

These growth forecasts, joined with the company's good market standing in analog semiconductors and embedded processing, give basic support for continued dividend growth.

Investment Factors

For dividend-centered investors, Texas Instruments offers a strong case built on its mix of yield, growth history, and basic strength. The company's place in the semiconductor industry gives contact to long-term technology directions while its focus on analog chips and embedded processing provides relative steadiness compared to more variable semiconductor parts.

The recent stock price drop, while worrying from a full return view, has improved the dividend yield chance. Investors should, however, perform complete investigation about the reasons for the price change and judge if short-term market feeling or basic problems guide the valuation.

For investors wanting to find similar dividend chances, the Best Dividend Stocks screen gives more candidates meeting like standards for high dividend ratings with acceptable profit and condition basics.

For a full basic examination of Texas Instruments, including full ratings across all assessment groups, see the complete fundamental report.

Disclaimer: This examination is based on basic data and filtering methods for information only. It does not form investment guidance, nor does it suggest any specific investment move. Investors should do their own study and think about their personal money situation before making investment choices. Past results do not ensure future outcomes, and dividend distributions depend on company choice and market factors.