For investors aiming to assemble a portfolio of lasting, high-standard businesses, the quality investing approach offers a persuasive framework. This method centers on finding companies with durable competitive strengths, sound financial condition, and a demonstrated capacity to produce steady, high-returns on capital. Instead of searching for significantly undervalued opportunities, quality investors frequently accept a reasonable price for outstanding businesses they can own for many years. A structured method to find such prospects is through a rigorous stock screen, like the "Caviar Cruise" strategy, which selects for excellent historical growth, earnings power, and financial soundness.

One company that recently appeared from this screen is TRADEWEB MARKETS INC-CLASS A (NASDAQ:TW), a top operator of electronic marketplaces for trading rates, credit, money markets, and equities. The company's profile indicates it functions where finance and technology meet, supplying the electronic framework that enables trading for institutional and wholesale clients worldwide. We will look at how Tradeweb's fundamentals match the main pillars of quality investing.

Excellent Growth and Profitability Increase

A central principle of quality investing is finding companies that are not only expanding, but expanding with earnings and efficiency. The Caviar Cruise screen highlights this by seeking maintained revenue and profit growth, with special attention on earnings before interest and taxes (EBIT). The reasoning is straightforward: consistent EBIT growth, particularly when it exceeds revenue growth, shows pricing ability, operational efficiency, and a business model that can scale.

Tradeweb displays these characteristics clearly. Over the last five years, the company has recorded a compound annual revenue growth rate (CAGR) of 11.36%. More notably, its EBIT has increased at a CAGR of 29.17% over the same span. This difference, where profit growth is over twice revenue growth, is a sign of a high-standard enterprise. It means Tradeweb is effectively turning additional sales into even larger profits, probably through scale benefits and a strong competitive standing in its market.

Outstanding Returns on Capital and Financial Condition

Maybe the most important measure for a quality investor is return on invested capital (ROIC). A high and steady ROIC shows a company's skill in creating profits from the capital it uses, indicating a lasting advantage and capable management. The screen establishes a high standard, demanding an ROIC (excluding cash, goodwill, and intangibles) above 15%. Tradeweb not only meets this level; it exceeds it with a number of 106.06%. This very high return implies the business requires few assets and is highly efficient, needing little extra capital to expand its earnings.

Financial durability is also key for a "buy-and-hold indefinitely" prospect. Quality companies should possess sound balance sheets that can endure economic declines without fundamental risk. Tradeweb's financial condition is solid:

- Operation Without Debt: The company has no debt, leading to a Debt-to-Free Cash Flow ratio of 0.0. This gives great operational freedom and eliminates any risk linked to interest costs or refinancing.

- High Earnings Quality: The screen searches for companies that turn accounting profits into actual cash. Tradeweb's five-year average Profit Quality, the ratio of free cash flow to net income, is a remarkable 201.53%, meaning it produces much more cash than its stated income, an indicator of excellent earnings soundness.

Fundamental Analysis Summary

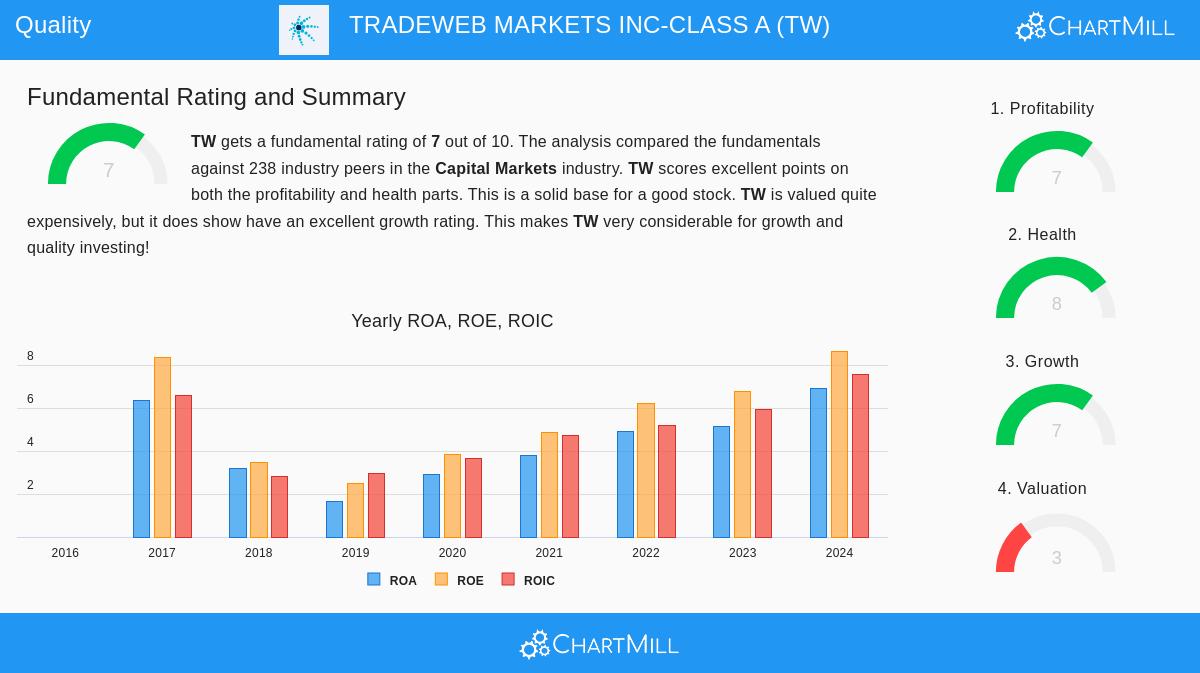

An examination of Tradeweb's detailed fundamental report supports the results from the quality screen. The report gives the stock a firm overall rating of 7 out of 10, with specific high points in earnings power and financial condition.

- Profitability (Rating: 7/10): The company receives high scores for its margins and returns. Its profit margin of 31.45% and operating margin of 40.10% exceed most of its competitors in the capital markets industry. The report mentions steady betterment in these margins in recent years.

- Financial Condition (Rating: 8/10): Tradeweb's health score is supported by its clean, debt-free balance sheet and good liquidity, with current and quick ratios of 3.71. Its Altman-Z score of 9.14 shows a very small chance of financial trouble.

- Growth (Rating: 7/10): The company displays strong historical growth in both revenue and earnings per share. While analyst projections suggest future growth may slow from its exceptional past rate, it is still expected to be solid.

- Valuation (Rating: 3/10): As is typical with high-standard franchises, you pay a higher price. The report notes Tradeweb's valuation as costly based on standard price-to-earnings measures, trading at a higher multiple than many industry peers. This highlights the quality investor's challenge: exceptional businesses are seldom inexpensive.

Is Tradeweb a Quality Investment Prospect?

According to the quantitative filters of the Caviar Cruise strategy, Tradeweb Markets makes a persuasive argument. It shows the typical markers of a quality business: excellent profit growth from operational efficiency, a very high return on capital, and a strong balance sheet with no debt. These traits imply a company with a durable competitive advantage in electronic trading, a platform that can scale, and careful management.

For investors who follow the quality philosophy, the main question may not concern the business's strengths, but its cost. The present valuation shows the market's acknowledgment of Tradeweb's advantages. The investment argument, then, depends on whether the company can continue to perform and expand to match its valuation over the long run, validating the higher price paid now.

Interested in examining other companies that meet strict quality filters? You can execute the Caviar Cruise screen yourself and view the complete list of outcomes here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. The analysis is based on data and a specific screening methodology; investors should perform their own complete research and consider their personal financial situation before making any investment decisions.