For investors looking to join major price moves with defined entry rules, the method created by Mark Minervini offers a strong framework. This process, called the SEPA (Specific Entry Point Analysis) strategy, finds stocks that are in clear uptrends and have quickening fundamental growth. It joins the strict technical checks of the Minervini Trend Template, which confirms a stock is in a clear advance, with a detailed study of earnings and sales momentum. The aim is to find leading stocks early in their big price moves, where the combination of solid price movement and getting better business results forms a likely setup for large profits.

Travere Therapeutics Inc (NASDAQ:TVTX) is a present example that seems to fit this two-part strategy. An examination of its technical state and fundamental path indicates it deserves more study from growth-focused investors.

A Clear Technical Trend

The main purpose of the Minervini Trend Template is to sort out all but the clearest uptrends, requiring the investor to "trade what is, not what might be." TVTX now shows a chart that fits these strict technical rules.

- Moving Average Arrangement: The stock's price is trading above its important moving averages (50-day: $34.56, 150-day: $24.24, 200-day: $22.67), a main rule. Importantly, these averages are in the correct order: the 50-day is above the 150-day, which is above the 200-day, and all are moving up. This arrangement shows continued buying across different time periods.

- Nearness to Highs: TVTX is trading within 6% of its 52-week high of $42.13, inside the Template's rule of being within 25%. At the same time, its current price is over 200% above its 52-week low, well past the 30% minimum. This shows strong recovery force and performance compared to its recent history.

- Market Performance Strength: Its ChartMill Relative Strength (CRS) score of 97.04 is significant. This means the stock has done better than 97% of the market over the last year. Minervini notes that real market leaders show high relative strength, as large investors move money into the top performers first.

This technical view is positive. The long-term trend is seen as positive, and the stock gets a full 10 out of 10 on ChartMill's Technical Rating, putting it in the market's top group from a price-performance view.

The Basis for Growth: Quickening Fundamentals

A strong chart is necessary, but the Minervini strategy looks for the reason for the move. For TVTX, the fundamental story is one of major change, suitable for a growth and momentum investor. The given data shows a company during a strong operational shift.

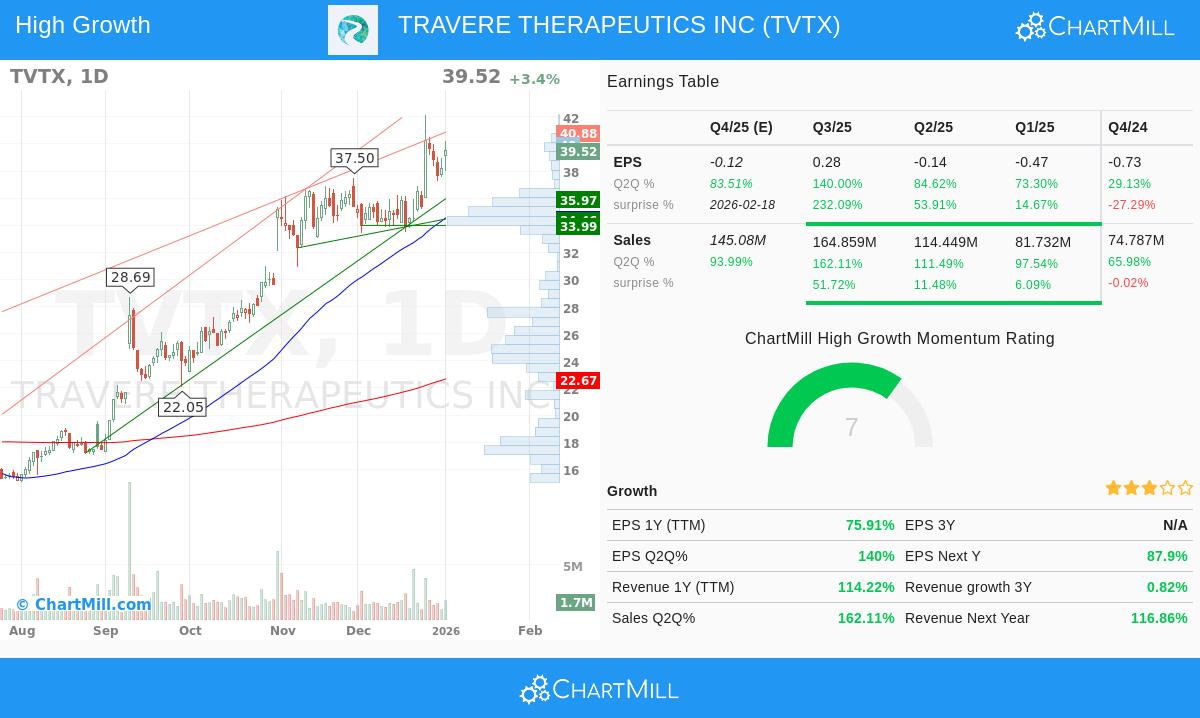

- Fast Earnings Momentum: The most notable numbers are in earnings per share (EPS) growth. Quarterly EPS growth year-over-year has increased quickly: from +29% three quarters ago, to +73%, then +85%, and most lately to +140%. This series of repeated, large increases is a clear sign of a company reaching a turning point, a main signal Minervini seeks.

- Rising Revenue Growth: The sales story is also strong. Trailing twelve-month revenue growth is over 114%. Recent quarterly sales growth has been high, with the last quarter up over 162% year-over-year. Also, analysts are getting more positive, increasing their sales estimates for the next year by almost 20% in the last three months.

- Move Toward Profit: After times of losses common for clinical-stage biopharma, the latest quarter shows a reported profit margin of 15.6%. The EPS for the trailing twelve-month period, while still negative at -$1.06, has gotten better by 76% over the prior period. Free cash flow is also improving clearly, up 65% year-over-year. This move toward making money is important for continuing growth and proving the business plan.

This fundamental picture indicates the solid price trend is driven by real, quickening gains in the company's business results, likely from the launch and use of its main product, FILSPARI, for a rare kidney disease.

Combined View and Technical Condition Summary

When combining the technical and fundamental views, TVTX shows a situation where a solid price trend is backed by fast fundamental momentum. The stock's chart follows the strict rules of the Trend Template, keeping an investor aligned with the trend. At the same time, the business is showing the kind of quickened growth in sales and earnings that often draws large investor interest and can support continued price increases.

ChartMill's detailed technical report describes TVTX's condition as "excellent," giving it the top rating of 10. The report states the stock's solid positive trends in both the short and long term, its leader position (doing better than 97% of the market), and its high relative strength in the biotechnology industry. While the report notes that recent price changes may not offer a perfect low-risk entry point right now, a idea in line with Minervini's focus on exact entry points, the basic technical structure is rated as very sound. For a full look at the support levels, moving average study, and volume trends, investors can see the full Technical Analysis Report for TVTX.

Locating Like Examples

Travere Therapeutics shows the kind of stock that can be found by looking for both technical trend strength and high-growth fundamentals. Investors wanting to use this combined method in the present market can use a prepared screen made for this goal. Click here to view the "High Growth Momentum + Trend Template" screen and see other possible examples.

Disclaimer: This article is for information and learning only. It is not a suggestion to buy or sell any security. The study is based on given data and a specific investment method. All investing has risk, including the possible loss of your money. You should do your own study and think about talking with a qualified financial advisor before making any investment choices.