Biopharmaceutical company Travere Therapeutics Inc (NASDAQ:TVTX) recently appeared in a specific investment screen made to find promising high growth momentum possibilities with good technical formations. The screening process uses three distinct ChartMill ratings to sort the market for stocks that fit particular standards for both fundamental momentum and technical condition. The screen specifically searches for securities with a High Growth Momentum Rating above 4, signaling strong earnings and sales improvement, a Technical Rating above 7, verifying the stock is in a good uptrend, and a Setup Rating above 7, indicating the stock is forming a pattern that might come before a new price increase. This layered method tries to find companies showing both strong business momentum and a price structure that provides a measured entry point.

High Growth Momentum Fundamentals

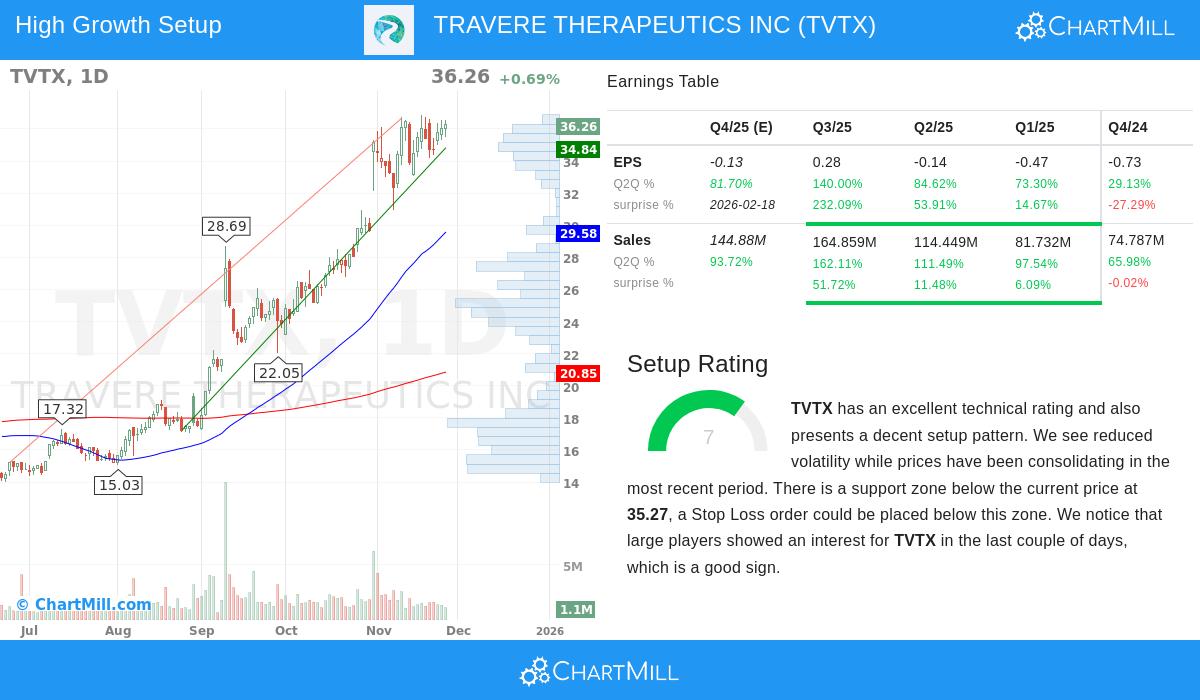

Travere Therapeutics displays the type of fast growth that high momentum investors look for. The company's work on rare kidney and metabolic diseases is resulting in major financial improvement, as shown by its High Growth Momentum Rating of 7. The fundamentals show a company in a strong growth stage, with important measures showing large gains.

- Sales Growth: The company reported a very high 162.1% year-over-year sales growth in its most recent quarter. This comes after earlier quarters of 111.5% and 97.5% growth, showing a sequence of good and improving revenue growth.

- Earnings Trajectory: While the company's trailing twelve-month EPS is still negative at -$1.06, the direction is clearly getting better. The EPS growth for the last quarter was 140% compared to the same quarter a year before, an important signal of moving toward profitability.

- Analyst Confidence: The future appears positive, with analysts changing their estimates higher. The average EPS estimate for the next year has been increased by 18.4% over the last three months, and revenue estimates have seen a 13.9% rise, showing growing positive feeling about the company's outlook.

- Cash Flow Improvement: Supporting the earnings story, Travere's free cash flow has gotten better by 64.8% over the past year, a good sign for financial condition and stability.

These elements are key to the high growth momentum plan, which focuses on companies displaying fast sales growth, positive earnings changes, and higher revisions from analysts, all of which point to the possibility for continued good momentum.

Technical Strength and Market Position

From a technical viewpoint, Travere Therapeutics is showing very good strength. The stock has been given a top-level Technical Rating of 9 out of 10 by ChartMill. This high score shows a good and maintained uptrend across several time periods. The stock is trading near its 52-week high and has done much better than the wider market, placing in the top 10% of its biotechnology industry group over the past year. Both its short-term and long-term trends are rated as positive, with the stock trading well above its important moving averages (20, 50, 100, and 200-day SMAs), which are all moving upward. This steady performance signals strong institutional backing and a clear upward trend. For a complete look at the technical analysis, you can check the full ChartMill Technical Report for TVTX.

Consolidation and Setup Quality

Beyond a strong trend, a high-quality setup is important for finding a possible entry point. Travere Therapeutics currently has a Setup Rating of 7, signaling it is making a constructive consolidation formation. After a large rally, the stock's price movement has become tighter, and volatility has gone down, which often comes before the next price move. The technical analysis finds a clear support area between $34.63 and $35.27, made by a mix of moving averages and trendlines. This gives a sensible level for risk management, as a move below this area could signal a problem with the setup. On the other hand, a clear move above the identified resistance near $36.48 could signal the restart of the uptrend. The existence of this specific trading range, along with recent activity from large investors as measured by the Effective Volume indicator, makes TVTX a stock to monitor for momentum investors looking for a formed opportunity.

Discover More Potential Setups

The mix of strong fundamental momentum and a technically good setup makes Travere Therapeutics an interesting candidate for investors using a high growth momentum plan. For traders and investors trying to find similar possibilities, new breakout setups are found daily. You can look at the current list of qualifying stocks by visiting the High Growth Momentum Breakout Setups Screen.

Disclaimer: This article is for informational purposes only and does not constitute investment advice of any kind. The analysis and any suggested trade setups are based on automated processes and historical data, which are not guarantees of future performance. Always conduct your own due diligence, consider your financial situation and risk tolerance, and consult with a qualified financial advisor before making any investment decisions. Investing in stocks, especially in the biopharmaceutical sector, involves substantial risk, including the potential loss of principal.