Investors looking for growth chances at fair prices often use screening methods that consider several basic factors. The "Affordable Growth" method focuses on companies showing solid growth paths while keeping good financial condition and earnings, all at prices that do not seem too high. This process tries to find businesses set for increase without making investors pay high costs that could already include future hopes. TTM TECHNOLOGIES (NASDAQ:TTMI) recently appeared from this kind of screening process, indicating it could deserve more study for investors using this method.

Growth Path Evaluation

The company's growth picture is a central part of its attraction for affordable growth investors. TTM Technologies shows speeding increase in important measures, with especially good recent results and positive future estimates.

- Revenue rose by 17.88% over the last year, much higher than its past average

- Earnings per share expanded by a notable 54.61% in the latest year

- Future EPS increase is estimated at 21.88% each year, showing continued speed

- Revenue growth forecasts of 10.55% each year point to ongoing expansion

This speeding growth pattern is especially significant as it indicates the company is starting a time of better business performance. For growth-at-reasonable-price investors, this mix of strong past growth and positive future estimates gives the needed growth part without depending only on uncertain future results.

Price Assessment

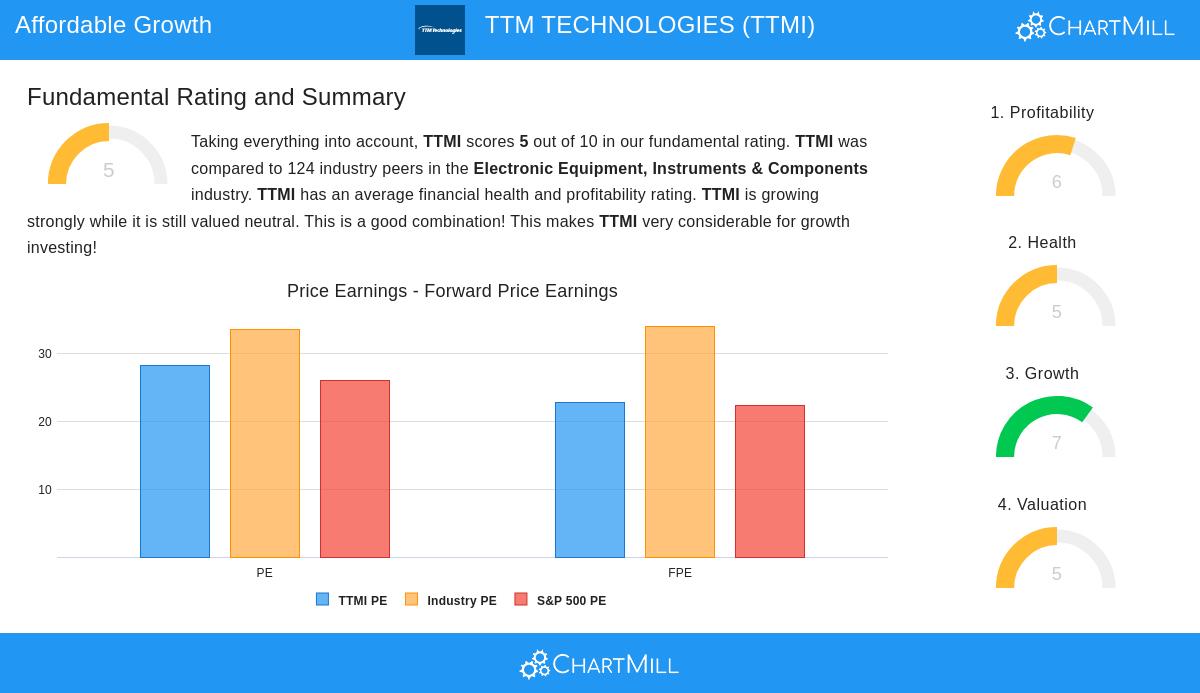

TTM Technologies shows a varied but finally acceptable price view when looked at through different angles. While some measures seem high alone, the setting within the industry and growth forecasts gives useful viewpoint.

- The P/E ratio of 28.21 is close to S&P 500 averages but looks good next to industry others

- The forward P/E ratio of 22.76 also compares well to sector rivals

- The PEG ratio, which includes growth forecasts, shows possibly low-price situations

- Enterprise Value to EBITDA ratios position the company lower cost than 60% of industry others

The price evaluation becomes especially interesting when thinking about the growth pay part. The company's expected earnings growth of almost 22% each year helps support its present multiples, making a situation where investors are not clearly paying too much for future growth possibility. This balance between growth forecasts and present cost fits well with the affordable growth idea.

Financial Condition and Earnings

Beyond growth and price, TTM Technologies keeps acceptable financial bases that support its growth path without showing major warning signs.

The company's earnings measures show several positive points:

- Return on equity of 5.69% and return on invested capital of 6.12% do better than most industry others

- Profit margin of 3.52% and operating margin of 8.05% place well within the sector

- Margin growth patterns show getting better business effectiveness over recent times

Financial condition presents a balanced view:

- Altman-Z score of 3.69 suggests low failure risk and financial steadiness

- Current ratio of 2.03 shows enough cash for short-term needs

- Debt amounts stay workable though a bit high compared to some others

These condition and earnings details give useful setting for growth investors, as they indicate the company's expansion is backed by lasting operations instead of financial tricks or too much risk-taking.

Investment Points

For investors using affordable growth methods, TTM Technologies stands as an interesting example in balancing growth possibility with acceptable price. The company's strong growth scores, especially its speeding revenue and earnings path, form the base of its attraction. When joined with price measures that seem acceptable related to both the wider market and industry others, the picture indicates chance for growth without too much premium cost.

The full fundamental analysis report for TTMI gives more detail across all studied groups for those wanting complete careful checking.

Investors curious about finding similar chances through organized screening can look at more affordable growth possibilities using the same process that found TTM Technologies.

Disclaimer: This article provides factual information based on fundamental data and should not be taken as investment advice. All investment choices should come from personal study and risk comfort.