Investors looking for growth openings often face the task of finding companies with both good fundamental outlooks and positive technical patterns. One method brings together these fields, filtering for stocks displaying solid growth traits while also showing technical breakout formations. This process tries to identify companies with improving business fundamentals just as they come out of quiet phases, possibly marking the start of new upward moves. The plan centers on stocks showing very good revenue and earnings growth, firm profitability, and sound finances, while their price charts display formations hinting at buyer interest and coming price strength.

The Trade Desk Inc-Class A (NASDAQ:TTD) runs a cloud-based advertising platform that allows clients to plan, manage, and improve data-driven digital advertising campaigns across different channels including connected television, display, audio, and native advertising. The company's self-service platform works with many inventory, publisher, and data partners, giving advertisers wide reach and advanced targeting options in the digital advertising field.

Fundamental Strength Evaluation

The company's fundamental picture shows several traits that growth investors usually look for. According to the fundamental analysis report, The Trade Desk displays:

- Very Good Growth Measures: Revenue growth of 23.18% over the last year and 29.90% average yearly growth over recent years

- Firm Earnings Increase: EPS growth of 25.18% year-over-year with 35.00% average yearly growth in the past

- Sound Profitability: Profit margin of 15.57% performing better than 94% of industry peers, with operating margin of 17.73% above 86% of others in the field

- Good Financial Standing: No debt on the books, strong Altman-Z score of 5.82 showing financial health, and current ratio of 1.71 giving liquidity assurance

These fundamental aspects fit with growth investing ideas where companies showing increasing revenue and earnings while keeping firm profitability often represent interesting chances. The company's place in the digital advertising sector, especially in connected television, gives exposure to a growing market area with good expansion possibility.

Technical Formation Review

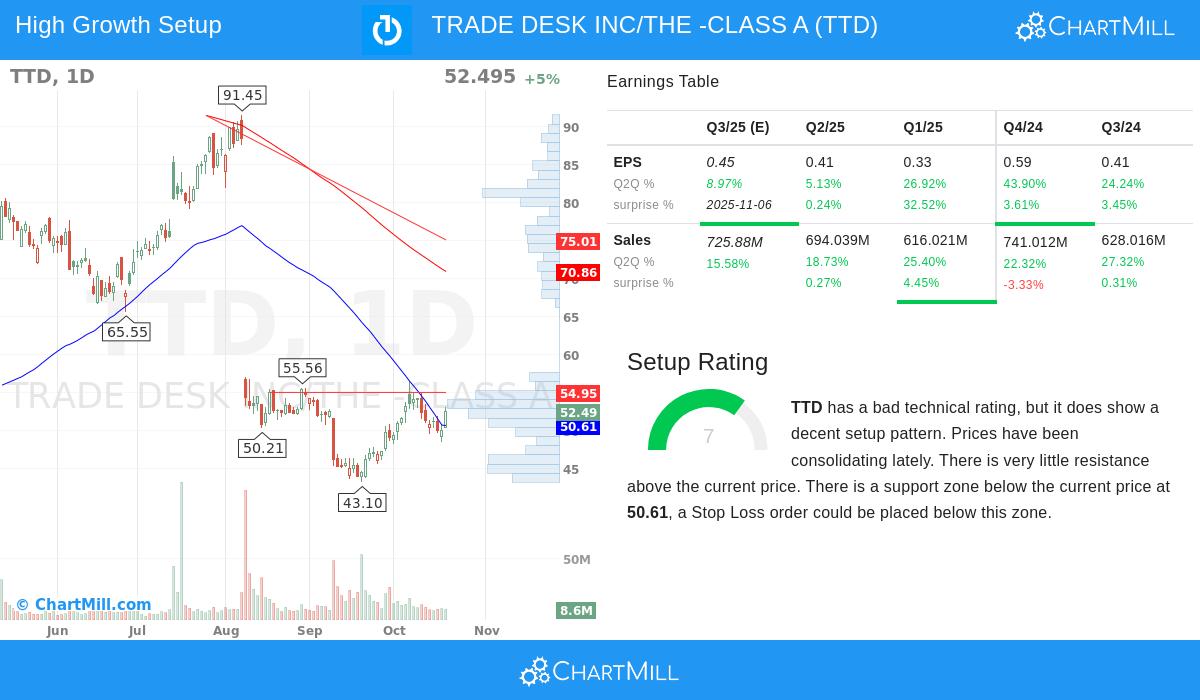

The technical view shows an interesting shape even with recent market difficulties. The technical analysis report points out:

- Quiet Phase Pattern: The stock has been moving in a set area between $45.47 and $56.39 over the last month, now placed in the middle of this zone

- Support Level Formation: An important support area exists between $49.90 and $50.61, made by several trend lines and moving averages across different time frames

- Lessened Hurdles: Very few obstacles appear above present price levels, hinting at possibility for upward movement if price strength appears

- Formation Score Quality: The setup rating of 7/10 shows a positive technical shape even with the general technical rating issues

This technical build suggests the stock may be creating a foundation after big previous drops, possibly preparing for a turn-around pattern. For growth investors, such technical formations can offer planned entry points when paired with good fundamental outlooks.

Growth Path and Market Standing

The company's growth story stays interesting even with wider market pressures. The digital advertising market keeps moving toward programmatic platforms, with connected television standing for a particularly active growth part. The Trade Desk's platform method places it to gain from these industry changes, while its focus on data-driven advertising solutions matches marketer needs for more openness and performance tracking.

Future growth forecasts remain good, with analysts expecting:

- EPS growth averaging 20.73% each year over coming years

- Revenue growth predicted at 16.77% per year on average

- Continued market share gains in the growing programmatic advertising system

While these expected growth rates show some slowing from past levels, they still clearly beat wider market averages and many others in the field.

Risk Points

Investors should note several risk factors next to the chance. The stock's price level stays high compared to standard value measures, with a P/E ratio of 30.17, though this is not rare for fast-growth companies. The technical view, while displaying hopeful formation traits, still works inside a longer-term negative move that will need continued betterment to change. Also, the digital advertising market stays very competitive and somewhat tied to economic cycles, relying on overall marketing spending and economic situations.

For investors wanting to look into similar chances that mix good growth fundamentals with hopeful technical formations, more filtering results can be found through this Strong Growth Stocks with Good Technical Setup Ratings screen.

Disclaimer: This analysis is for information purposes only and does not make up investment advice, suggestion, or backing of any security or plan. Investors should do their own research and talk with financial advisors before making investment choices. Past results do not assure future outcomes, and all investments hold risk including possible loss of original money.