For investors using a value investing method, the search for fundamentally healthy companies trading for less than their inherent worth is a central plan. This system, created by Benjamin Graham and famously used by Warren Buffett, concentrates on finding securities that seem priced too low according to fundamental analysis. The aim is to buy these assets for less than their actual value, offering a "margin of safety" and the possibility for price growth as the market adjusts its valuation. A structured method to use this plan is by filtering for companies with good basic business condition and earnings that are also valued appealingly, hinting they might be missed by the wider market.

Valuation Measurements

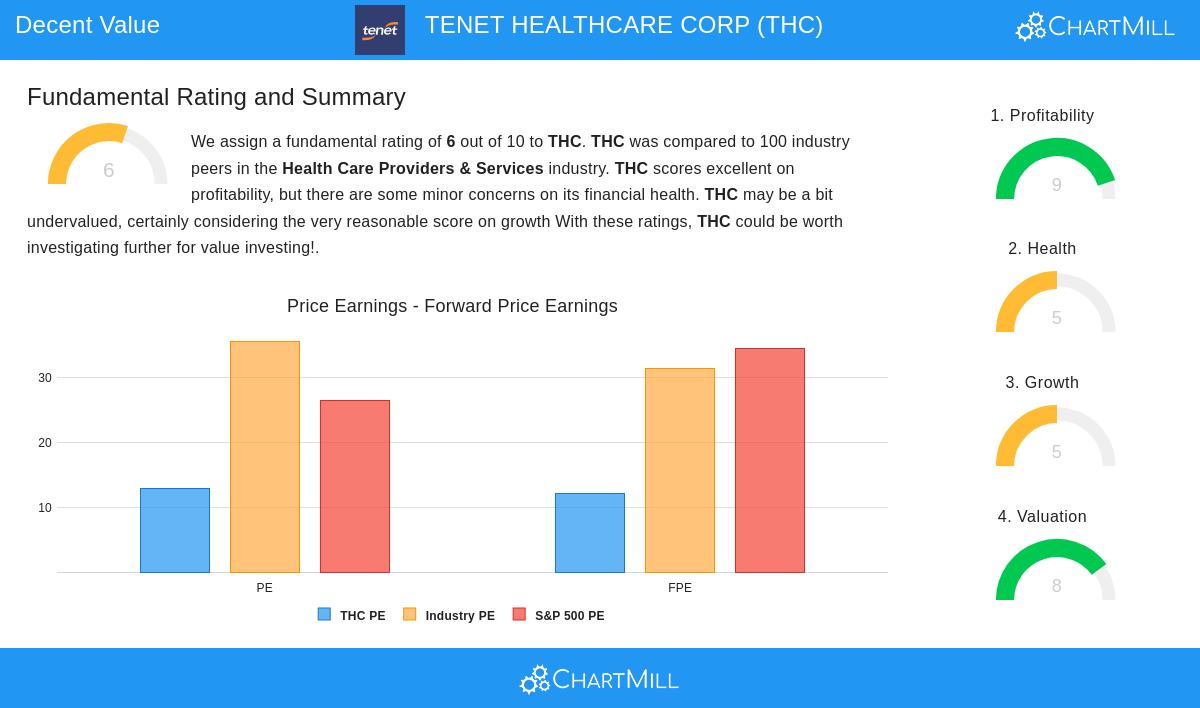

The foundation of value investing is discovering a notable difference between a company's market price and its inherent worth. Tenet Healthcare Corp (NYSE:THC) offers a strong case founded on its valuation measurements, which are a main reason it was chosen by a "Decent Value" filter. The company's stock is not trading at a very high price, which is a positive sign for value hunters.

- Price-to-Earnings (P/E) Ratio: THC's P/E ratio of 12.89 is much lower than the industry average of 35.55 and the S&P 500's average of 26.34. This shows investors are paying less for each dollar of profit compared to similar companies and the wider market.

- Forward P/E Ratio: The forward P/E of 12.02 supports this appealing valuation, being less expensive than 83% of its industry rivals.

- Enterprise Value to EBITDA: This measurement, which is often seen as a more complete valuation method, also implies THC is valued inexpensively inside its industry, performing better than 88% of similar companies.

- Price-to-Free-Cash-Flow: The ratio here is also positive, showing a less expensive valuation than 82% of the industry.

For a value investor, these measurements are vital because they give numerical proof that the stock could be priced under its inherent worth, providing that crucial margin of safety before an investment is made.

Profitability Condition

While a low price is critical, value investing steers clear of "value traps"—companies that are inexpensive for a cause, often because of weak business basics. Therefore, a company's capacity to produce earnings is essential. Tenet Healthcare performs very well here, having a high profitability grade.

- Return on Equity (ROE): At 33.73%, THC's ROE is outstanding, putting it in the top 5% of its industry. This shows very efficient use of shareholder capital.

- Operating Margin: The company's operating margin of 17.52% is with the best in its field, performing better than 95% of industry peers and displaying improvement lately.

- Profit Margin: With a profit margin of 6.49%, THC performs better than 84% of its rivals, and this margin has been increasing.

- Consistent Performance: The company has been profitable and created positive operating cash flow in each of the last five years, showing business model strength.

This good and steady profitability is exactly what value investors search for to confirm that a low-priced stock is supported by a high-grade, profit-making business.

Financial Condition Evaluation

A company's financial strength is critical for value investing, as the plan often includes a longer-term ownership period. Investors need confidence that the company can survive economic declines. Tenet Healthcare's financial condition shows a varied but acceptable situation.

- Liquidity Position: The company displays good short-term financial condition with a Current Ratio of 1.71 and a Quick Ratio of 1.64, both superior to most of its industry peers. This implies THC should not have issues meeting its short-term debts.

- Debt Considerations: The review does point out areas for care, mainly a high Debt-to-Equity ratio of 3.26, which is poorer than 77% of the industry. The Debt-to-Free-Cash-Flow ratio is also somewhat high. However, it is significant to note that the Altman-Z score shows limited short-term bankruptcy danger, and the company has been lowering its share count and bettering its debt/assets ratio over time.

While the leverage is a point to watch, the company's good profitability and cash flow give it the ability to manage its debt, making it a measured risk instead of a disqualifying factor for value-focused investors.

Growth Outlook

Finally, value investing is not only about fixed measurements; it includes a perspective on a company's future possibility. A low-priced company with growth outlook offers a double chance for gains: valuation improvement and profit growth. Tenet Healthcare displays a satisfactory growth path.

- Earnings Growth: The company's Earnings Per Share (EPS) has increased at a notable average yearly rate of 34.84% over recent years. While future EPS growth is anticipated to slow, it is still forecast at a good 13.65% per year.

- Revenue Trajectory: Historical revenue growth has been slight, but analysts predict an increase in revenue growth to 3.27% per year in the near future.

This pairing of good historical earnings growth and a positive forward view supports the idea that the company's present low valuation may not be warranted by its future possibility.

A thorough summary of these basic factors is accessible in the full fundamental analysis report for THC.

Conclusion

Tenet Healthcare Corp stands as a strong candidate for investors applying a value-based filtering method. The stock satisfies the central requirements by trading at a notable discount to industry and market valuations while being supported by outstanding profitability, acceptable liquidity, and positive growth forecasts. The higher debt level is a factor that needs observation, but it seems to be offset by the company's good cash-producing capacity. For value investors looking for a possible difference between market price and inherent worth in the healthcare field, THC deserves more study.

This analysis was founded on a "Decent Value" stock filter. You can find more investment ideas using this same method here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an offer to solicit any transaction in securities. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.