For investors looking for a dependable source of passive income, a systematic screening method can be a useful instrument to find potential options. One practical way is to concentrate on stocks that provide a good dividend and also show the basic financial soundness to keep it. This means selecting for firms with a high dividend score, which assesses yield, increase, and record, while also demanding a basic degree of earnings and financial condition. This technique tries to look past a merely high yield to locate firms where the dividend is backed by good business foundations.

Skyworks Solutions Inc (NASDAQ:SWKS) appears from such a screening process as a notable option for dividend-oriented portfolios. The semiconductor firm, a main provider of analog and mixed-signal chips for items from phones to car systems, now shows a good combination of income creation and fundamental steadiness.

A Notable Dividend Picture

The main draw of SWKS for income investors is its solid dividend traits, which are key to the screening method's concentration on dependable distributions.

- Good Yield: Skyworks now provides a dividend yield near 4.68%. This is much greater than both the typical yield of the S&P 500 (near 1.89%) and similar firms in the semiconductor field.

- Good Increase History: The company has built a dependable history of giving capital to shareholders. It has paid dividends for more than ten years and has not cut its payment in the last five years. More notably, it has raised its dividend at an average yearly rate of almost 9% over this time.

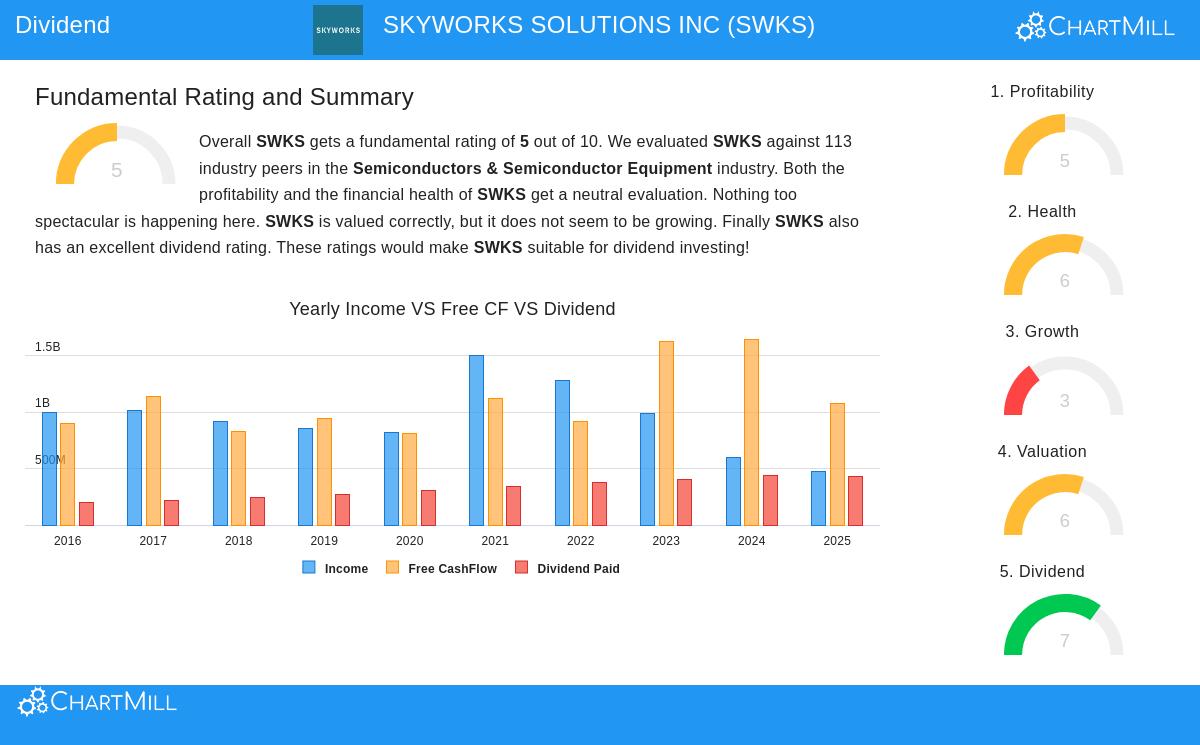

- High Dividend Score: These points lead to Skyworks receiving a ChartMill Dividend Score of 7 out of 10, putting it in the high group of dividend-paying stocks by this measure. A full look at this score is in the full fundamental analysis report.

Looking at Earnings and Financial Condition

A high yield by itself can be misleading if the firm does not have the profit ability or financial steadiness to continue it. This is why the screening rules call for acceptable scores for earnings and condition, to make sure the dividend is not in danger. Skyworks scores sufficiently on both points.

Earnings: With a ChartMill Earnings Score of 5, Skyworks shows steady profit ability. Important good points include:

- The company has been profitable and made positive operating cash flow in each of the last five years.

- Its return on assets, equity, and invested capital all do better than most of its industry rivals.

- While profit and operating margins have seen recent strain, a usual event in the varying semiconductor sector, they stay above the industry middle point.

Financial Condition: Skyworks has a ChartMill Condition Score of 6, showing a good balance sheet that backs the screening method's need for stability.

- The company has a very small debt-to-equity ratio of 0.09 and could pay off all its debt with less than one year of free cash flow, pointing to good stability.

- An Altman-Z score much above the trouble level suggests no short-term bankruptcy worry.

- While its current and quick cash ratios are a bit under the industry average, they remain at levels that sufficiently cover near-term responsibilities.

Price and Increase Points

From a price view, Skyworks seems fairly valued, trading at a P/E ratio near 10. This is much lower than both the wider market and its own industry average, possibly giving a buffer for investors. The increase outlook is more quiet, with the company seeing small drops in sales and profits over the last year. However, analysts forecast a return to slight increase in the next few years, and the fundamental report states that the increase rate is predicted to rise from its recent path.

A Point of Care for Dividend Continuation

While the total dividend picture is solid, investors should note one key measure from the fundamental study. The company's dividend payout ratio is now high, at over 90% of its net profit. This shows that almost all its profits are being paid to shareholders, which could reduce room for future raises or present a worry if profits fall. This highlights the value of the screening method's focus on earnings; investors must watch if Skyworks can grow its profits to lower this ratio to a more maintainable level with time.

Locating Other Dividend Options

Skyworks Solutions shows the kind of stock a systematic dividend screening process can find: one with a good, rising yield supported by sufficient earnings and a sound balance sheet. For investors aiming to create or add to a collection of income-producing assets, this approach gives a firm beginning point.

You can view the full "Best Dividend Stocks" screen and see the whole list of passing firms by using this link: Best Dividend Stocks Screen.

Disclaimer: This article is for information only and does not make up financial guidance, a suggestion, or a bid or request to buy or sell any securities. The information given is based on supplied data and should not be the only base for any investment choice. Investors should do their own study and talk with a qualified financial advisor before making any investment.