Sterling Infrastructure Inc (NASDAQ:STRL) has appeared as a notable option for quality investors after satisfying the Caviar Cruise screening methodology. This investment process concentrates on finding companies with excellent business attributes that can produce lasting long-term results. The method stresses measurable indicators like steady revenue and profit expansion, high returns on invested capital, solid cash flow production, and acceptable debt amounts, all signs of lasting competitive edges and operational skill.

Satisfying the Quality Standard

The Caviar Cruise screen uses strict financial filters to find companies deserving of long-term investment. Sterling Infrastructure shows outstanding results across several important measures:

-

Notable Profitability Expansion: With EBIT growth of 44.55% CAGR over five years, STRL greatly surpasses the screen's 5% minimum. This considerable operational profit increase signals strong pricing ability and effective scaling of business activities.

-

Excellent Capital Effectiveness: The company reaches a notable ROIC excluding cash, goodwill and intangibles of 182.79%, greatly exceeding the 15% limit. This measure is important for quality investing as it shows how efficiently management uses capital to produce returns.

-

Superior Cash Flow Generation: STRL's five-year average profit quality of 200.18% is much higher than the 75% standard, showing the company turns accounting profits into real cash flow at a notable rate. This offers financial room for strategic projects.

-

Prudent Debt Handling: The debt-to-free cash flow ratio of 0.81 years is much lower than the screen's 5-year maximum, indicating STRL could pay back all debt in under one year using current cash flows. This financial solidity offers stability during economic instability.

Fundamental Soundness Evaluation

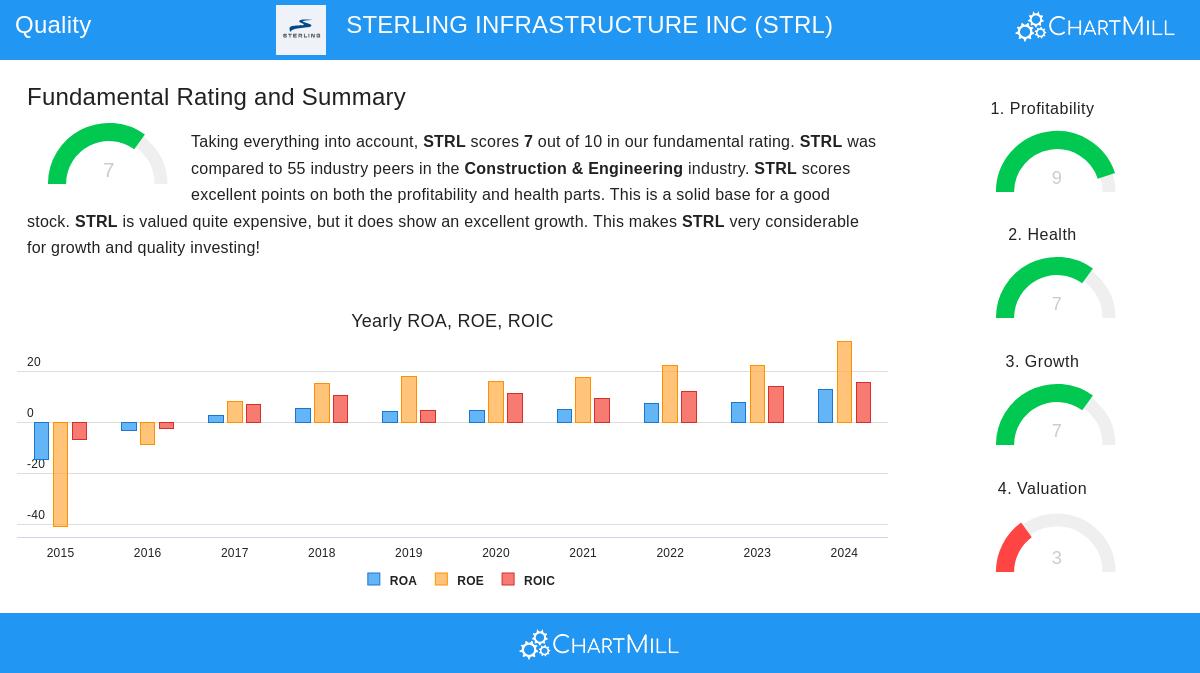

According to the detailed fundamental analysis, Sterling Infrastructure receives an overall rating of 7 out of 10, with especially good results in profitability and financial condition. The company works in the construction and engineering industry, serving various markets including e-infrastructure solutions for data centers, transportation infrastructure, and building solutions mainly in Texas.

The fundamental report notes several prominent attributes:

- Profitability measures rank in the top quartile of industry peers, with return on equity of 30.04% and profit margins of 14.14%

- Very good solvency measures, including an Altman-Z score of 5.90 signaling low bankruptcy risk

- Solid historical expansion with EPS growing at 54.19% each year over recent years

- Positive future growth projections with analysts estimating 13.38% yearly EPS growth

While valuation seems elevated with a P/E ratio of 33.31, this higher price may be reasonable given the company's notable growth path and profitability measures. Quality investors frequently accept higher valuations for businesses showing lasting competitive edges and consistent performance.

Strategic Placement and Future Prospects

Sterling Infrastructure's business structure fits well with several qualitative elements important to quality investors. The company gains from involvement in long-term trends including data center growth, infrastructure updates, and residential construction expansion. Its varied service offerings across e-infrastructure, transportation, and building solutions supply multiple growth paths while lowering cyclical risks.

The company's impressive ROIC and profit quality scores indicate management has good capital allocation discipline and operational knowledge. These qualities are necessary for increasing shareholder value over long periods. Also, STRL's prudent debt position gives sufficient ability to handle economic cycles while continuing strategic investments.

Investigating Quality Investment Options

For investors curious about finding other companies that meet the Caviar Cruise quality standards, the complete screening results are accessible for more study. The screen finds companies displaying the financial soundness and growth attributes valued by quality-centered investors.

Sterling Infrastructure offers a notable case for quality investors looking for businesses with outstanding operational results, solid financial condition, and involvement in lasting growth trends. The company's prominent measures across profitability, capital effectiveness, and cash flow production show the attributes that quality investing methods try to find.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial analysis, or recommendation to buy or sell any securities. Investors should conduct their own research and consult with financial advisors before making investment decisions.