The choice of Seacoast Banking Corp. of Florida (NASDAQ:SBCF) comes from a systematic screening process made to find stocks that fit a disciplined, growth-focused investment philosophy. This method uses two strong frameworks: Mark Minervini's Trend Template and a High Growth Momentum (HGM) rating. The Minervini Trend Template is a strict technical checklist that sorts for stocks showing solid, confirmed uptrends, making sure an investor only looks at securities where the current market momentum is positive. At the same time, the HGM rating judges a company's fundamental growth path, concentrating on speeding up earnings, sales, and positive analyst changes. By needing a stock to clear both filters, the method aims to locate companies that are both technically set to continue and supported by sound and getting better business foundations.

Fitting the Minervini Trend Template

For a trader using Mark Minervini's ideas, a stock must first show faultless technical condition. SBCF now meets the main points of the Trend Template, which is made to spot stocks in a clear Stage 2 advance. The template's rules create discipline, making the investor concentrate on strength and momentum instead of trying to buy a declining stock.

A look at the given data shows SBCF fits these technical rules:

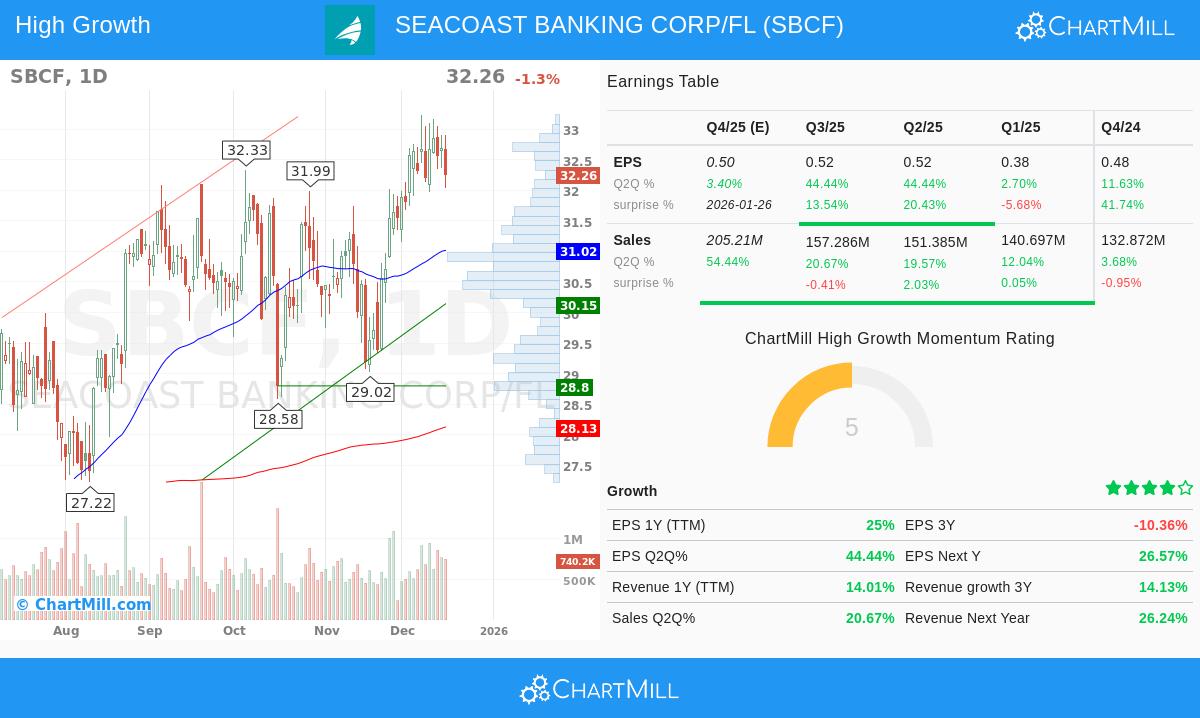

- Trend Alignment: The stock's price of $32.26 trades above its rising 50-day ($31.02), 150-day ($29.28), and 200-day ($28.13) simple moving averages (SMAs). Also, the 50-day SMA is above the 150-day SMA, which is above the 200-day SMA, forming the "stacked" moving average order that Minervini notes as a sign of a sound, speeding up uptrend.

- Proximity to Highs: SBCF is trading within 3% of its 52-week high of $33.23, well inside the template's need to be within 25% of the high. It is also more than 50% above its 52-week low, much higher than the 30% minimum. This shows the stock is displaying leadership and strength, not bouncing back from serious weakness.

- Relative Strength: With a ChartMill Relative Strength (CRS) score of 73.47, SBCF is doing better than almost three-quarters of the market. While Minervini often looks for scores above 80 for top leaders, a score above 70 meets the basic rules and indicates the stock is maintaining its position, especially as the wider S&P 500 also trends upward.

This technical view is important because, as Minervini's strategy states, the largest stock market winners are almost always in a definite uptrend before they make their biggest moves. The Trend Template methodically takes away subjective bias and makes sure an investor is trading with the current trend.

Passing as a High Growth Candidate

Clearing the technical screen is only part of the process. The "High Growth Momentum" part of the filter makes sure the basic company is seeing fundamental speeding up, which often works as the reason for continued price gains. SBCF's recent financial numbers show several positive growth patterns that fit this idea.

Key fundamental points include:

- Earnings Momentum: The company has shown notable recent earnings power. Earnings per share (EPS) increased by 44.4% in the latest quarter compared to the same time last year. Also, analysts have become clearly more positive, raising their EPS estimates for the next year by over 15% in the last three months. This pairing of strong actual results and upward changes is a standard sign of positive fundamental momentum.

- Sales Growth Speed: Revenue growth has been solid and is speeding up. Year-over-year sales growth was 20.7% last quarter, a clear gain from the 3.7% growth seen three quarters before. This hints at growing business activity and market reach.

- Consistent Execution: SBCF has surpassed analyst EPS estimates in three of the last four quarters, with an average beat of over 17%. This record of beating expectations builds trust with investors and can lead to continued positive feeling.

- Profitability: The company keeps good profit margins, with the last quarter showing a net profit margin of 23.2%. Solid margins give a base for earnings growth to reach the bottom line.

For a growth investor, these numbers are key. Minervini himself notes that "big earnings attract big attention." A stock with speeding up fundamentals is more likely to draw institutional buying interest, which gives the support for a maintained price trend. The HGM rating tries to catch this pattern early in its cycle.

Technical Condition and Setup Summary

ChartMill's own technical analysis gives a combined view of SBCF's position. The stock gets a high Technical Rating of 8 out of 10, showing its strong positive trends across both short-term and long-term periods. Adding to this, it also has a Setup Rating of 8, showing the price action has lately moved in a narrower range, possibly preparing for a new directional move.

The technical report states that SBCF is trading near the top of its recent range and has just shown a "Pocket Pivot" signal, a volume-based sign often linked to institutional buying during a consolidation. While a resistance area exists just above the current price around $32.54-$32.86, a clear move above this level could be seen as a new entry signal for trend-following methods. You can see the full, detailed technical analysis for SBCF here.

Locating Comparable Opportunities

Seacoast Banking Corp. of Florida gives an example of a stock that now meets the two needs of technical trend strength and fundamental growth momentum. For investors wanting to use this combined screening method to find other possible candidates, the ready-made "High Growth Momentum + Trend Template" screen is available to use. You can use this screen here to see the current results and do your own further study.

Disclaimer: This article is for information and learning only. It is not a suggestion to buy or sell any security. The analysis is based on given data and certain screening methods. All investing has risk, including the possible loss of principal. You should do your own complete study and think about talking with a qualified financial advisor before making any investment choices.