RHYTHM PHARMACEUTICALS INC (NASDAQ:RYTM) has been identified as a high-growth momentum stock that aligns with Mark Minervini’s Trend Template. The company’s technical strength, combined with accelerating revenue growth, makes it a compelling candidate for growth-focused investors.

Technical Strength: Meeting Minervini’s Trend Template

RYTM satisfies all key technical criteria from Minervini’s strategy:

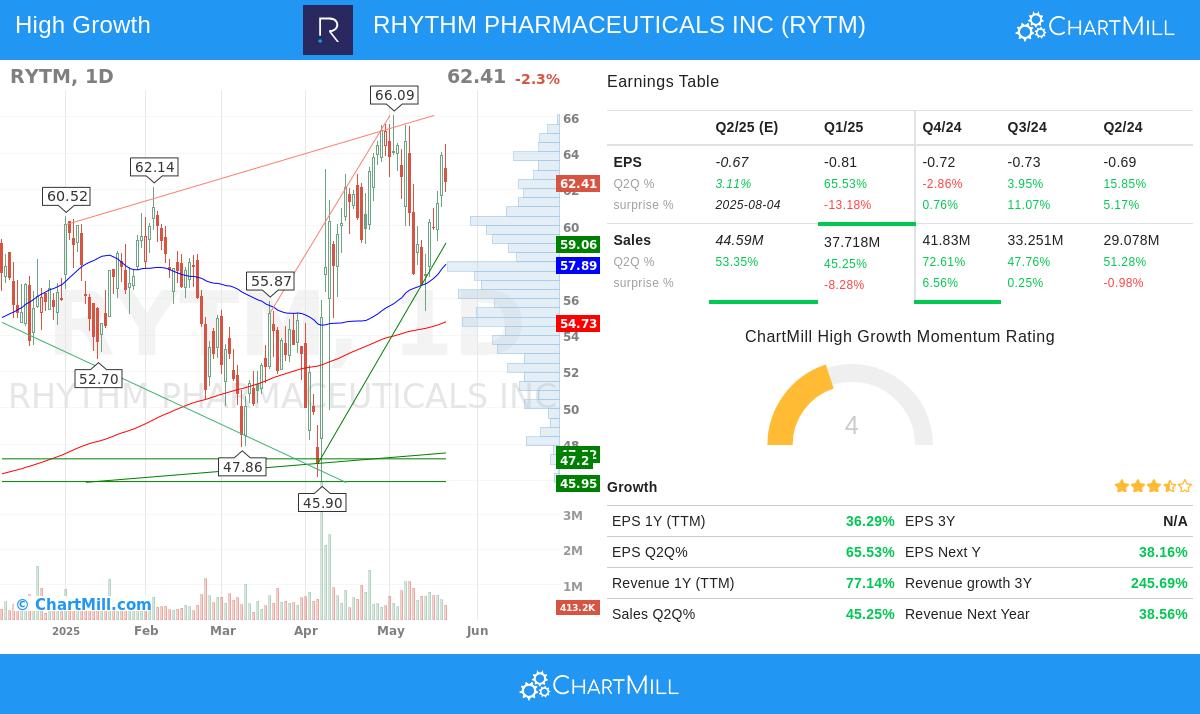

- Price Above Key Moving Averages: The stock trades at $62.41, well above its 50-day ($57.89), 150-day ($56.84), and 200-day ($54.73) moving averages.

- Upward-Trending Averages: The 50-day, 150-day, and 200-day moving averages are all rising, confirming a sustained uptrend.

- Strong Relative Strength: With a ChartMill Relative Strength score of 94.75, RYTM outperforms nearly 95% of all stocks.

- Price Near 52-Week High: Currently at $62.41, the stock is within 10% of its 52-week high ($68.58), a sign of strong momentum.

Growth Fundamentals: High Revenue and Earnings Momentum

RYTM’s financials reflect accelerating growth, a key factor for high-growth investors:

- Revenue Growth:

- Quarterly revenue surged 45.25% year-over-year, with prior quarters showing even stronger gains (72.6%, 47.8%, and 186.4%).

- Annual revenue growth stands at 68.06%, highlighting rapid expansion.

- Earnings Improvement:

- Recent quarterly EPS growth of 65.53% signals improving profitability.

- Despite negative earnings (common in biotech growth phases), losses are narrowing, with TTM EPS improving by 36.29% year-over-year.

- Analyst Expectations:

- The company has beaten EPS estimates in 3 of the last 4 quarters, with an average beat of 95.34%.

Technical Outlook & Trade Setup

The ChartMill Technical Report rates RYTM a perfect 10/10 for technical strength, citing:

- A strong uptrend in both short and long-term timeframes.

- Support near $56.78-$59.88, providing a clear stop-loss level.

- Low overhead resistance, suggesting room for further upside.

Our High Growth Momentum + Trend Template screener lists more high-growth stocks that meet these criteria.

Disclaimer

This is not investing advice. The article highlights observations at the time of writing, but investors should conduct their own analysis before making decisions.