REVOLVE GROUP INC (NYSE:RVLV) has recently appeared as a candidate through a screening method that mixes technical and fundamental analysis. This method looks for stocks showing solid growth features, such as accelerating earnings and revenue, while also presenting good profitability and financial soundness. The method also uses technical analysis to find breakout patterns, indicating possible upward movement. By mixing these methods, investors try to capture growth stocks at good times, just as they start to gain attention in the market.

Growth and Fundamental Strength

RVLV’s attraction as a growth stock is backed by several important fundamental metrics. The company works in the specialty retail sector, concentrating on next-generation fashion for millennial and Gen Z consumers, a group with significant long-term purchasing ability. According to its fundamental analysis report, RVLV shows positive growth qualities:

- Revenue Growth: Over the past year, revenue rose by 10.68%, with an average yearly growth of 13.46% in recent years. Future revenue is estimated to grow by almost 15% each year.

- Earnings Trajectory: Although past EPS growth has been variable, future EPS is predicted to rise by over 30% per year, showing a solid forward earnings increase.

- Financial Health: The company has a strong balance sheet with no debt, a current ratio of 2.71, and an Altman-Z score of 7.15, indicating good liquidity and very low bankruptcy risk.

- Profitability: Gross margins are at a notable 52.47%, doing better than 81% of industry peers, though operating and net margins have experienced some recent pressure.

These points match the main ideas of growth investing, which focus on companies with increasing market opportunities, good financials, and the ability to do better than sector averages.

Technical Breakout Indicators

From a technical view, RVLV displays positive signs that match its fundamental strong points. The technical analysis report points out several good signals:

- Trend Strength: Both short-term and long-term trends are positive, supporting the stock’s upward movement.

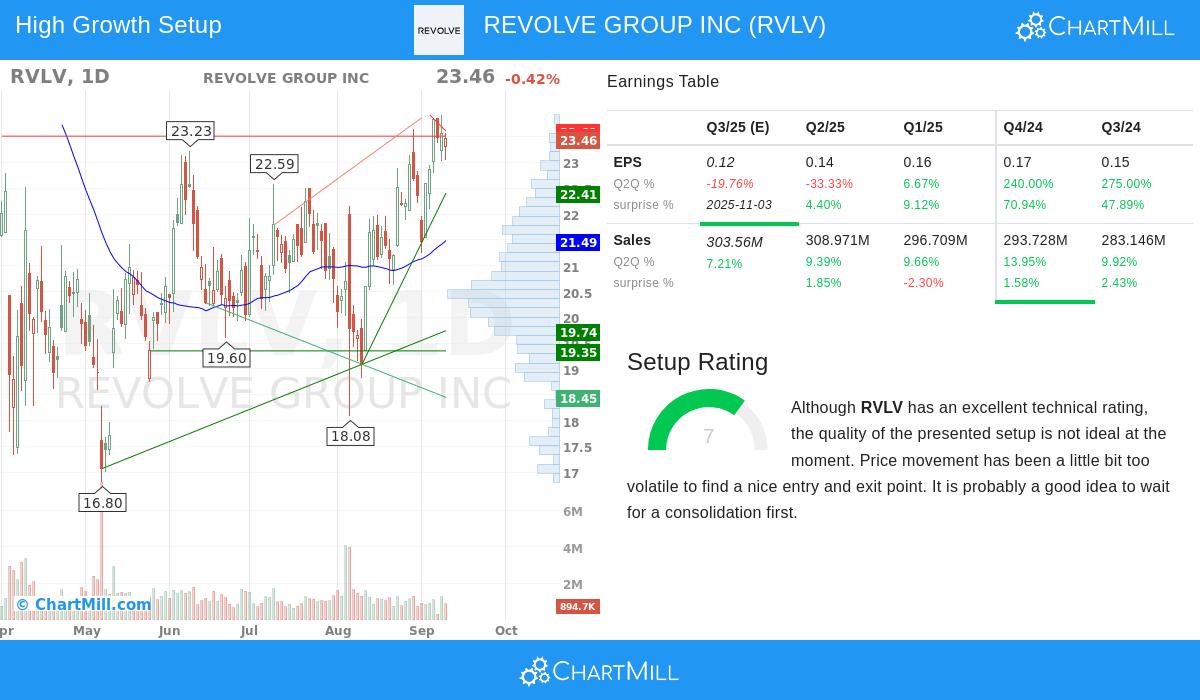

- Trading Range: The stock has been trading between $20.52 and $23.92 over the past month and is now nearing the top of this range, hinting at consolidation close to a possible breakout point.

- Support and Resistance: Important resistance is between $23.51 and $23.84. A continued move above this area could indicate a bullish breakout, with close support levels offering a cushion against drops.

- Volume and Liquidity: Average daily trading volume of 1.2 million shares shows good market interest and liquidity.

These technical features are important for timing entries in growth stocks, as breakouts frequently come before times of faster price increase.

Strategic Fit and Market Context

RVLV’s mix of fundamental growth and technical placement makes it a good example of a stock that fits the requirements for a "strong growth stock with a good technical setup." The company’s focus on an expanding target market, millennial and Gen Z consumers, supports its long-term growth ability, while its debt-free balance sheet and high gross margins offer financial strength. Technically, the stock’s consolidation near resistance levels, along with positive trend signals, implies it may be set for more gains.

This combined method, valuing both basic business quality and market timing, is important for investors looking to take advantage of growth stocks before they become widely known and fully priced.

Explore Similar Opportunities

For investors curious about finding more stocks that match this method, other candidates can be located using the Strong Growth Stocks with Good Technical Setup Ratings screen. This tool mixes fundamental and technical filters to find high-potential opportunities in real-time.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The analysis is based on available data and should not be the sole basis for making investment decisions. Always conduct your own research and consider consulting with a qualified financial advisor before investing.