RESMED INC (NYSE:RMD) stands out as a compelling candidate for quality investors, meeting stringent criteria for profitability, growth, and financial health. The company, a leader in digital health and cloud-connected medical devices, demonstrates consistent revenue and earnings growth, high returns on capital, and a strong balance sheet.

Key Strengths of RESMED

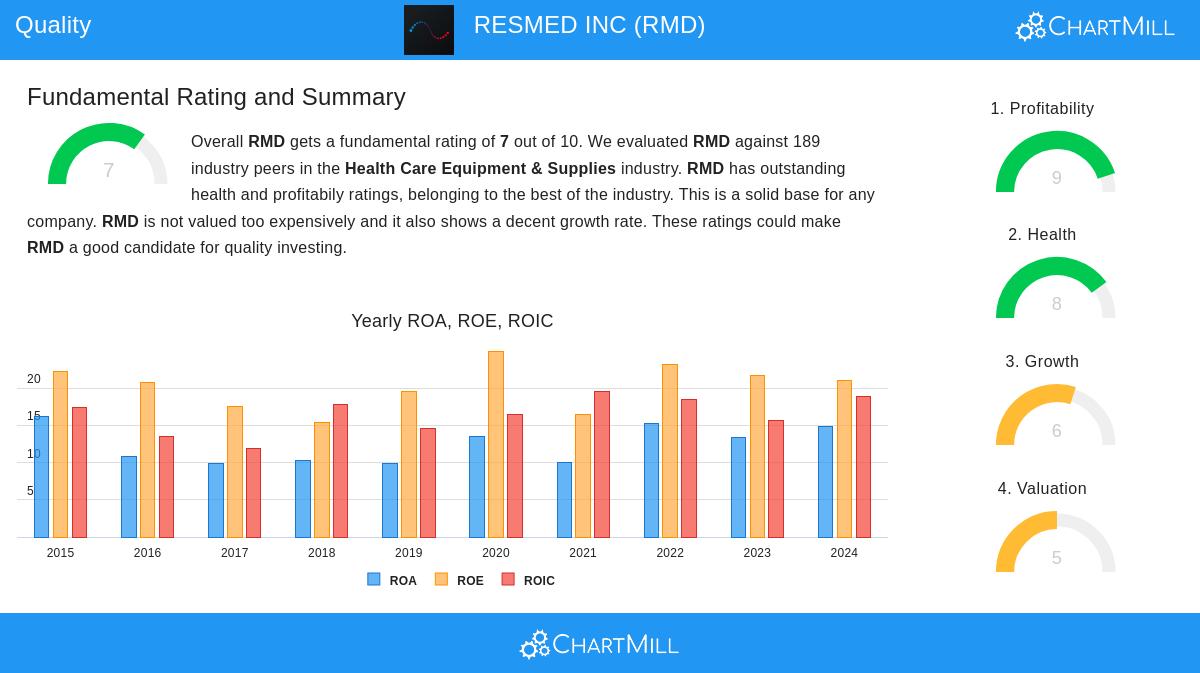

- Revenue and EBIT Growth: Over the past five years, RMD has delivered an 8.4% annual revenue growth and an impressive 16.8% EBIT growth, indicating improving operational efficiency.

- High Return on Invested Capital (ROIC): With an ROIC of 54.1%, the company efficiently generates profits from its capital investments, far exceeding industry standards.

- Strong Profit Quality: RMD converts 91.2% of its net income into free cash flow, reflecting high earnings quality and financial stability.

- Low Debt Burden: A Debt-to-Free Cash Flow ratio of 0.43 means the company could repay its debt in less than six months using current cash flows, highlighting financial resilience.

- Profitability Metrics: Operating margins (32.1%) and profit margins (26.2%) rank among the top in the healthcare equipment sector, demonstrating pricing power and cost management.

Valuation and Growth Outlook

While RMD trades at a premium with a P/E of 27.7, its strong earnings growth (14.5% expected annually) and high profitability justify the valuation. Analysts project continued revenue growth of 8.4% over the next three years, supported by demand for respiratory and sleep disorder solutions.

Our Caviar Cruise screener lists more quality stocks updated daily. For a deeper analysis, review the full fundamental report on RMD.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.