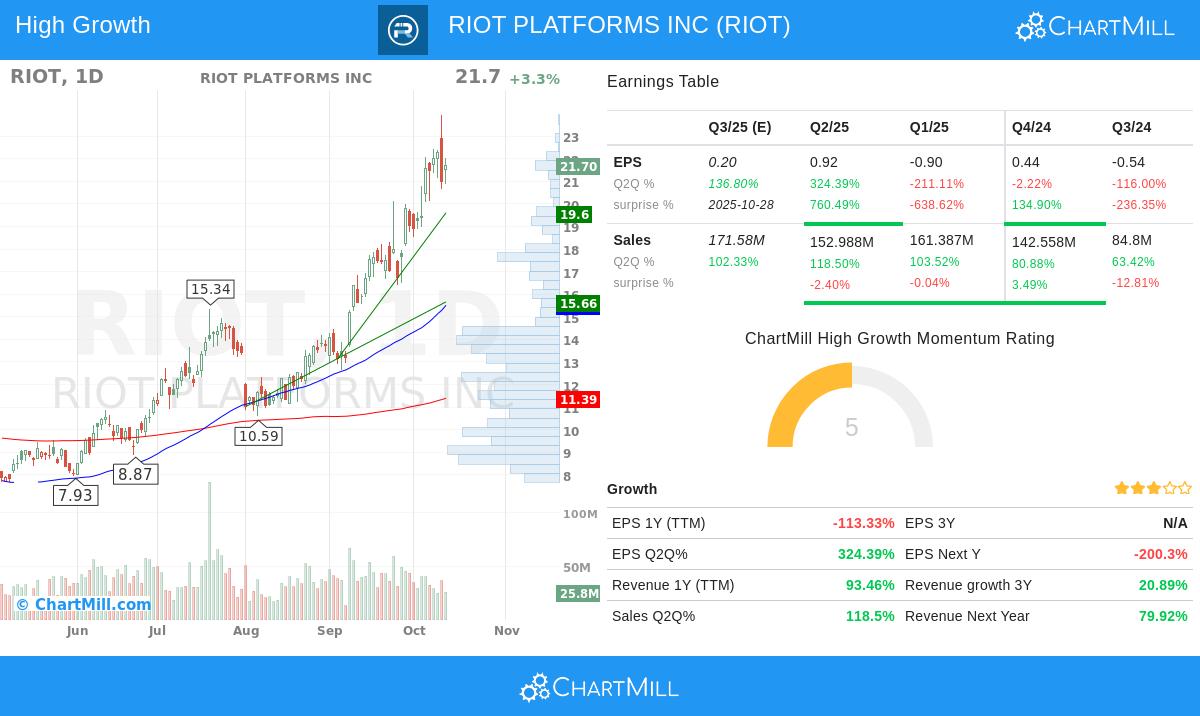

RIOT PLATFORMS INC (NASDAQ:RIOT) has become a notable option for investors using systematic growth plans, joining Mark Minervini's strict trend-based framework with a high growth momentum screen. The selection process finds stocks displaying solid technical condition through Minervini's Trend Template, which focuses on stocks in clear uptrends with better relative performance, while also needing solid fundamental growth traits from the High Growth Momentum rating system. This two-part method aims to find companies displaying both price momentum and business speed improvement.

Technical Strength and Trend Template Alignment

RIOT shows very good technical traits that fit well with Minervini's Trend Template standards. The template needs stocks to display clear uptrends in various time periods, trading higher than important moving averages with rising slopes, and displaying good relative performance compared to the wider market. These technical states help find stocks in Stage 2 accumulation periods, where the chance for continued upward momentum is greatest.

The stock now meets all main Trend Template needs:

- Current price ($21.70) trades much higher than the 150-day SMA ($11.45) and 200-day SMA ($11.39)

- Both the 150-day and 200-day moving averages display upward paths

- The 50-day SMA ($15.51) sits higher than both the 150-day and 200-day SMAs

- Price is 250% higher than its 52-week low ($6.19) and within 9% of its 52-week high ($23.94)

- Relative strength ranking of 95.63 shows it performs better than 96% of all stocks

These technical traits indicate RIOT is in a solid Stage 2 uptrend, fitting Minervini's main idea that stocks displaying the strongest technical condition often continue their better performance.

Growth Momentum Fundamentals

Beyond technical condition, RIOT displays speeding fundamental growth that supports its High Growth Momentum rating. The company's recent financial results show major gains across important measures that growth investors focus on, especially earnings speed improvement and revenue growth.

The fundamental view shows several positive growth factors:

- Quarterly EPS growth of 324% year-over-year displays major earnings gain

- Revenue growth of 118% in the latest quarter shows large business growth

- Analyst EPS revisions for next year have grown 74% over three months, showing increasing expectations

- Profit margins have grown noticeably to 143% in the most recent quarter

These growth measures fit with Minervini's focus on companies displaying "big earnings surprises" that draw institutional interest. The joining of technical condition and fundamental speed improvement creates the kind of setup Minervini describes as having the possibility for "exponential growth" when found at the correct timing point.

Technical Health Assessment

According to ChartMill's full technical study, RIOT gets a perfect technical rating of 10 out of 10, showing very good technical condition across all studied areas. The stock displays solid positive trends in both short-term and long-term time periods, with all main moving averages moving upward. Its relative strength performance puts it in the top group of all stocks, performing much better than both the wider market and 90% of stocks in the software industry.

While the technical base remains solid, the study notes that present instability may create difficulties for good entry points, with the stock trading in a wide monthly range between $16.43 and $23.93. For investors using Minervini's method, this indicates waiting for possible consolidation or instability decrease patterns to form before starting new positions. The full technical report gives detailed support levels and extra study.

Investment Considerations

For growth-focused investors, RIOT shows a notable case of a company displaying both technical momentum and fundamental speed improvement. The fit with Minervini's standards indicates the stock has the traits that have historically come before major price gains when found during proper market timing. However, the present higher instability shows the need for controlled entry plans and risk management, main parts of the Minervini method that focus on protecting capital in all market states.

Disclaimer: This analysis is for informational and educational purposes only and does not constitute investment advice. All investment decisions should be based on individual research and risk tolerance. Past performance does not guarantee future results. Please read our full disclaimer at https://www.chartmill.com/documentation/disclaimer.