Technical analysis provides investors with tools to identify potential trading opportunities by evaluating price trends and patterns. One effective strategy involves screening for stocks that exhibit both strong technical health and consolidation patterns, indicating potential breakouts. This approach combines the ChartMill Technical Rating, which assesses the overall trend strength, with the Setup Quality Rating, which identifies optimal entry points during price consolidation phases. Stocks scoring high in both metrics often present favorable risk-reward scenarios for momentum-based strategies.

Technical Strength Overview

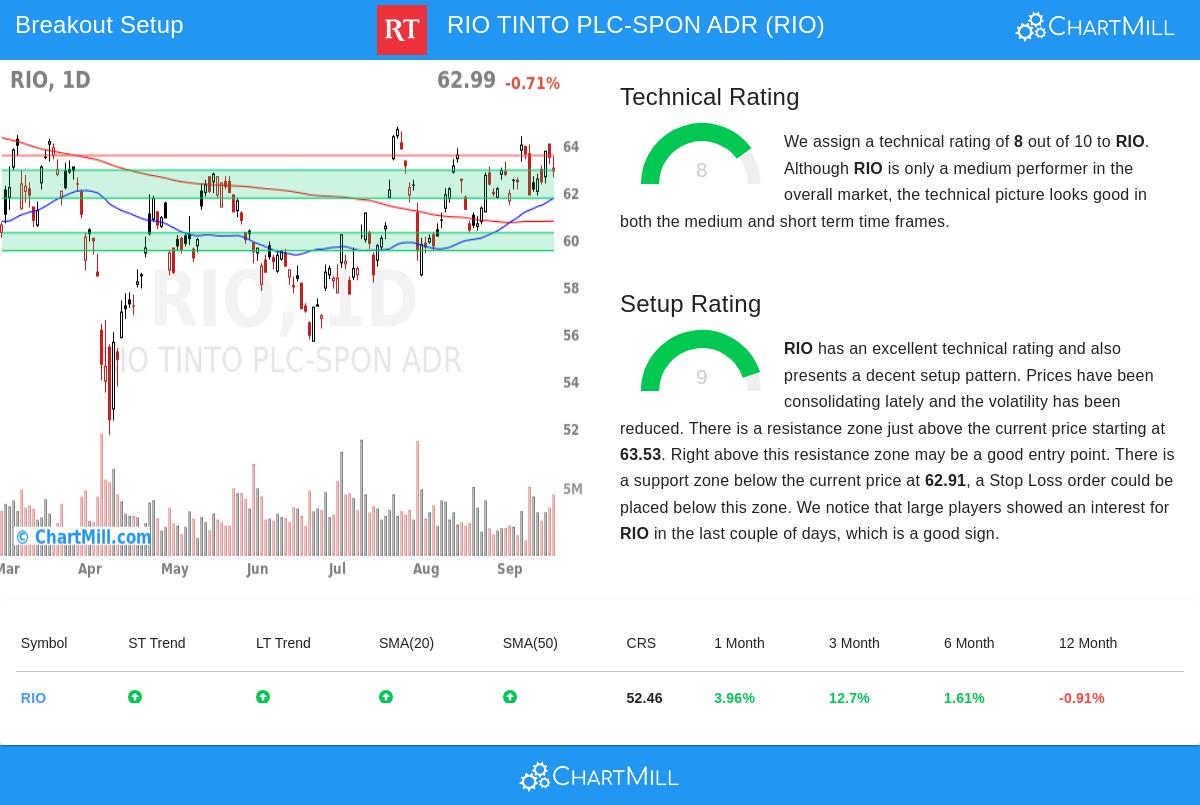

RIO TINTO PLC-SPON ADR (NYSE:RIO) demonstrates solid technical characteristics, earning a Technical Rating of 8 out of 10. This score reflects sustained positive momentum across multiple timeframes, a critical factor for technical investors seeking stocks with established upward trends rather than erratic movements. Key elements contributing to this rating include:

- Consistent upward trends in both short-term and long-term moving averages

- Price trading above all major simple moving averages (20-day, 50-day, 100-day, and 200-day)

- Positive performance across recent periods with 3-month returns exceeding 12%

The stock's ability to maintain these technical attributes suggests underlying strength, making it suitable for investors following trend-based methodologies. A solid technical foundation reduces the probability of false breakouts and provides confidence in the sustainability of price movements.

Setup Quality and Consolidation Pattern

Beyond technical strength, RIO presents an exceptional Setup Rating of 9, indicating the stock is forming a high-quality consolidation pattern. This aspect addresses the crucial "when to buy" question for technical traders, as consolidation phases often precede significant price movements. The current setup exhibits several favorable characteristics:

- Recent price action confined to a defined range between $60.37 and $64.35

- Reduced volatility suggesting accumulation or distribution by institutional players

- Clear support established near $62.91 with resistance around $63.53-$64.98

- Notable institutional interest detected through volume analysis in recent sessions

These consolidation characteristics are particularly valuable because they provide defined risk parameters. Traders can place precise stop-loss orders below support levels while positioning for potential upside breakouts above resistance zones.

Trading Implications and Market Context

The combination of strong technicals and tight consolidation makes RIO an interesting candidate for breakout strategies. The stock's current position near the middle of its trading range, coupled with declining volatility, creates conditions favorable for a potential upward move. While the broader metals and mining sector has shown mixed performance, RIO's individual technical characteristics outweigh sector concerns for momentum-focused approaches.

Traders monitoring this setup might consider entry points above the $64.99 resistance level, with protective stops below $61.83. This provides a clear risk-management framework with approximately 4.86% downside risk on the trade position.

For investors seeking similar technical breakout opportunities, additional candidates can be found through our Technical Breakout Setups Screen, which regularly identifies stocks meeting these rigorous technical criteria.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. All investments involve risk, and past performance does not guarantee future results. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.