Biotechnology firm Regeneron Pharmaceuticals (NASDAQ:REGN) has been found using a screening process made to find possible value investments. This method centers on companies that seem to be trading for less than their inherent worth, a central idea of value investing. The screen looks for stocks with solid fundamental valuation scores while also holding acceptable ratings in profitability, financial health, and growth, with the goal of finding strong companies the market might be pricing too low.

Valuation Metrics

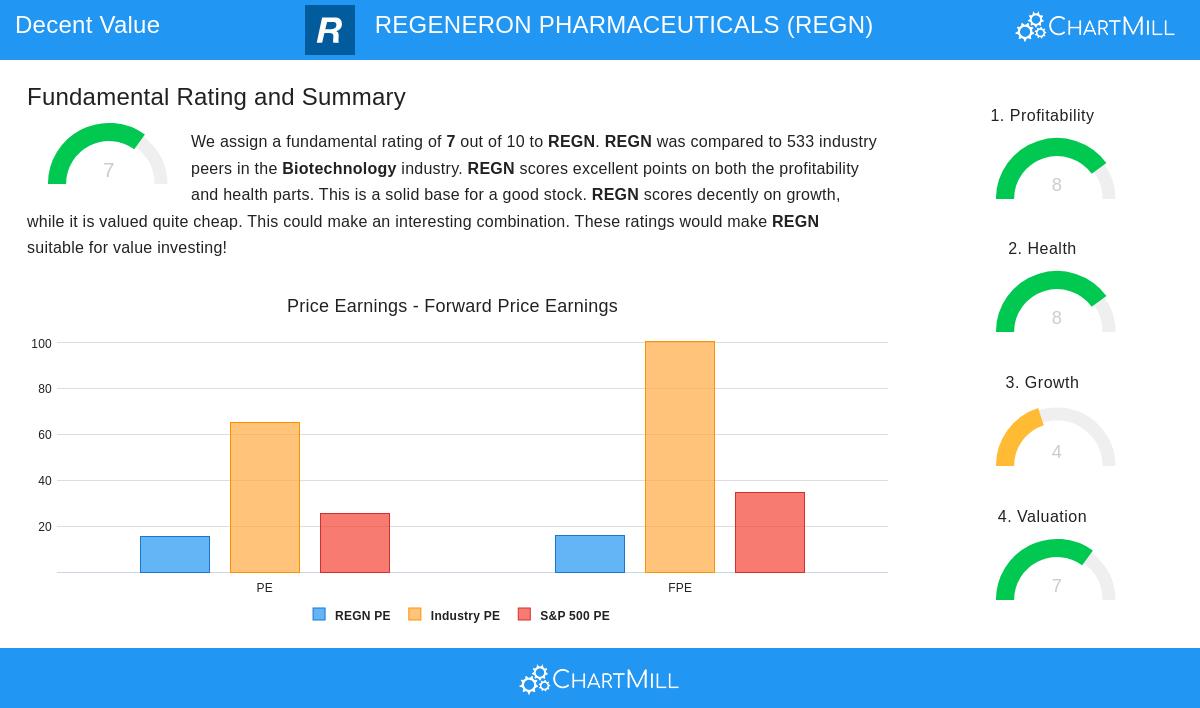

The foundation of value investing is finding a large difference between a company's market price and its inherent value. Regeneron's valuation measures indicate it is trading at a good price compared to both its industry and the wider market. The company's valuation rating of 7 out of 10 is seen as positive, suggesting it may be priced too low.

- Price-to-Earnings (P/E) Ratio: At 15.65, Regeneron's P/E ratio is much lower than the industry average of 65.09, making it less expensive than 95.68% of its biotechnology counterparts. It also trades below the S&P 500's average P/E of 25.56.

- Forward P/E Ratio: In the same way, its forward P/E of 15.86 is well under the industry average of 100.62 and the S&P 500 average, supporting the idea that its future earnings are not completely represented in the current share price.

- Enterprise Value to EBITDA & Price/Free Cash Flow: Judging by these important valuation measures, Regeneron is valued more affordably than over 94% of companies in its field, pointing to a possible market mispricing that value investors look for.

Financial Health

A solid financial base is important for value investments, as it gives a company the strength to handle economic declines and steer clear of the dangers of a "value trap." Regeneron receives a high health rating of 8, indicating a strong balance sheet.

- Solvency: The company has a very good Altman-Z score of 7.17, showing a very small risk of bankruptcy. Its debt level is very low, with a Debt-to-Equity ratio of only 0.09, and its free cash flow is enough to pay for all outstanding debts quickly.

- Liquidity: With a Current Ratio of 4.06 and a Quick Ratio of 3.51, Regeneron has plenty of liquidity to meet its short-term responsibilities without difficulty, offering a good cushion against unexpected problems.

Profitability Strength

For a value stock to be a good investment, it must be a high-quality business, not just an inexpensive one. Solid and steady profitability is a main sign of a company's basic quality and its capacity to produce returns for shareholders over the long term. Regeneron performs well here with a profitability rating of 8.

- Margins: The company has notable margins, including a Profit Margin of 32.13% and a Gross Margin of 86.28%, which are some of the highest in the biotechnology industry.

- Returns on Capital: Its Return on Assets (11.40%), Return on Equity (14.79%), and Return on Invested Capital (8.69%) all put it in the top group of its industry, showing very effective use of its capital to create profits.

Growth Outlook

While pure value investing sometimes values price more than growth, a reasonable growth path can be a strong catalyst that helps reduce the difference between market price and inherent value. Regeneron's growth rating of 4 is seen as acceptable, indicating a good historical performance even as the speed lessens.

- Past Performance: Over the last several years, the company has achieved solid average yearly growth in both Earnings Per Share (13.12%) and Revenue (12.55%).

- Future Expectations: While future growth is expected to be more moderate, analysts still predict steady rises in EPS (6.65%) and Revenue (5.75%) each year. This ongoing growth supports the view that the company is a stable, continuing enterprise instead of a static one.

Conclusion

Regeneron Pharmaceuticals presents an interesting case for investors using a value-focused approach. The company trades at a noticeable discount to its industry based on several important valuation measures, yet it is supported by outstanding profitability and a very solid financial base. This mix of a low stock price and a high-quality business fits with the value investing idea of looking for a "margin of safety." The company's acceptable, though slower, growth profile indicates it is an established and stable business rather than one weakening, lowering the risk of it being a value trap.

For investors wanting to find other companies that match a similar profile, our Decent Value Stocks screen can offer more possible candidates. You can also see the full fundamental analysis report for REGN here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. All investment decisions involve risk, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.