RADIAN GROUP INC (NYSE:RDN) was identified as a strong dividend candidate through our Best Dividend stock screener. The company stands out for its reliable dividend track record, solid profitability, and stable financial health, making it an appealing option for income-focused investors.

Dividend Strength

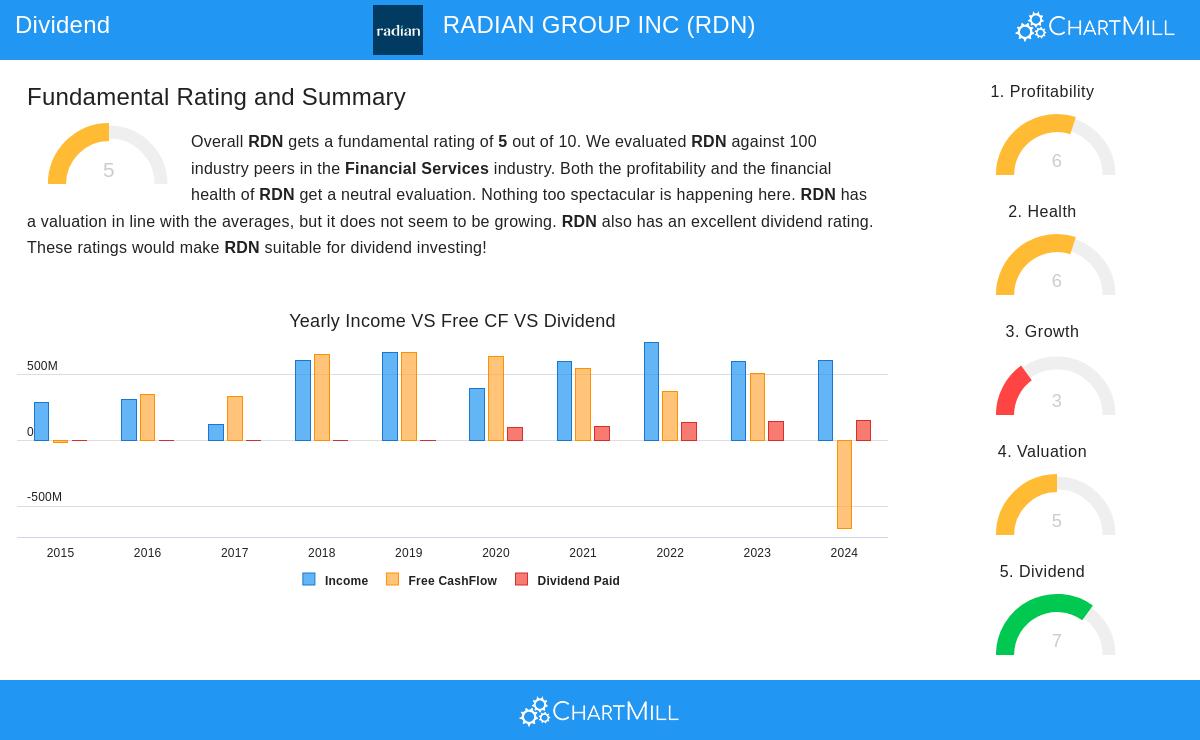

- Attractive Yield: RDN offers a dividend yield of 2.98%, slightly above the S&P 500 average of 2.34%.

- Consistent Growth: The company has increased its dividend at an impressive annualized rate of 151.22% over the past five years.

- Long-Term Reliability: RDN has paid dividends for at least 10 years without reductions, demonstrating commitment to shareholders.

- Sustainable Payout: Only 25.42% of earnings are allocated to dividends, indicating room for future increases.

Profitability & Financial Health

- Strong Margins: RDN’s Profit Margin (46.29%) and Operating Margin (68.74%) outperform most industry peers.

- Solid Returns: The company maintains a Return on Equity (13.01%) and Return on Invested Capital (7.97%) above industry averages.

- Healthy Liquidity: With a Current Ratio of 3.59, RDN comfortably meets short-term obligations.

- Moderate Debt: A Debt/Equity ratio of 0.52 is in line with industry norms, suggesting balanced leverage.

Valuation

RDN trades at a P/E ratio of 8.21, below both the S&P 500 (27.18) and industry average (20.04), making it reasonably priced relative to earnings.

For a deeper analysis, review the full fundamental report on RDN.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.