A rising count of investors are using a mixed method that joins fundamental and technical analysis to find good prospects. This method looks for stocks with good basic business expansion, confirmed by financial numbers, that are also showing positive chart formations indicating a possible price rise. The aim is to locate firms where sound operational condition matches with good market movement, possibly indicating a good time to buy. One stock now matching this description is Reddit Inc - Class A (NYSE:RDDT).

Fundamental Growth Assessment

The foundation of this method is finding companies with very good expansion paths, and Reddit's fundamental report shows good points in this part. The company's growth score of 8 out of 10 is backed by notable financial increases.

- High Earnings Increase: Earnings Per Share (EPS) has risen by 153.82% over the last year.

- Good Revenue Growth: Revenue increase of 69.71% in the last year shows solid market use and growing activities.

- Continued Movement: The company has kept an average yearly revenue growth of 38.93% over recent years.

- Positive Future View: Experts estimate EPS to grow by 39.17% on average in the next years, with revenue predicted to rise by 35.99% each year.

This growth is not happening alone. For a growth stock to last, it must work in a big and growing target market. Reddit’s system, with more than 100 million daily active users and over 100,000 active groups, gives a large and involved audience. This big size presents good chance for making money through ads and data deals, which is already seen in its rising revenue numbers. You can see the full details in the complete fundamental analysis report.

Financial Health and Profitability

More than just growth, the method needs a company to have a good financial base to handle market changes and put money into future growth. Reddit’s financial health score of 8 out of 10 points to a strong balance sheet.

- Very Good Cash Position: A Current Ratio and Quick Ratio of 12.13 show the company can easily meet its near-term bills, doing better than 95% of similar companies.

- Good Financial Standing: An Altman-Z score of 80.05 points to a very small chance of failure.

- No Debt Operation: The company has no debt, giving it a lot of financial room.

While its total profitability score is a middle 6, Reddit does well in important margin numbers that point to a way to better final results as it gets bigger.

- Top-Level Gross Profit: A Gross Margin of 91.21% is with the best in its field, doing better than 92% of others.

- Getting Better at Operations: An Operating Margin of 13.81% and a Profit Margin of 18.33% are both good for the interactive media group.

Technical Setup and Market Position

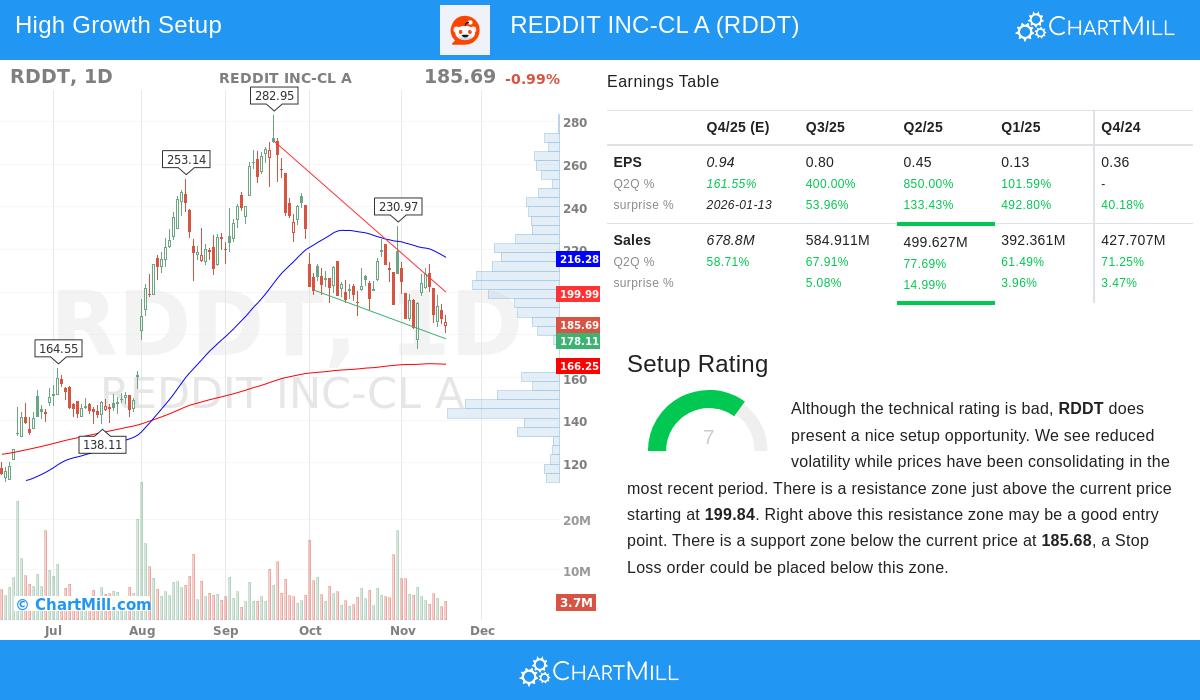

The technical analysis part is key for timing, and Reddit shows an interesting picture even with a low total technical score. The stock's setup score of 7 out of 10 points to a possible resting phase that often comes before a new price move.

- Resting Stage: Prices have been moving within a band, with recent trading close to the lower support area between $183.63 and $185.68. This lessening of up-and-down movement can often lead to a big price jump.

- Clear Price Ceiling: A set resistance area is present just above the current price, starting at $199.84. A clear move above this point could show the beginning of a new upward path.

- Relative Performance: The stock shows a relative strength of 70.71, meaning it has done better than over 70% of all stocks in the market, showing basic strength even during wider market softness.

This technical view suggests the stock is at a possible turning point. For a full look at the support and resistance points, along with moving average study, see the full technical analysis.

Valuation Context

Valuation is an important point for growth stocks, which often sell at high multiples. Reddit's valuation score of 4 shows a market that is counting on its future expansion potential.

- The stock sells at a high Price-to-Earnings (P/E) ratio of 106.72, which is costly next to the wider S&P 500.

- However, its Price-to-Earnings Growth (PEG) ratio is more positive, suggesting the high P/E may be partly reasonable given its large earnings growth hopes.

- When put next to its field peers in the interactive media group, Reddit's valuation multiples are closer to group averages.

Investment Considerations

Reddit shows a good example of a company that fits with a growth-and-movement investment method. Its fundamental story is one of fast user growth and revenue speed, backed by a debt-free balance sheet with good cash on hand. The technical setup suggests the stock may be getting ready for its next big move, with a set resistance point above that, if passed, could bring more buyer interest. The mix of high top-line growth, a large and involved system, and a positive technical formation makes it a stock worth watching for investors using this particular approach.

This study was built on a search for "Strong Growth Stocks with good Technical Setup Ratings." If you want to find other companies that meet these exact conditions, you can see the full search results here.

Disclaimer: This article is for information only and does not make up financial guidance, a suggestion, or a bid or request to buy or sell any investments. The information given should not be used as the only reason for making any investment choice. Investors should do their own separate study and talk with a qualified financial guide before making any investment.