For investors aiming to create a durable, long-term portfolio, the ideas of quality investing present a strong framework. This method centers on finding outstanding companies with lasting competitive strengths, sound financial condition, and the capacity to produce steady, superior earnings over many years. The "Caviar Cruise" stock screen puts this thinking into practice by selecting for firms with a record of solid revenue and profit increase, high returns on invested capital, good cash flow generation, and reasonable debt. The aim is not to locate short-term discounts, but to hold the finest businesses, frequently at a reasonable price, for the extended future.

One firm that appears from this strict screening process is RBC BEARINGS INC (NYSE:RBC), a producer of highly engineered precision bearings and parts. A detailed look shows how its financial picture matches a number of important principles of quality investing.

Match with Quality Investing Standards

The Caviar Cruise screen uses particular, measurable filters to find possible quality investments. RBC Bearings shows ability in many of these important areas:

-

High Return on Invested Capital (ROIC): A fundamental part of quality investing, ROIC calculates how well a company produces profits from its capital. The screen asks for an ROIC (leaving out cash, goodwill, and intangibles) over 15%. RBC Bearings greatly passes this level with a number of 24.98%. This shows the firm has a strong competitive position, probably through its technical skill and regulated products, letting it earn high returns on the funds it puts into the business.

-

Strong Profit Quality and Cash Flow Production: Quality investors value real cash earnings more than accounting profits. The screen searches for a 5-year average profit quality (Free Cash Flow/Net Income) over 75%. RBC Bearings performs well here, with a high average of 173.26% over the last five years. This means the company is not just profitable but is very effective at turning those profits into cash, giving great financial room for dividends, lowering debt, or strategic spending.

-

Reasonable Debt Load: Financial strength is essential. The screen applies a Debt-to-Free Cash Flow ratio under 5 years to make sure debts can be handled easily. RBC Bearings' ratio of 3.54 fits well within this limit, indicating it could pay off all its debt with under four years of present cash flow. This careful financial setup lowers risk and aids long-term steadiness.

-

Continued Profit Increase: The screen requires a 5-year CAGR for EBIT (earnings before interest and taxes) growth over 5%, favoring it to be higher than revenue growth, a signal of better operational effectiveness and pricing ability. RBC Bearings has achieved an EBIT growth of 18.70% over this time. While the given 5-year revenue growth data is not present, the solid EBIT rise points to capable management and a profitable expansion of activities.

Basic Health and Price Setting

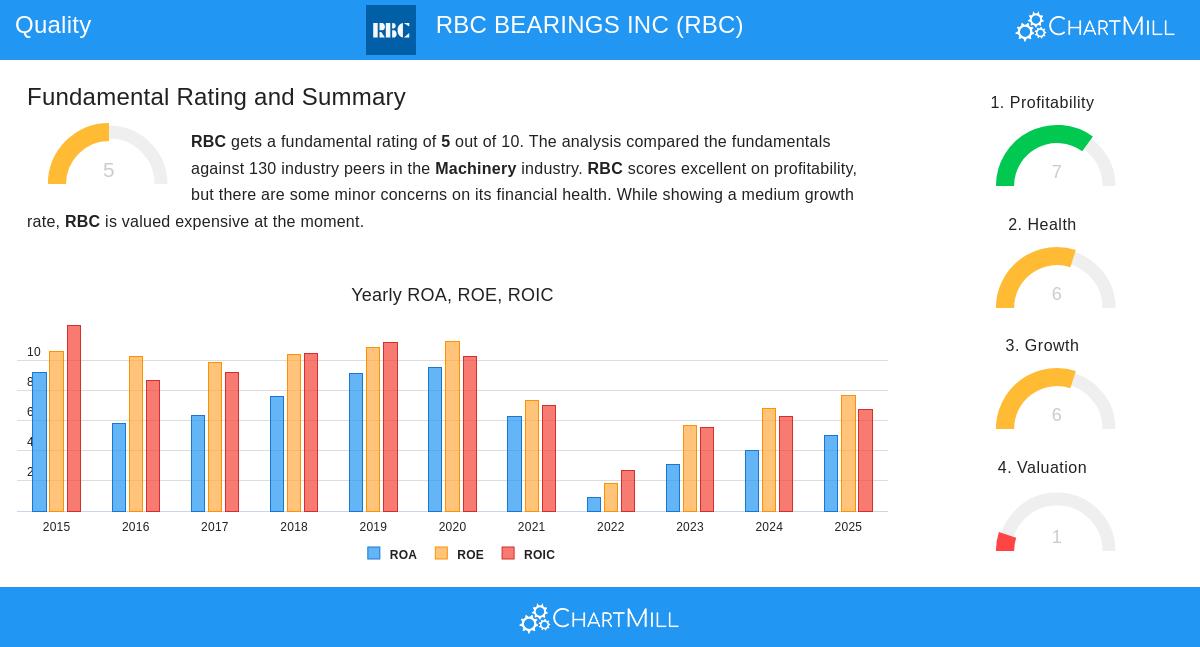

A look at the company's wider fundamental analysis report gives a more detailed picture. The report gives RBC a medium total score of 5 out of 10, noting a combination of clear strengths and visible difficulties.

Strengths:

- High Profitability Margins: The company's gross, operating, and profit margins are in the highest groups of the machinery field, highlighting its premium place and operational effectiveness.

- Sound Financial Condition: The company shows high solvency, with a good Altman-Z score and a debt-to-equity ratio that shows little reliance on debt funding.

- Steady Past Growth: Both revenue and earnings per share have displayed strong, double-digit growth paths over recent years.

Points for Investors:

- High Price Setting: The main warning in the report connects to price. RBC sells at a Price-to-Earnings ratio much greater than both its industry friends and the wider market. Investors are clearly paying a high price for its quality traits.

- Return on Capital Compared to Cost of Capital: The report states that the company's usual ROIC is now under its cost of capital, which is a point for review. It is key to separate this from the "ROICexgc" number used in the screen, which leaves out cash and intangibles and shows a better view of core operational effectiveness.

- Slowing Growth Outlooks: While still solid, analysts' predictions for future revenue and earnings growth are a bit under the high rates seen in the past.

Is RBC Bearings a Quality Investment?

RBC Bearings makes a strong argument for quality-centered investors. It meets key needs: high returns on its core invested capital, excellent turning of profits into cash, a careful balance sheet, and a past of solid profit growth. These are the signs of a business with a lasting competitive edge in its specific aerospace, defense, and industrial markets.

Yet, the quality investing idea also includes a strict review of cost. The company's clear strengths are seen in its high price, which requires belief in its capacity to keep high growth and profitability for the long future. For a quality investor, the choice rests on if RBC Bearings' shown operational skill and market standing support paying today's high price for a share in its long-term path.

Find other firms that pass the Caviar Cruise screen by viewing the complete screening results here.

Disclaimer: This article is for information only and is not financial advice, a suggestion, or an offer to buy or sell any securities. Investing has risk, including the possible loss of principal. You should do your own study and talk with a qualified financial advisor before making any investment choices.