QIFU TECHNOLOGY INC (NASDAQ:QFIN) emerged from our Peter Lynch-inspired stock screen as a compelling pick for growth-at-a-reasonable-price (GARP) investors. The company combines solid earnings growth, strong profitability, and a conservative financial structure—all while trading at an attractive valuation. Below, we examine why QFIN fits the criteria for long-term investors seeking sustainable growth.

Key Strengths of QFIN

- Earnings Growth: QFIN has delivered a 5-year average EPS growth of 19.96%, comfortably within Peter Lynch’s preferred range of 15-30%. This indicates steady, sustainable expansion rather than overheated growth.

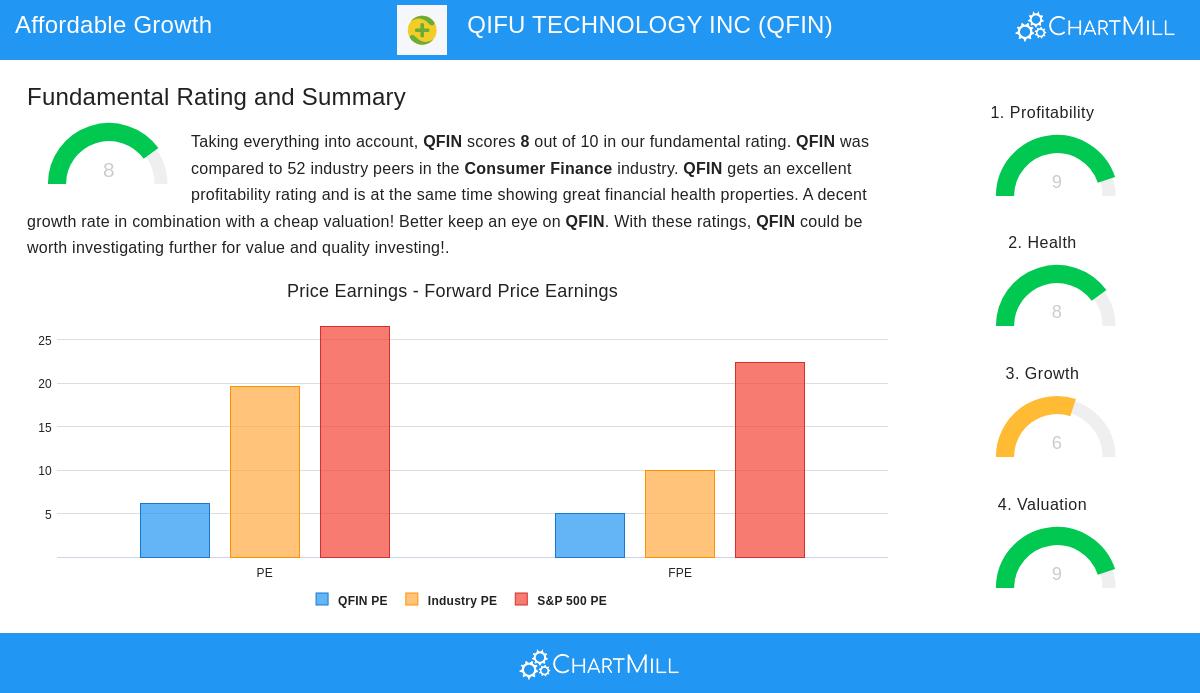

- Attractive Valuation: With a PEG ratio (5-year) of 0.31, well below the benchmark of 1, the stock appears undervalued relative to its growth prospects. The P/E ratio of 6.14 further supports this assessment.

- Strong Profitability: The company boasts a return on equity (ROE) of 29.92%, significantly above the 15% threshold Lynch favored, reflecting efficient use of shareholder capital.

- Healthy Balance Sheet: A debt-to-equity ratio of 0.27 and a current ratio of 3.08 demonstrate financial stability, with ample liquidity to meet short-term obligations.

Fundamental Highlights

Our fundamental analysis report assigns QFIN a score of 8 out of 10, citing excellent profitability and financial health. Key takeaways include:

- High Margins: Operating margins of 45.98% and profit margins of 38.98% rank in the top tier of the consumer finance industry.

- Efficient Capital Use: ROIC stands at 16.09%, indicating effective allocation of resources.

- Dividend Potential: While not a primary focus for growth investors, QFIN offers a dividend yield of 2.98%, slightly above the S&P 500 average.

Why It Fits the Peter Lynch Approach

QFIN aligns with Lynch’s principles by maintaining disciplined growth, prudent leverage, and a business model that generates consistent earnings. Its valuation metrics suggest the market may not yet fully appreciate its growth trajectory.

For investors seeking similar opportunities, our Peter Lynch Strategy screener provides a curated list of stocks meeting these criteria.

Disclaimer

This is not investing advice. The observations here are based on data available at the time of writing. Always conduct your own research before making investment decisions.