For investors aiming to join fundamental momentum with technical accuracy, a multi-layered screening method can be very useful. One such tactic finds stocks that show solid high-growth momentum traits while also displaying a positive technical arrangement for a possible entry. This plan searches for firms with quickening earnings and sales growth, key features of the CANSLIM and Minervini methods, and then adds a chart displaying a sound, formed uptrend that is now pausing, giving a defined breakout level. The aim is to locate chances where strong business momentum matches a chart formation that hints the next upward move could be near.

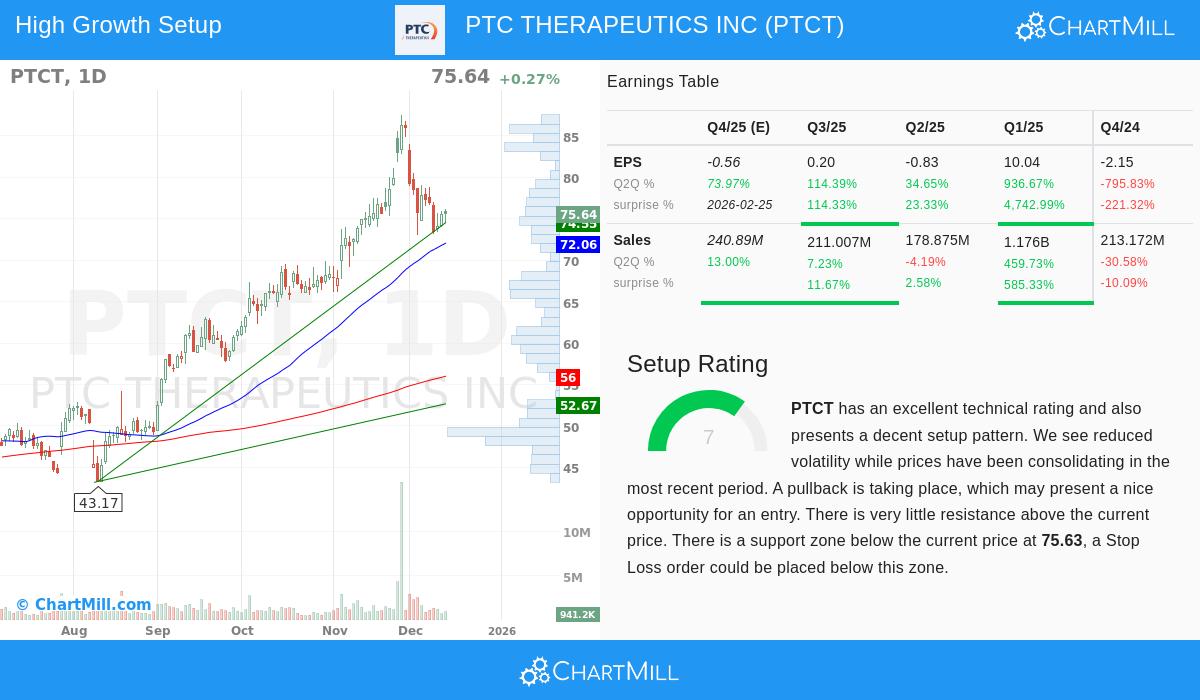

PTC THERAPEUTICS INC (NASDAQ:PTCT) appears from such a screen, receiving a 6 out of 10 on the ChartMill High Growth Momentum Rating and a full 10 on the Technical Rating, with a Setup Quality score of 7.

High Growth Momentum Fundamentals

The High Growth Momentum Rating combines a number of important growth and momentum measures into one score. For PTCT, the rating of 6 shows a varied but clearly getting better fundamental situation, with several figures indicating solid positive momentum.

- Very High Earnings Growth: The most notable numbers are in earnings per share (EPS). The firm's TTM EPS growth year-over-year is at a remarkable 277%. The latest quarterly report shows this momentum is current: the last reported quarter had EPS grow 114% against the same quarter a year before.

- Solid Cash Flow Generation: Free cash flow, a vital gauge of financial soundness and earnings quality, has jumped by 376% in the past year.

- Analyst Confidence: Sentiment on Wall Street is firming, with analysts raising their average EPS estimate for the coming year by more than 23% in the past three months.

- Earnings Surprises: The firm has a solid history of surpassing forecasts, beating EPS estimates in three of the past four quarters by an average of over 1,100%.

While sales growth has been less steady from quarter to quarter and yearly revenue growth figures show some variation, elements that keep a higher HGM score from being reached, the potent mix of rising profitability, sound cash flow, and positive estimate changes forms a positive momentum picture for growth-oriented investors.

Technical Soundness and Setup Quality

A solid growth narrative is most effective alongside a stock chart that shows institutional buying and a clear trend. Based on the detailed technical report, PTCT does very well here.

Technical Condition (Rating: 10/10) PTCT gets a top-level technical rating, showing very good relative strength and a clear uptrend. Important supporting information contains:

- The stock is in a positive long-term trend and has done better than 92% of all stocks in the past year.

- It trades higher than all its main moving averages (20, 50, 100, and 200-day), which are all increasing, a standard indicator of continued positive momentum.

- Inside its competitive Biotechnology field, it performs better than 73% of similar firms.

Pause Setup (Rating: 7/10) The Setup Quality score of 7 indicates a stock that is resting inside its larger uptrend, possibly preparing for its next rise. The analysis states that prices have been pausing lately, with less movement. The stock is now trading in the lower part of its one-month range, moving back toward an important support area between $73.47 and $75.63. This move back inside a solid trend might provide a planned entry point for investors looking for a more favorable risk/reward arrangement, with a defined support level below to set a stop-loss.

A Merging Chance

The argument for PTCT from this joined momentum and technical view is defined. Fundamentally, the firm is showing very strong earnings speed and gaining more analyst positive outlook, main requirements for high-growth momentum plans. Technically, the stock is a verified market leader trading in a sound uptrend, and it is now in a helpful pause. This merging hints the basic business momentum could shortly be seen in the next upward price action. For investors using this method, such agreement is exactly what screens are made to find.

This review of PTCT came from a specific screen. Investors wanting to locate similar chances where high-growth momentum meets positive technical formations can review the High Growth Momentum Breakout Setups screen for an updated list of possible candidates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented is based on data provided and should not be the sole basis for any investment decision. Investing involves risk, including the potential loss of principal. Always conduct your own due diligence and consider consulting with a qualified financial advisor before making any investment decisions.