Investors looking for companies with solid growth potential often find it difficult to identify stocks that mix attractive fundamental traits with positive technical patterns. One method that tackles this difficulty uses filters for securities that display good growth measurements while also showing technical breakout formations. This strategy tries to find companies set for continued growth while timing entries during phases of technical sideways movement that frequently come before notable price changes.

PTC THERAPEUTICS INC (NASDAQ:PTCT) offers an interesting example for this investment strategy. The biopharmaceutical company works on creating treatments for rare disorders, functioning in an industry where successful drug development can lead to rapid growth.

Fundamental Growth Profile

The company's fundamental view shows several traits that match growth investment ideas. PTC Therapeutics displays notable revenue increase and earnings progress, which are important signs for investors focused on growth. The company's financial statements indicate considerable year-over-year gains in important measurements:

- Revenue increase of 96% over the past year

- Earnings per share rising by 226.85% each year

- Five-year revenue growth averaging 21.32% per year

These growth numbers are much higher than industry norms and back the company's status as a solid growth possibility. The fundamental analysis report gives PTCT a growth score of 7 out of 10, showing better-than-average expansion measurements compared to other biotechnology firms. This continued growth path is especially significant considering the company's work on rare disease treatments, where effective therapies can gain considerable pricing ability and market share.

Valuation and Financial Health

While growth measurements are notable, lasting growth investment needs focus on valuation and financial soundness. PTC Therapeutics offers an interesting valuation situation:

- Price-to-earnings ratio of 11.88, much lower than industry average of 61.63

- Enterprise value to EBITDA ratio standing as more affordable than 98% of industry counterparts

- Good profit margins of 35.65%, doing better than 96% of biotechnology firms

The company keeps acceptable financial health with a score of 6 out of 10, helped by enough cash availability and workable debt amounts. The current ratio of 3.62 shows comfortable short-term financial room, while the debt-to-free-cash-flow ratio of 3.44 points to sensible borrowing compared to cash creation ability.

Technical Setup and Market Position

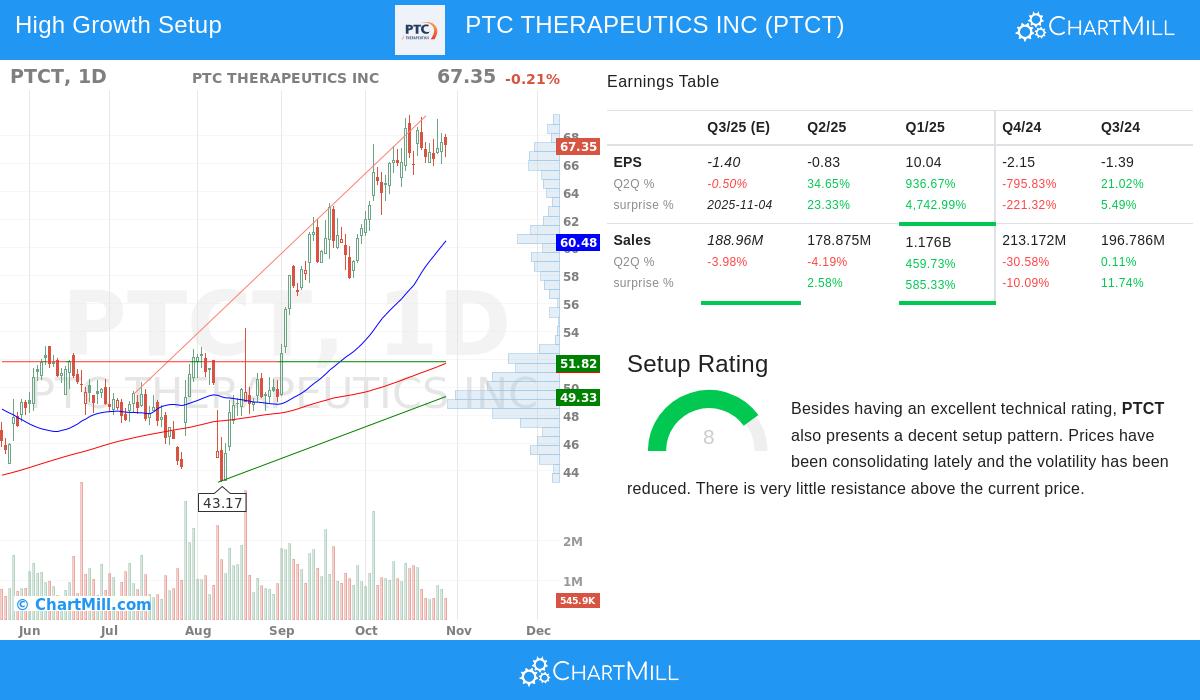

The technical view supports the fundamental story, with PTCT currently showing a bull flag formation after a maintained upward direction. According to the technical analysis report, the stock gets a full technical score of 10 out of 10, supported by several positive signs:

- Both short-term and long-term directions stay positive

- Stock results do better than 90% of all market investments over the past year

- Trading close to 52-week highs with lower volume during recent sideways action

- Clear resistance point seen at $68.51 with multiple support areas underneath

The technical formation score of 8 out of 10 indicates the stock is set for a possible breakout, with the sideways pattern giving a potential entry point for investors expecting continued upward movement.

Investment Considerations

The mix of solid fundamental growth and positive technical placement makes PTCT significant for investors using a growth-with-technical-timing approach. The company's focus on rare disease treatments gives exposure to a specialty pharmaceutical area with little competition and possible pricing ability. The technical sideways action after major price gains hints at institutional gathering rather than selling, which often comes before more advances.

Still, investors should note that biotechnology companies deal with built-in regulatory and clinical development uncertainties. The negative forward P/E ratio shows analyst predictions for short-term earnings difficulties, though this is typical in growth-stage biopharmaceutical companies putting money back into research and development.

Looking at Similar Possibilities

For investors curious about similar possibilities that mix solid growth fundamentals with positive technical formations, more filtering can find comparable securities. The Strong Growth Stocks with Good Technical Setup Ratings screen offers a structured way to find companies displaying these traits across different industries and company sizes.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consider their individual financial circumstances, risk tolerance, and investment objectives before making any investment decisions. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.