For investors looking for chances where the market price of a company seems separate from its basic financial condition, a methodical value method can be a useful rule. This process involves searching for stocks that are fundamentally strong, showing good profitability, stable balance sheets, and reliable growth, yet are trading at prices that appear too low. The aim is to find possible discounts before the wider market sees and fixes the difference. One stock that recently appeared from such a "Decent Value" search, which looks for a high valuation score together with good scores in growth, health, and profitability, is Power Solutions International (NASDAQ:PSIX).

Examining the Basics

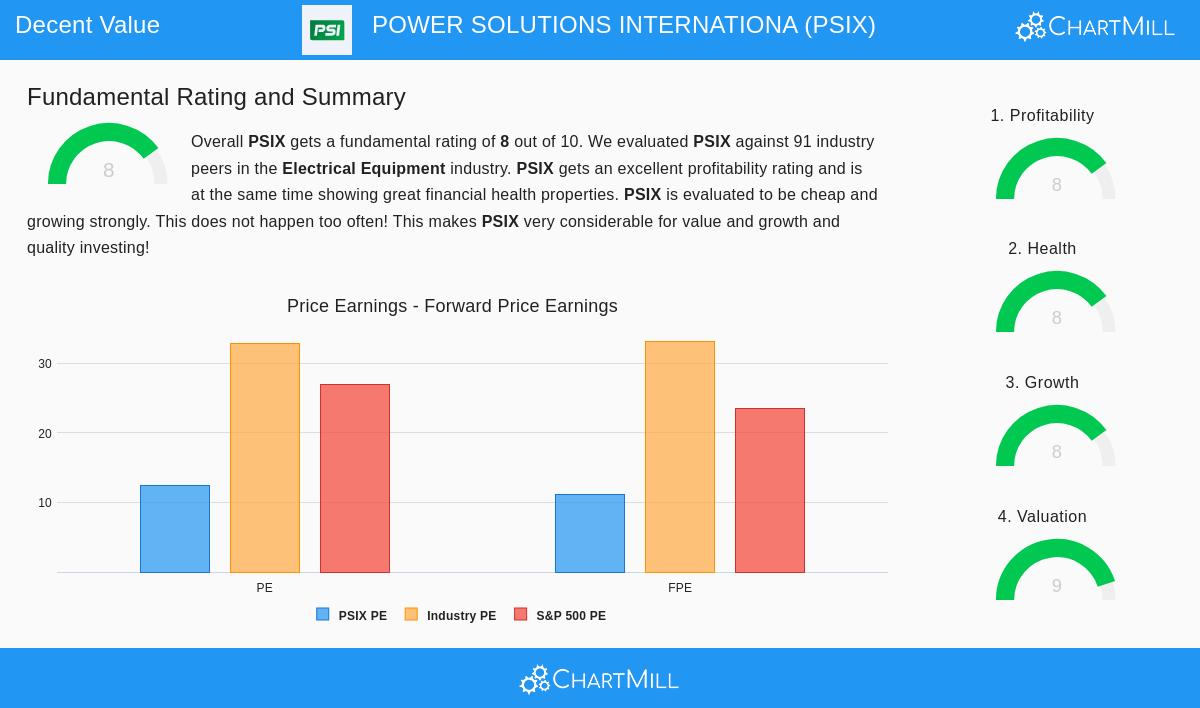

A full fundamental analysis report for PSIX shows a strong profile that matches value investing needs. The company gets an overall fundamental score of 8 out of 10, putting it in a good position within the Electrical Equipment industry. For a value investor, this complete score implies the business is on firm ground, which is important; a low-priced stock is only a real chance if the company is financially sound and able to continue.

Valuation: The Heart of the Chance The most notable part of PSIX's report is its valuation score of 9. This number shows the stock is priced modestly compared to its financial results and future outlook. Important measures backing this include:

- A Price/Earnings (P/E) ratio of 12.36, which is lower than 92% of its industry group and is under the S&P 500 average.

- An even more appealing Price/Forward Earnings ratio of 11.10, implying the market has not yet accounted for expected earnings growth.

- A modest PEG ratio, which includes growth, further hinting the stock may be priced below its worth given its expansion path.

This mix is exactly what value searches try to reveal: a company trading for less than both its current earnings capacity and its industry, offering a possible buffer.

Financial Health and Profitability: The Base A low price means little if a company carries heavy debt or has trouble making profits. PSIX scores an 8 for both Financial Health and Profitability, pointing to a durable operational foundation.

- Health: The company has a very good Altman-Z score of 5.81, showing low short-term bankruptcy danger. Its debt amounts are reasonable, with a Debt-to-Free-Cash-Flow ratio of 1.87, meaning it could pay off all debt in less than two years with its present cash flow, a situation more favorable than 90% of its peers.

- Profitability: PSIX's effectiveness in creating returns is very high. Its Return on Invested Capital (ROIC) of 27.37% and Return on Equity (ROE) of 74.60% are near the top in its industry, doing better than 98-100% of rivals. Firm and improving operating and profit margins complete a view of a very profitable business.

These supports of health and high returns are essential for dedicated value investing. They lower the danger of a "value trap", a stock that is low-priced for a cause, by verifying the company's basic business is sound.

Growth: The Driver for New Pricing While strict value choices sometimes include slow-moving companies, the most interesting chances often contain those with growth the market has missed. PSIX's Growth score of 8 emphasizes this point. The company is not just steady; it is getting bigger quickly.

- Recent results show very fast growth, with Earnings Per Share (EPS) up 150% and Revenue up 55% over the last year.

- Looking ahead, analysts think this speed will keep going, with EPS forecast to increase at an average of 46% each year over the next few years.

For the value investor, this growth part is key. It offers a possible reason for the market to reassess and reduce the space between the stock's present price and its true worth, pushed by rising future earnings.

Final Thoughts

Power Solutions International shows an example of what value-focused searches are made to locate: a financially sound, very profitable, and expanding business that is valued at a lower price compared to its industry and the wider market. Its firm scores in Health and Profitability give trust in the company's operational steadiness, while its notable Valuation score suggests the market may be underestimating its future. The large growth, both past and expected, provides a clear way for market opinion to match basic facts.

This review of PSIX came from a structured hunt for decent value stocks. Investors curious about finding other companies that fit similar standards of firm basics combined with appealing valuations can check the set search here.

Disclaimer: This article is for information only and is not financial advice, a suggestion, or an offer to buy or sell any security. The review uses data and scores from ChartMill, and investors should do their own research and think about their personal money situation and risk comfort before making any investment choices.