Perimeter Solutions Inc (NYSE:PRM) appears as a notable option for investors using a high-growth momentum strategy paired with technical breakout analysis. This method focuses on companies showing solid earnings acceleration, good sales expansion, and favorable analyst views, all while displaying acceptable price trends and consolidation patterns that indicate possible breakout chances. By filtering for stocks with a High Growth Momentum Rating over 4, a Technical Rating over 7, and a Setup Rating over 7, investors try to find firms with both fundamental momentum and positive chart structures.

Fundamental Growth Momentum

Perimeter Solutions displays several traits that fit high-growth momentum investing. The company’s recent financial results show major operational gains and market presence:

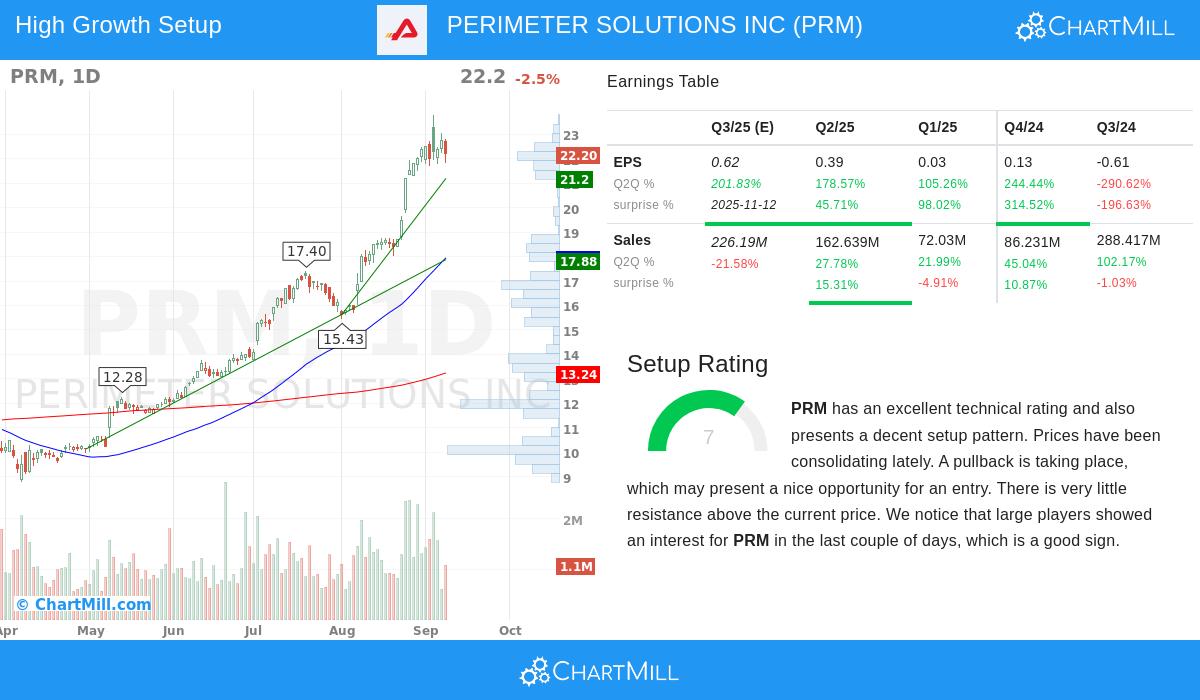

- Earnings Growth: Quarterly EPS growth rose 178.57% year-over-year in the latest quarter, with the prior quarter showing a 105.26% gain. This quickening in profit generation points to good operational scale.

- Sales Expansion: Revenue expansion stays solid, with a 27.78% year-over-year gain last quarter and a trailing twelve-month sales growth of 56.85%. The company has exceeded revenue forecasts in two of the last four quarters by an average of 5.06%.

- Cash Flow Strength: Free cash flow per share increased 572.59% over the past year, highlighting better liquidity and financial condition.

- Analyst Confidence: Analysts have increased next year’s EPS projections by 5.03% over the last three months, showing positive expectations for future results.

These measures are important for momentum investors, as quickening earnings and revenue growth often come before more price gains. The High Growth Momentum Rating of 6 shows acceptable performance across these areas, even as the company aims to reach steady positive EPS on a trailing basis (-$0.06 TTM).

Technical Strength and Setup Quality

From a technical view, Perimeter Solutions shows very good strength. The stock gets a full Technical Rating of 10, signaling high relative performance and trend quality. Important technical features include:

- Trend Consistency: Both short-term and long-term trends are positive, with the stock trading near its 52-week high of $23.79. It has done better than 95% of all stocks in the market over the past year.

- Moving Averages: The stock is trading above all key moving averages (20-day, 50-day, 100-day, and 200-day), which are all increasing, confirming continued bullish momentum.

- Support and Resistance: The technical analysis finds good support near $22.19 and resistance about $22.76. A breakout above resistance might signal the next upward move.

The Setup Rating of 7 shows a consolidating pattern that could provide a positive entry point. Prices have been moving between $17.67 and $23.79 over the past month, with recent dips toward support forming a possible base for progress. The setup indicates a potential buy point above $22.77, with a stop-loss near $22.18, capping downside risk to about 2.59%. For a complete technical review, see the full technical report here.

Investment Considerations

Perimeter Solutions works in the fire safety and specialty chemicals industries, markets with consistent demand sources like wildfire management and industrial lubricant additives. The company’s recent growth phase seems driven by both market tendencies and operational gains. However, investors should note the stock’s price swings, wide monthly trading ranges need attentive risk management. Also, while earnings momentum is good, the negative TTM EPS reminds that profitability on an annualized basis is still developing.

Exploring Similar Opportunities

For investors curious about similar high-growth, technically positive setups, more options can be located using the High Growth Momentum Breakout Screen. This screen actively finds stocks with good growth ratings and bullish chart patterns, providing a simplified way to find potential opportunities each market day.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.