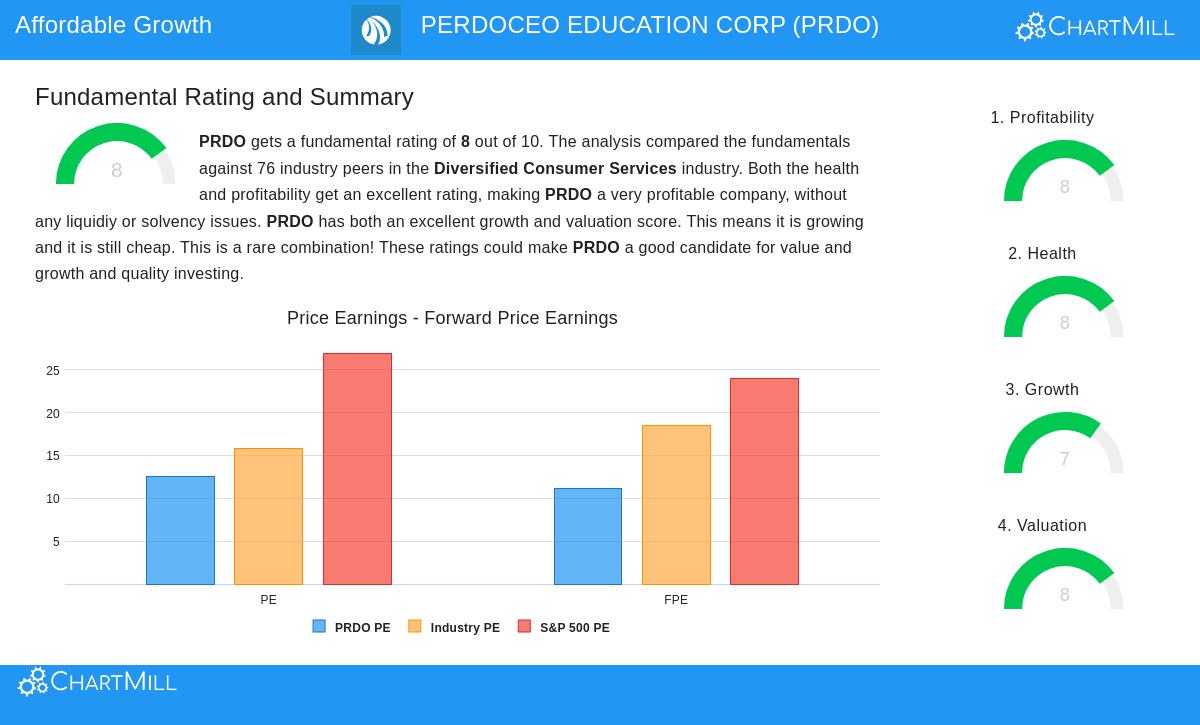

For investors looking to balance the search for growth with a degree of caution, the Growth At a Reasonable Price (GARP) or "affordable growth" strategy offers a sensible middle path. This method focuses on companies with good and lasting growth paths, but importantly, it requires they are not priced at extreme levels. The aim is to sidestep the high-risk, high-valuation stocks of pure momentum investing while still benefiting from rising earnings potential. A useful way to apply this is by using fundamental screening tools that rank stocks across important areas like growth, valuation, profitability, and financial soundness. One stock that recently appeared through such a screen is Perdoceo Education Corp (NASDAQ:PRDO).

A Good Growth Profile

The central idea of any affordable growth strategy is, expectedly, growth. A company must show a solid ability to raise its earnings and revenue. Perdoceo Education’s fundamental report indicates a firm growth base, receiving a ChartMill Growth Rating of 7 out of 10. This rating is supported by notable recent results and encouraging forward estimates.

- Recent Performance: Over the last year, the company reported a notable 24.23% growth in revenue and a 22.33% rise in Earnings Per Share (EPS).

- Historical Trend: The average yearly EPS growth over recent years is a sound 10.19%.

- Future Outlook: Analyst projections signal a pickup, with estimated average yearly growth of 14.73% for revenue and 11.28% for EPS over the next years.

This mix of good recent outcomes and a improving growth forecast is precisely what growth-focused investors seek. It signals the company is not just benefiting from a short-term trend but may have a durable business model able to grow.

Appealing Valuation Measures

Growth by itself is insufficient; it must be bought at a reasonable price. Paying too much for future growth is a frequent error that the affordable growth strategy aims to prevent. Perdoceo Education performs well here too, achieving a high ChartMill Valuation Rating of 8. The stock seems priced low compared to both its industry and the wider market.

- Price-to-Earnings (P/E): PRDO trades at a P/E ratio of 12.54, which is viewed as fair on an absolute basis. More significantly, it is less expensive than almost 79% of similar companies in the Diversified Consumer Services industry and rests notably below the S&P 500 average of about 26.94.

- Forward P/E & Cash Flow: The valuation argument is reinforced with forward-looking measures. Its Price/Forward Earnings ratio of 11.15 is less expensive than 84% of industry rivals. Also, its Price/Free Cash Flow ratio is more appealing than 87% of the industry.

- PEG Ratio: The low PEG ratio, which modifies the P/E for growth, implies the market may not be fully rewarding investors for the company's anticipated earnings growth rate.

This valuation view is important for the strategy. It implies that the market has not yet completely valued Perdoceo's growth possibilities, possibly providing a safety buffer and opportunity for valuation improvement along with earnings growth.

Supporting Fundamentals: Profitability and Soundness

An affordable growth stock needs to be more than just inexpensive and growing; it requires the basic financial fortitude to maintain that growth. This is where profitability and financial soundness are key. Perdoceo Education earns an 8 in both groups, offering a stable base for its growth story.

The company’s profitability is very good, with margins that are best in its industry. Its Operating Margin of 23.81% and Profit Margin of 19.18% are better than over 90% and 88% of peers, in order. High and getting better margins signal pricing strength and operational effectiveness, which are necessary for turning revenue growth into net profits.

Just as critical is financial soundness, where Perdoceo shows notable strength. Its balance sheet has almost no debt, with a very small Debt/Equity ratio of 0.01. The company also has very high liquidity, with Current and Quick Ratios above 4.4, showing sufficient resources to cover short-term needs and fund future chances without financial pressure. A strong Altman-Z score further indicates its stability and low failure risk.

Conclusion

Perdoceo Education Corp presents a strong example for the affordable growth investment method. It effectively meets all the strategy's main points: showing good past and expected growth, trading at a price that seems low compared to its industry and growth rate, and being backed by excellent profitability and a very strong balance sheet. This mix seeks to provide involvement in corporate growth while reducing the danger linked to speculative, high-priced growth stocks.

For investors wanting to examine other companies that match this description, more results from the "Affordable Growth" screen can be found here.

A full look at Perdoceo's fundamental ratings can be seen in its complete fundamental analysis report.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. Investors should conduct their own research and consider their individual financial circumstances and risk tolerance before making any investment decisions.