Growth investing strategies often look for companies with strong earnings momentum, leadership in their field, and positive technical traits. One systematic method is the CAN SLIM system, made famous by William O'Neil, which uses both fundamental and technical analysis to find high-growth market leaders. The system judges stocks on current and yearly earnings growth, new products or price highs, supply and demand, leadership position, institutional ownership, and the general market trend. A filter using these ideas recently identified Palantir Technologies Inc-A (NASDAQ:PLTR) as a stock for more detailed review.

Meeting the Core CAN SLIM Criteria

A look at Palantir's main numbers shows it fits several measurable parts of the CAN SLIM system.

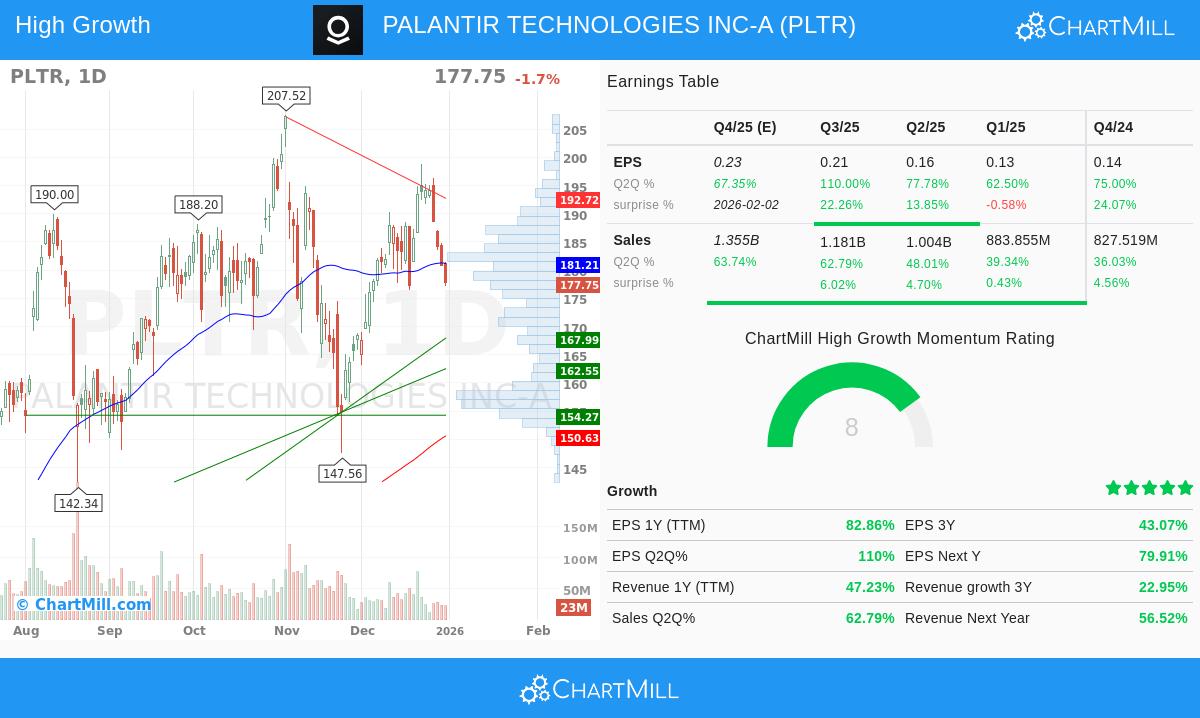

- Current Quarterly Earnings & Sales (C): The system looks for large or speeding up quarterly growth. Palantir shows 110% year-over-year EPS growth and about 63% revenue growth for its latest quarter, well above the common minimum levels the method uses. This fast momentum in both profit and sales is a key filter for CAN SLIM filters.

- Annual Earnings Increases (A): Investors are told to find steady, large yearly growth. Palantir's three-year EPS compound annual growth rate (CAGR) is 43.1%, showing a continued history of major profit growth that beats the system's basic needs.

- Leader or Laggard (L): A stock's relative strength, which compares its price change to the wider market, is key. CAN SLIM looks for leaders. Palantir has a ChartMill Relative Strength (CRS) score of 95.42, meaning it has done better than over 95% of all stocks. This confirms its position as a market leader, a required trait for the strategy.

- Institutional Sponsorship (I): While some institutional ownership is good, very high ownership can reduce future buying. Palantir's institutional ownership is about 60%, which is in a zone that indicates attention from professional investors but is not too high, allowing for more ownership growth.

- Supply and Demand / Financial Health (S): The system prefers companies with solid balance sheets. Palantir shows very good financial health here, with a debt-to-equity ratio of 0.0, meaning no debt. This adds to a sound fundamental picture and fits the focus on good finances.

Fundamental and Technical Profile Overview

A broad review of Palantir's separate reports gives background beyond the filter's settings. The company's fundamental analysis shows a picture marked by very high growth and good profitability, though with a high valuation. Main points include a high profitability score from good margins and returns on equity and capital. The growth score is top-level, with excellent past results and equally solid forecasts for future revenue and earnings growth. The primary note is on valuation, where common price-to-earnings ratios are high, a point often tolerated in growth investing when paired with very fast growth paths.

From a price movement view, the technical analysis for PLTR is also positive, with a total score of 8 out of 10. The long-term trend is up, and the stock's 12-month performance puts it in the top group of the market and its software industry. The high relative strength score confirms this leadership with numbers. The technical report states that while the score is very good, recent price swings suggest the stock may not be in a perfect quiet phase for a new purchase now, noting that timing is a different, important part of the CAN SLIM method.

The "N" and "M" Factors

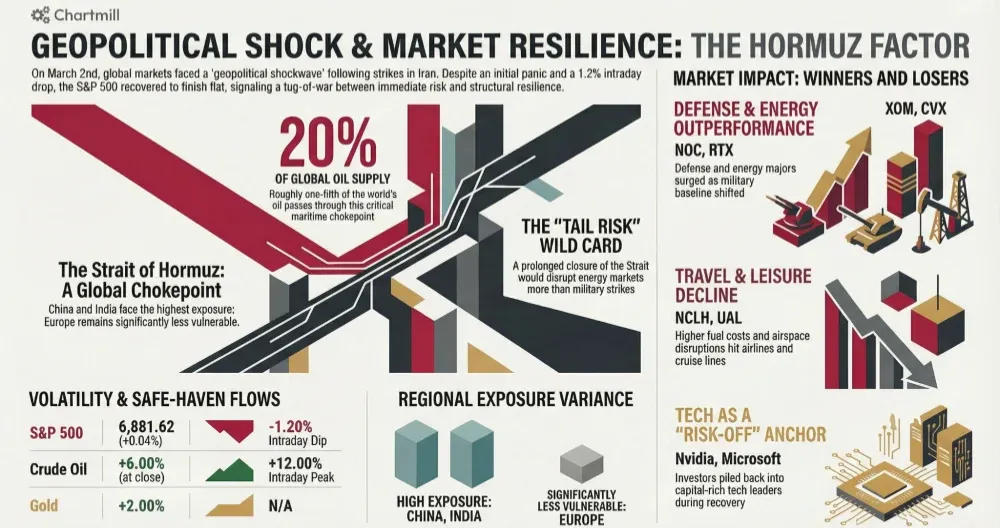

Two parts of CAN SLIM are more subjective. The "N" means new products, services, or leadership. Palantir's main business is its advanced data integration and AI platforms (Gotham, Foundry, AIP), which are key to modern data analytics and artificial intelligence, a clear "new" and changing technology trend. The "M" requires noting the general market trend. With the S&P 500's long and short-term trends currently up, the wider market setting is favorable for looking at growth-focused strategies like CAN SLIM.

A Starting Point for Further Research

Palantir Technologies presents a notable example of a stock that meets a strict, multi-factor filter based on the CAN SLIM investment approach. Its very high quarterly growth, solid yearly earnings path, market-leading relative strength, and role in a major technology change make it a stock for growth investors to consider.

This review comes from a particular filter setup. Investors wanting to see other companies that meet similar CAN SLIM-based conditions can see the full filter results here.

Disclaimer: This article is for information and learning only. It is not investment advice, a suggestion to buy or sell any security, or a claim about future results. All investing has risk, including the possible loss of the money invested. Investors should do their own complete research and review, think about their personal money situation, and talk to a qualified financial advisor before making any investment choices.