For investors looking for a methodical way to find stocks with high growth, the approach detailed in Louis Navellier's The Little Book That Makes You Rich presents a strong framework. The plan is based on eight key rules meant to find companies showing better earnings momentum, faster growth, and sound financial condition. By filtering for stocks that fit these particular standards, investors try to select businesses in the initial phases of a strong growth path. A recent use of this filter has identified a significant candidate in the technology field: Palantir Technologies Inc-A (NASDAQ:PLTR).

Fitting the "Little Book" Standards

Palantir’s present financial condition matches well with many of Navellier's central ideas. The company's latest results display the rapid growth and better operations the plan looks for.

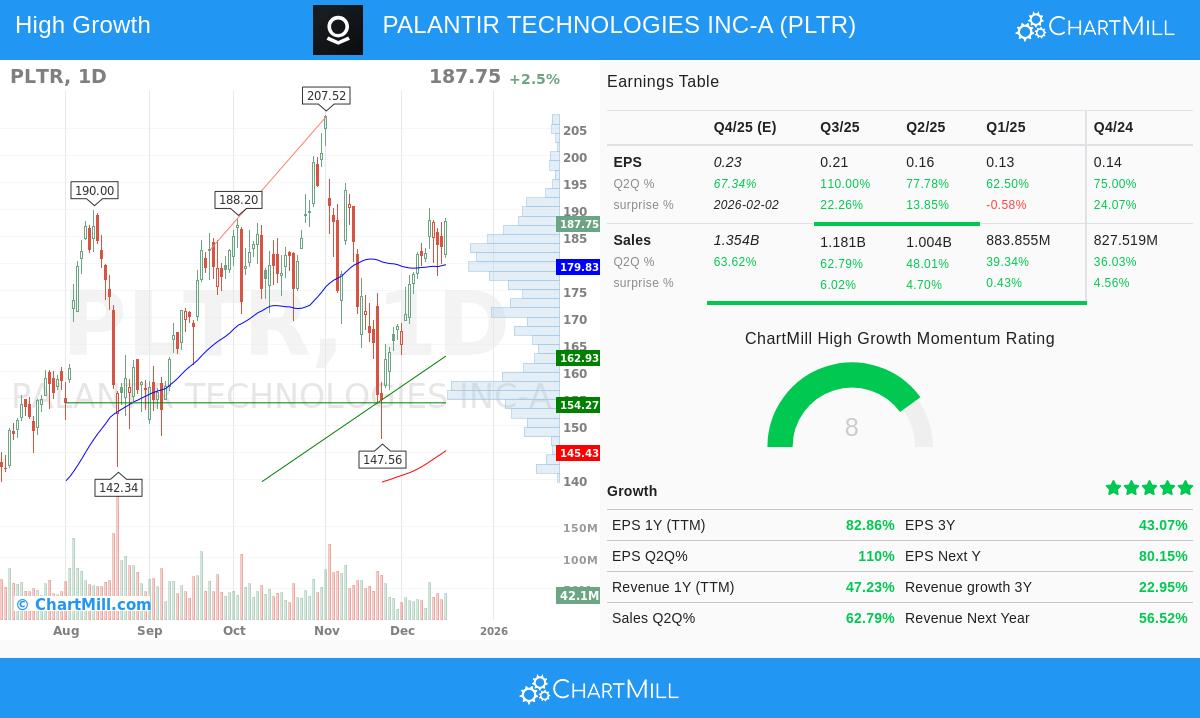

- Positive Earnings Revisions & Surprises: Analysts have greatly increased their forecasts for Palantir’s next quarter, with EPS revisions rising more than 20% in the past three months. This points to increasing confidence in short-term results. Also, the company has a history of surpassing forecasts, beating consensus EPS estimates in three of the past four quarters by an average of almost 15%.

- Speeding Up Growth Measures: The company is showing strong momentum in both revenue and profit growth.

- Revenue increased 47.2% year-over-year (TTM) and a more notable 62.8% quarter-over-quarter.

- Earnings growth is even more marked, with EPS growing 82.9% year-over-year and 110% in the latest quarter compared to the year-ago period.

- Growing Profitability and Sound Cash Flow: Importantly, this sales increase is turning into much better profits. Palantir’s operating margin has grown by over 58% in the last year, showing the company is expanding efficiently. This operational effect is also seen in cash production, with free cash flow jumping by about 278% in the same time.

- High Return on Equity: The plan focuses on efficient use of shareholder money. Palantir’s Return on Equity (ROE) of 16.6% is viewed as sound, putting it above a large portion of its software industry competitors and meeting the need for a high ROE.

These numbers together describe a company not only increasing, but speeding up its increase while also bettering its profit margins and cash production, a key profile for the growth-oriented "Little Book" approach.

Fundamental Condition and Valuation Setting

A wider fundamental analysis of Palantir supports its strong points while noting areas for investor thought. The company gets a good total fundamental score of 7 out of 10. Its financial condition is solid, having no debt and outstanding liquidity measures, giving important financial room. Profitability is a high point, with sector-leading margins and returns on assets and invested capital.

The main point to note, as is usual with high-growth companies, is in valuation. Palantir trades at high earnings multiples, a sign of the market valuing its unusual growth rates. While its profitability and estimated future growth of over 40% each year in both revenue and EPS can support a higher price, it brings a greater degree of risk if growth hopes are not achieved. This valuation situation is a key element for investors to balance against the company's operational momentum.

A Pick for Growth-Oriented Plans

Palantir’s match with the "Little Book" filter standards makes it a relevant stock for investors using growth or momentum plans. The filter is made to find companies at a turning point, where speeding up basics may come before major market notice. For position traders or those with a longer-term growth investment view, Palantir’s mix of fast sales growth, margin gain, and sound cash flow production offers a strong fundamental argument. The company’s very strong balance sheet further lowers operational risk.

It is key to remember that this filter is a beginning for more study, not a buy recommendation. The present market situation, with a good short-term direction for the S&P 500, may be supportive for growth stocks, but investors should always perform their own complete examination.

For investors wanting to look at other companies that currently pass this strict growth filter, you can see the complete list of outcomes via the Little Book That Makes You Rich screener on ChartMill.

Disclaimer: This article is for information only and does not make up financial guidance, a support, or a suggestion to buy, sell, or hold any security. Investing includes risk, including the possible loss of original money. Always do your own research and think about your personal financial situation and risk comfort before making any investment choices.