For investors looking for chances where a company's market price may not show its full value, a methodical value investing method can be a practical beginning. This method, made famous by Benjamin Graham and Warren Buffett, centers on finding stocks selling for less than their true value, usually decided by examining financial condition, earnings, and future possibilities. By concentrating on firms with good basics that the market prices cautiously, investors try to find a "margin of safety", a cushion that offers some defense against mistakes in assessment or unexpected business difficulties.

One stock that recently came up from a methodical search for such "reasonable value" chances is Photronics Inc (NASDAQ:PLAB). The search specifically looked for companies with a good basic valuation score while also keeping acceptable ratings in earnings, financial condition, and expansion. Photronics, a maker of photomasks needed for semiconductor and flat-panel display production, seems to match this description, deserving more examination from a value-focused view.

Valuation: An Interesting Beginning

The central idea of value investing is buying an asset for less than its calculated value. Photronics’ present valuation numbers imply the market may be setting its price at a notable markdown compared to both its field and the wider market.

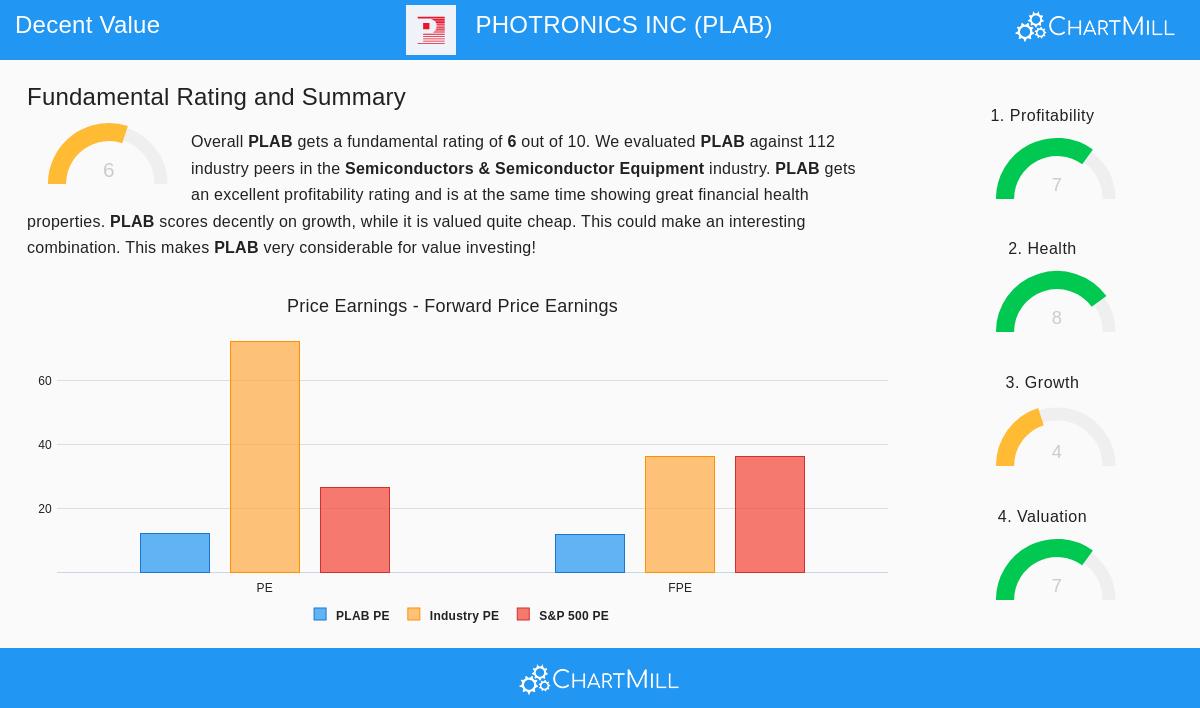

- Price-to-Earnings (P/E) Ratio: At 12.00, PLAB's P/E ratio is much lower than the S&P 500 average of about 26.37. More notably, it is valued at a lower cost than 96% of similar companies in the Semiconductors & Semiconductor Equipment field, where the average P/E is above 72.

- Forward P/E Ratio: The view stays similar when looking forward. With a forward P/E of 11.85, PLAB costs less than 97% of its field rivals and rests below the S&P 500 forward average.

- Enterprise Value to EBITDA: This number, which includes debt and cash, shows that 100% of the companies in its field have a higher cost than Photronics by this measure.

For a value investor, these numbers are the first attraction. They point to a stock that is not only low-priced but is valued at a large markdown to its area, which could be a possible chance if the company's basics are good.

Financial Health: A Good Base

A low price means little if the company is in poor financial shape. Value investors focus on financial condition to steer clear of "value traps", stocks that are low-cost for a cause, often because of basic problems. Photronics’ balance sheet, however, seems strong.

- Good Solvency: The company has no debt, shown by a Debt/Equity ratio of 0.00 and a Debt to Free Cash Flow ratio of 0.00. This puts it in the best group of its field for financial steadiness and removes interest cost risk.

- High Liquidity: With a Current Ratio of 4.99 and a Quick Ratio of 4.62, Photronics has plenty of liquid assets to meet its short-term needs easily. These ratios are much better than most field peers.

- Altman-Z Score: A score of 3.30 shows a low short-term risk of financial trouble, giving more confidence in the company's good position.

This good financial condition supplies the margin of safety value investors want. It suggests the company has the strength to handle economic changes and put money into its business without the burden of debt.

Profitability: Creating Quality Income

A low-cost company must also be able to create earnings. A low P/E ratio is less appealing if the "E" (earnings) is of low quality or not lasting. Photronics shows acceptable and getting better profitability.

- Acceptable Margins: The company's Operating Margin of 24.75% is very good, doing better than 82% of its field. Its Profit Margin of 12.67% also rates above the field middle and has shown gain in recent years.

- Effective Use of Capital: Returns on Assets (6.19%), Equity (9.64%), and Invested Capital (9.95%) are all above the field middle, showing management is using capital well to create profits.

- Steady Cash Flow: The company has been steadily profitable and has created positive operating cash flow in each of the past five years, a main sign of earnings quality.

These numbers show that Photronics is not only a financially steady business but a profitable one. The mix of high margins and acceptable returns backs the idea that its present earnings power may support a higher valuation.

Growth Points and the Value Idea

Growth is the element that can change how a stock's valuation is seen. While Photronics’ growth picture is more measured, it gives setting for the valuation. The company has provided a good past EPS growth rate averaging almost 34% each year over recent years, though it had a small drop in the latest fiscal year. Future guesses point to slower, single-digit growth in both sales and earnings.

For a value investor, this careful growth view is likely already shown in the stock's low multiples. The investment idea here is not a wager on fast growth, but instead on the market possibly misjudging the lasting nature of the company's cash flows and the condition of its competitive place within its specialty. The aim is to get a profitable, debt-free business at a price that gives a notable markdown to its true value, with any future growth acting as possible extra gain.

Is Photronics a Value Chance?

A full fundamental analysis report for PLAB brings these parts together, giving the stock a total rating of 6 out of 10. It notes the "very good points on both the profitability and health parts" mixed with a "low-cost valuation" as a good base for more study. This matches exactly with the value search method: finding companies where price and seen value may have separated.

The argument for Photronics as a value pick rests on this combination: a very strong, debt-free balance sheet giving a margin of safety; tested and getting better profitability that confirms its business model; and a valuation that prices it at a deep markdown to both the market and its own field. While its short-term growth path seems modest, the deep valuation markdown may already include this, possibly creating a setting for steady investors.

Interested in searching for more stocks that match a similar description of good basics combined with appealing valuations? You can view the "Reasonable Value Stocks" search and its present findings here.

Disclaimer: This article is for information only and is not financial advice, a suggestion, or a deal to buy or sell any securities. The study is based on data and sources thought to be dependable, but its correctness cannot be sure. Investing has risk, including the possible loss of original money. Readers should do their own study and talk with a qualified financial advisor before making any investment choices.