The Caviar Cruise screening method is a structured way to look for quality investments. It centers on firms showing steady revenue increases, growing profits, solid returns on capital used, acceptable debt, and reliable earnings. This approach favors companies with lasting competitive edges and sound financial traits that are appropriate for holding over a long time. By using these measurable screens, investors can find businesses with core strengths that might endure different economic conditions and produce increasing returns over many years.

Parker Hannifin Corp (NYSE:PH), a top producer of motion and control technologies, appears as a strong prospect when viewed with this quality-oriented perspective. The company's varied industrial and aerospace divisions give it presence in many different markets, forming a stable operational structure that fits with quality investment ideas of variety and steady operations.

Financial Performance Measurements

The Caviar Cruise method focuses on steady growth paths, and Parker Hannifin displays this in a number of important measures:

- Revenue growth (5Y CAGR): 5.48%, above the 5% minimum level

- EBIT growth (5Y CAGR): 18.50%, greatly exceeding revenue growth

- Profit Quality (5Y average): 125.58%, much higher than the 75% target

The large EBIT growth rate compared to revenue increase points to better operational effectiveness and possible pricing strength, both signs of high-quality firms. The outstanding profit quality figure, over 100%, implies the company efficiently turns accounting profits into real cash flow, giving it monetary room for strategic moves.

Profitability and Capital Use

Return on invested capital is a central measure in quality investing, showing how well management uses shareholder money. Parker Hannifin performs very well in this area with a ROIC excluding cash, goodwill, and intangibles of 77.92%, far above the 15% minimum. This remarkable return shows the company's capacity to create large profits from its operational assets, indicating a firm competitive position and good capital use.

The company's margin details further support its quality profile:

- Operating margin: 21.31%, better than 91.54% of similar companies

- Profit margin: 18.18%, higher than 95.38% of rivals

- Steady margin improvement in recent periods

Financial Condition and Debt Handling

Quality investors look for companies with maintainable financial setups, and Parker Hannifin's debt management fits this thinking. The company holds a debt-to-free-cash-flow figure of 3.05, safely under the 5.0 maximum. This shows the company could pay back all its debt in about three years using present cash flow, giving it good financial strength.

Other financial health measures support this view:

- Altman-Z score of 6.01, showing very low failure risk

- Debt/equity ratio of 0.54, showing reasonable borrowing

- Better debt-to-assets ratio compared to the previous year

Fundamental Evaluation Summary

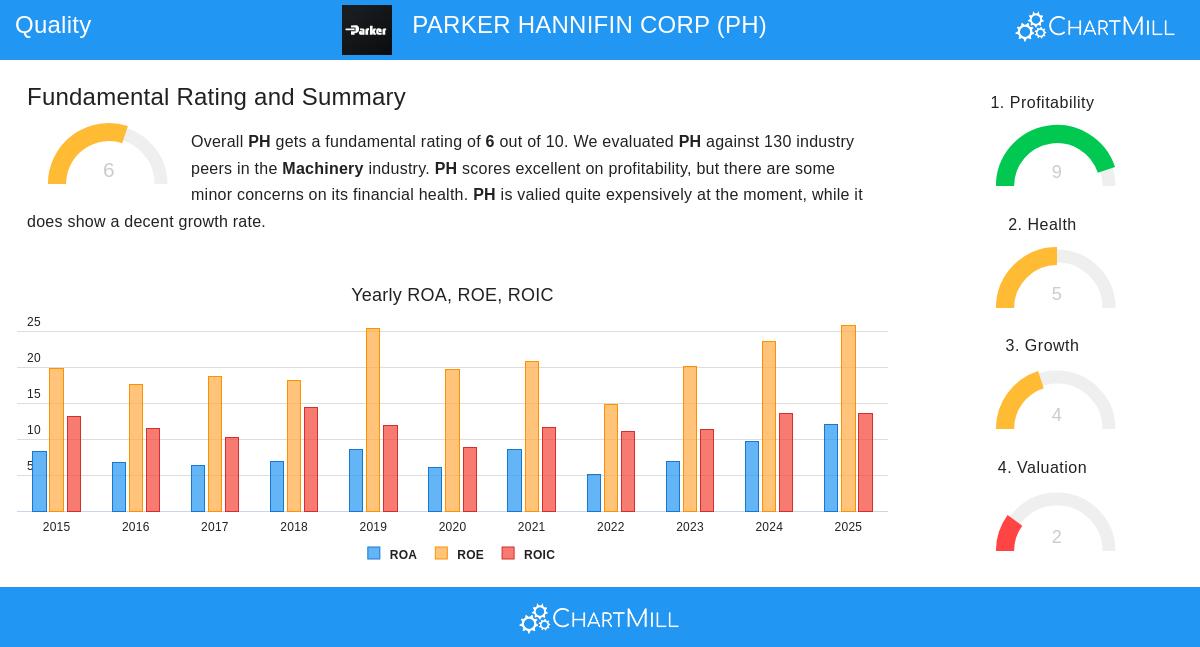

Parker Hannifin's full fundamental review shows a varied but mainly favorable situation. The company gets a total score of 6 out of 10, with special strength in profitability where it gets a 9 out of 10. The review points out Parker Hannifin's extraordinary returns on capital and improving margins, while also noting some issues with liquidity measures and present price levels. Growth figures display good past performance with some slowing expected in future projections. The detailed fundamental analysis offers more information for complete research.

Valuation Points

While quality investing usually allows higher prices for outstanding businesses, present measures indicate Parker Hannifin is priced at high levels:

- P/E ratio: 30.36, above the industry norm

- Forward P/E: 26.24, showing a small discount to the wider market

- Enterprise value/EBITDA: somewhat high compared to peers

Quality investors often find such price levels acceptable for companies showing better returns on capital, reliable growth, and financial soundness, though a careful price review is still important before investment choices.

Industry Standing and Competitive Strengths

Parker Hannifin's place across different industrial and aerospace markets gives it natural protection against downturns in any single area. The company's engineered products usually involve long-term client partnerships and significant costs to change suppliers, building lasting competitive benefits. Their global presence and technical knowledge in motion control systems match quality investment standards looking for businesses with lasting advantages and international scope.

For investors looking for other quality picks found through the Caviar Cruise method, the complete screening results offer many investment options for more study.

Disclaimer: This review is an impartial evaluation based on published financial information and screening rules and does not form investment guidance, a suggestion, or support. Investors should perform their own research and think about their personal financial situation before making investment choices.