PEGASYSTEMS INC (NASDAQ:PEGA) was identified as a decent value stock by our stock screener. The company shows a strong valuation rating while maintaining solid financial health, profitability, and growth. Below, we examine why PEGA may appeal to value investors.

Valuation

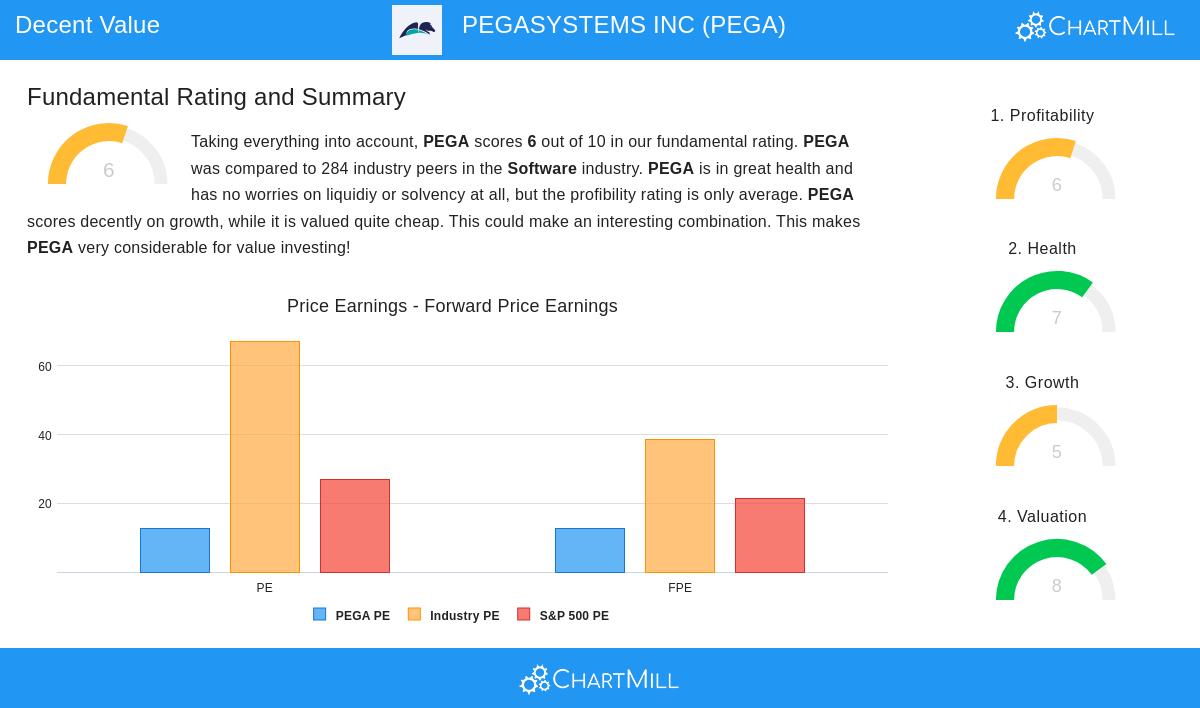

PEGA’s valuation metrics suggest the stock is attractively priced:

- P/E Ratio: At 12.74, PEGA trades below both the industry average (67.25) and the S&P 500 average (26.91).

- Forward P/E: 12.75, indicating continued reasonable pricing relative to earnings expectations.

- Price/Free Cash Flow: PEGA ranks cheaper than 92% of its software industry peers.

- Enterprise Value/EBITDA: Also favorable compared to 88% of competitors.

These metrics suggest the market may be undervaluing PEGA relative to its earnings and cash flow potential.

Financial Health

PEGA maintains a solid financial position:

- No Debt: The company has no outstanding debt, reducing financial risk.

- Altman-Z Score: A strong 6.06 indicates low bankruptcy risk.

- Liquidity: Current and quick ratios of 1.39 suggest sufficient short-term liquidity.

Profitability

Despite some past earnings volatility, PEGA demonstrates strong profitability:

- Return on Equity (ROE): 32.18%, outperforming 92% of industry peers.

- Operating Margin: 16.78%, ranking above 85% of competitors.

- Gross Margin: A healthy 75.74%, reflecting pricing power.

Growth

While future growth expectations are modest, PEGA has delivered strong historical growth:

- Revenue Growth: 14.29% over the past year and 10.44% annually over the past several years.

- EPS Growth: 50% in the last year and an impressive 184.70% average annual growth over the past five years.

Dividend

PEGA offers a small dividend (0.12% yield), but its payout ratio of just 5.22% is sustainable and leaves room for reinvestment.

Our Decent Value Stocks screener lists more stocks with strong valuations and fundamentals.

For a deeper analysis, review the full PEGA fundamental report.

Disclaimer

This is not investing advice! Always conduct your own research before making investment decisions.