For investors looking for chances in the market, a disciplined way to find undervalued companies can be a central part of a good plan. One method involves searching for stocks that show an attractive valuation while keeping good basic business foundations. This method looks past a low price alone, finding companies that are inexpensive without a clear cause, those with sound financial condition, steady earnings, and acceptable growth outlooks, all selling for less than their calculated worth or similar companies. It is a plan that tries to lower risk by confirming the "inexpensive" stock is supported by a good business, possibly providing a buffer for the steady investor.

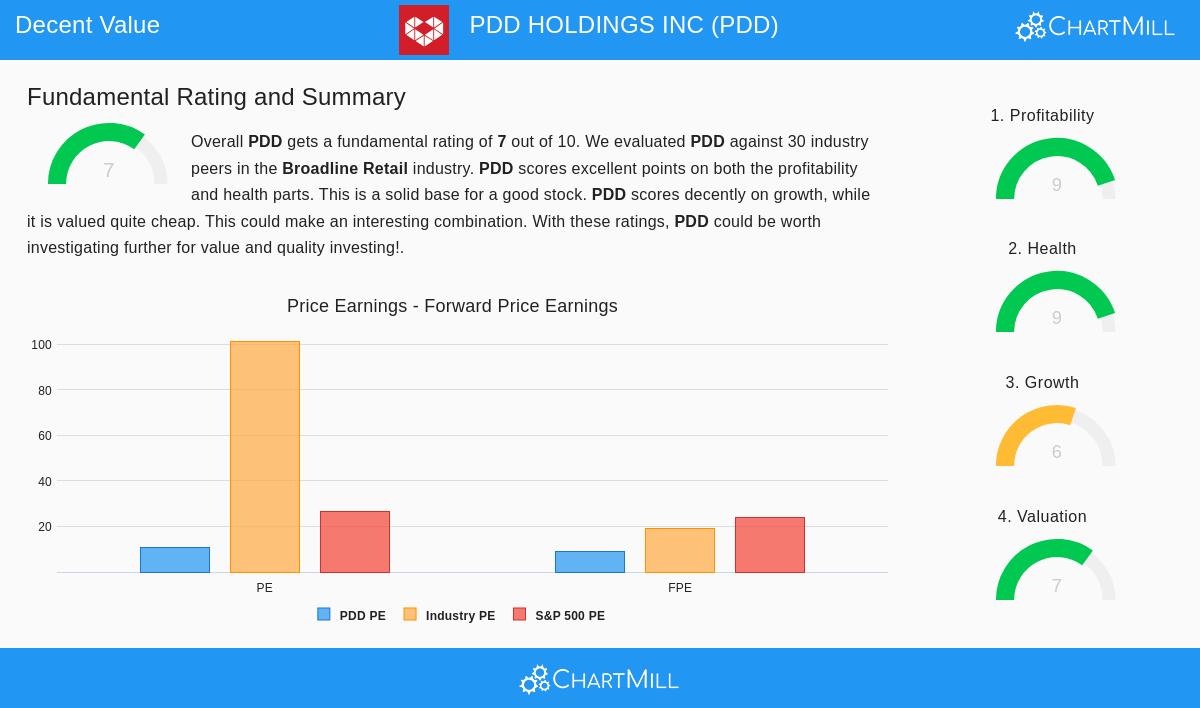

A recent search using this method has pointed to PDD HOLDINGS INC (NASDAQ:PDD) as a candidate worth more review. The Chinese multinational commerce group, which runs the Pinduoduo and Temu platforms, seems to mix an appealing valuation with very high marks in financial condition and earnings.

A More Detailed View of Valuation

The main filter in this search is a high valuation score, and PDD's numbers here are attractive. For value investors, a low valuation compared to earnings is an important beginning, as it hints the market may be placing too low a value on the company's present profit-making ability.

- Price-to-Earnings (P/E) Ratio: At 10.54, PDD's P/E ratio is much lower than the present S&P 500 average of 26.61. More notably, it costs less than 90% of similar companies in the Broadline Retail industry, where the average P/E is above 100.

- Forward P/E Ratio: Looking forward, the valuation stays appealing with a forward P/E of 8.98, which is also below both the industry and wider market averages.

- Other Multiples: The company's Enterprise Value to EBITDA and Price/Free Cash Flow ratios give more support to the idea, ranking as less expensive than most industry rivals.

This group of metrics forms a view of a company whose market price may not completely match its earnings ability, a common sign for value-focused investors.

Outstanding Financial Condition and Earnings

An inexpensive stock is only a worthwhile find if the company is basically sound. This is where PDD's profile gets especially notable, as it gets a nearly full 9 out of 10 in both Financial Condition and Earnings in its fundamental analysis report. These areas are vital for the plan because they lessen the chance of a "value trap", a company that is cheap because its business is weakening.

Financial Condition (Score: 9/10): PDD shows a very strong balance sheet, which gives stability and endurance.

- The company has no debt, leading to a Debt/Equity ratio of zero.

- Liquidity is solid, with a Current Ratio and Quick Ratio of 2.36, showing good ability to meet near-term needs.

- Its Altman-Z score of 5.38 points to a very small near-term chance of financial trouble.

Earnings (Score: 9/10): The company is not only in good condition, it is highly profitable, turning revenue into profit at a notable rate.

- Important return measures are top of the industry: a Return on Assets of 16.66%, a Return on Equity of 26.13%, and a Return on Invested Capital of 19.72%.

- Margins are high, with a Profit Margin of 24.43% and an Operating Margin of 22.10%, both placed in the best group of its sector.

This pairing of a clean balance sheet and high earnings creates a strong base, hinting the low valuation is not a sign of business problems.

Growth Background and Points

While the search looks for "acceptable" growth, PDD's growth narrative is detailed. The company gets a Growth score of 6 out of 10. Its past growth was very fast, with revenue increasing at an average yearly rate of more than 67% in recent years. However, this speed is slowing as the company becomes more established.

- Revenue growth over the last year stays good at 12.48%, and future projections indicate a continued sound speed of about 10.45% per year.

- Earnings per share (EPS) had a small decrease last year but have increased at a very high average rate historically. Forward projections suggest a more measured, single-digit EPS growth path.

For a value investor, this profile can be interesting. The market may be giving a valuation common for a low-growth company, while overlooking the company's still-good growth outlook and, more critically, its top-level earnings and financial strength. The plan depends on spotting this mismatch.

Conclusion

PDD Holdings presents a situation where a disciplined search process has found a possible difference between market price and business quality. The stock sells at valuation levels that are much lower compared to both the market and its industry, yet it is supported by outstanding earnings and very firm financial condition. While its growth is changing from very fast to a more maintainable speed, the basic engine of the business looks effective and efficient.

This match of low price with high basic quality is exactly what plans focusing on "acceptable value" try to find. It indicates a buffer, where the investor is paying a fair price for a clearly strong business.

Interested in reviewing other stocks that match this profile? You can perform a similar "Acceptable Value" search yourself to find more candidates with appealing valuations and sound basics here.

,

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented is based on data provided and should not be the sole basis for any investment decision. Investing involves risk, including the potential loss of principal. Always conduct your own due diligence and consider consulting with a qualified financial advisor before making any investment decisions.