The CAN SLIM investment methodology, created by William O'Neil, uses both fundamental and technical analysis to find high-growth market leaders. This methodical process assesses companies using seven main criteria represented by the acronym: Current quarterly earnings growth, Annual earnings increases, New products or services, Supply and demand dynamics, Leadership status, Institutional sponsorship, and Market direction. Stocks that satisfy these strict conditions usually show solid earnings momentum, institutional backing, and technical soundness during good market periods.

Fundamental Strength Evaluation

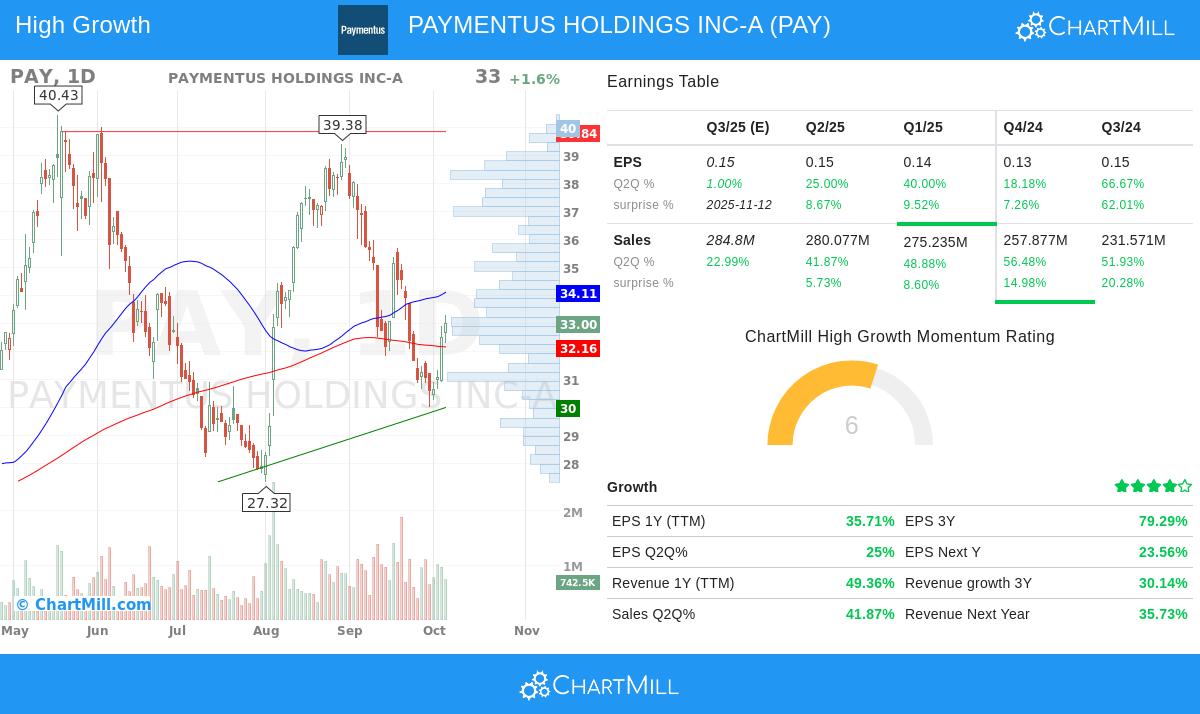

Paymentus Holdings Inc-A (NYSE:PAY) shows notable fundamental traits that fit CAN SLIM conditions. The company's financial data displays a trend of quickened growth and operational effectiveness:

- Quarterly EPS growth of 25% is above the CAN SLIM minimum of 20-25%

- Revenue growth of 41.87% is well over the 25% minimum condition

- Three-year EPS compound annual growth of 79.29% is much higher than the 25% standard

- Return on Equity of 10.86% meets the minimum 10% level

- Zero debt-to-equity ratio shows very good financial condition

These figures highlight the "C" and "A" parts of CAN SLIM, stressing the need for both recent quarterly speed and maintained yearly earnings growth. The company's cloud-based bill payment platform signifies the "N" aspect via its new technology offerings in the financial services field. According to the fundamental analysis report, Paymentus gets a 6 out of 10 total, with especially high marks in growth (8/10) and financial health (9/10), even though the valuation is high at 1/10.

Technical Situation and Market Position

From a technical viewpoint, Paymentus displays a number of traits liked by CAN SLIM investors. The stock keeps a high relative strength, doing better than 85% of all stocks in the market and 87% of financial services counterparts. This matches the "L" rule, which stresses investing in market front-runners instead of poorer performers.

The technical analysis report shows a neutral score of 5 out of 10, with the stock price moving in a confined range between $30.00 and $35.97. While the setup quality score of 3 points to little short-term breakout chance, the stock's place within its 52-week range and its large outperformance over the last year (+44.86%) back its leading position.

Institutional Backing and Supply Factors

Paymentus satisfies the "I" condition with institutional ownership at 78.4%, under the 85% level that could signal too much ownership. This amount indicates increasing institutional attention while keeping space for more institutional buying. The company's lack of debt and good liquidity ratios speak to the "S" factor, showing positive supply traits with little share dilution pressure.

The mix of quickening fundamentals, market leadership, and suitable institutional backing forms a notable profile for growth-focused investors using the CAN SLIM methodology. While present valuation numbers look high, the company's growth path and new position in the electronic payments area support higher multiples for investors concentrating on momentum and earnings speed.

For investors looking for more CAN SLIM suitable options, our pre-configured screener gives continuous access to companies meeting these strict growth and technical conditions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results.