PAN AMERICAN SILVER CORP (NYSE:PAAS) was identified as a decent value stock through our fundamental screening process. The company operates in the metals and mining sector, focusing on silver and gold production. With a solid valuation score and reasonable financial health, PAAS may appeal to value investors looking for opportunities in commodities.

Key Highlights from the Fundamental Report

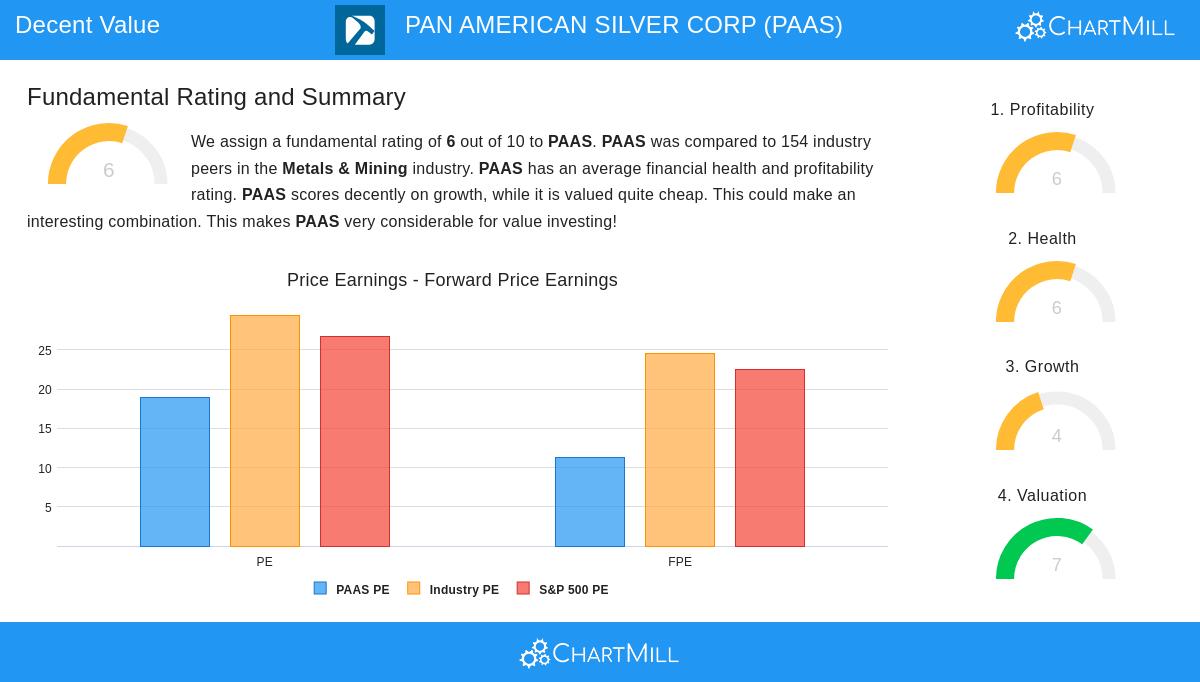

Valuation (Score: 7/10)

- The stock trades at a Price/Earnings (P/E) ratio of 18.95, which is below both the industry average (29.42) and the S&P 500 average (26.68).

- Its Forward P/E of 11.33 suggests a more attractive valuation based on expected earnings.

- The Price/Free Cash Flow ratio indicates PAAS is cheaper than 85% of its industry peers.

- A low PEG Ratio (accounting for growth) further supports the case for undervaluation.

Financial Health (Score: 6/10)

- A strong Current Ratio of 2.93 and Quick Ratio of 1.94 suggest good short-term liquidity.

- Debt/Equity ratio of 0.16 reflects a conservative capital structure.

- The company’s Debt-to-FCF ratio of 1.51 is among the best in the industry, indicating strong solvency.

Profitability (Score: 6/10)

- Profit Margin of 10.40% outperforms 81% of industry peers.

- Operating Margin (18.53%) and Gross Margin (24.13%) are above average for the sector.

- While profitability metrics are solid, recent declines in margins warrant monitoring.

Growth (Score: 4/10)

- Revenue grew by 18.34% in the past year, with a 5-year average growth of 15.85%.

- EPS surged by 5,900% last year, though this was partly due to a low base effect.

- Future growth projections are weaker, with expected declines in both EPS and revenue.

Why This Matters for Value Investors

PAAS presents a mix of reasonable valuation, stable financial health, and decent profitability. While growth expectations are subdued, the stock’s current pricing may already reflect these concerns, making it a candidate for value-oriented portfolios.

For a deeper look, review the full fundamental report on PAAS.

Our Decent Value Stocks screener lists more stocks with similar characteristics and is updated regularly.

Disclaimer

This is not investment advice. The observations here are based on available data at the time of writing. Always conduct your own research before making investment decisions.