One investment method that has remained effective over many years is Peter Lynch's system of locating companies with lasting growth at fair prices. This method centers on finding businesses that show steady profit increases without being overvalued, while also having sound financials. The system intentionally does not pursue extreme growth narratives, preferring companies expanding at a rate they can support over many years instead of only a few periods. This structured system helps investors create varied collections of stocks set up for lasting achievement instead of temporary bets.

Fitting the Lynch Standards

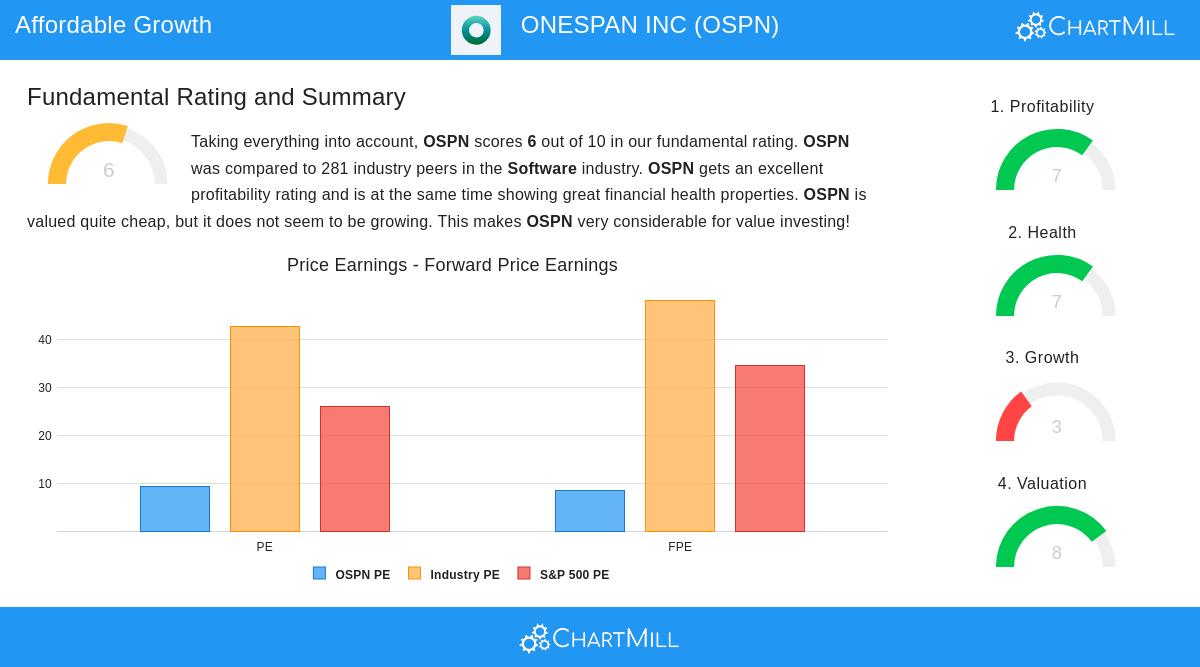

OneSpan Inc (NASDAQ:OSPN) stands out as an interesting option when assessed using Peter Lynch's main investment measures. The company's basic numbers match well with the system's central needs for lasting growth, fair price, and financial soundness.

The screening standards and OneSpan's related results include:

- Earnings Growth: The company has reached a 19.39% average yearly EPS growth over the last five years, fitting nicely within Lynch's chosen 15-30% lasting growth band

- Valuation Alignment: With a PEG ratio of 0.48, much lower than the system's highest limit of 1.0, the stock seems fairly valued compared to its growth path

- Financial Health: A balance sheet with no debt and a zero debt-to-equity ratio greatly exceeds Lynch's highest 0.6 requirement

- Liquidity Position: The current ratio of 1.77 is above the lowest limit of 1.0, showing good near-term financial ability

- Profitability: A 24.70% return on equity is much higher than the 15% minimum, showing good use of shareholder money

Basic Evaluation

OneSpan's overall basic picture shows a company with very good financial health and profit measures, although growth has been slower lately. The company functions with no debt, a feature Lynch especially liked, and shows strong profit levels that are some of the highest in the software field. Valuation numbers seem good across several measures, with the stock priced lower than both industry rivals and wider market measures.

The company's 24.9% profit margin and 21.8% operating margin are much better than most industry rivals, while having no debt offers significant financial room. Current valuation ratios, including a P/E of 9.32 and forward P/E of 8.50, indicate the market might be pricing the company's earnings below their worth compared to both the software industry and wider market indicators. For a full basic review, readers can see the detailed basic report.

Investment Points

While OneSpan fits many of Lynch's number-based standards, investors should think about several non-number factors. The company works in the cybersecurity and digital agreement area, fields with long-term expansion possibilities as digital change keeps happening worldwide. The business plan centers on offering security products for digital deals across online, mobile, and physical settings, serving ongoing market demands instead of passing technology fads.

The company's division into Security Solutions and Digital Agreements offers variety within its main skill of transaction security. This operational focus matches Lynch's liking for businesses that are clear to regular investors, as digital security has grown more important in daily life and business activities.

Looking for Other Options

For investors wanting to find other companies that fit Peter Lynch's investment standards, more screening results can be found using the Peter Lynch Strategy Screener. This tool allows for more adjustment and investigation of companies displaying the traits Lynch looked for in long-term investments.

This article gives factual study based on public data and should not be seen as investment guidance. Investors should do their own investigation and talk with finance experts before making investment choices. Past results do not ensure future outcomes, and all investments have risk including possible loss of original money.