OneSpan Inc (NASDAQ:OSPN) has appeared as a candidate for investors following the Peter Lynch investment philosophy, which highlights identifying companies with lasting growth, fair valuations, and sound financial condition. Lynch’s method, described in his book One Up on Wall Street, centers on long-term holdings in businesses that are both profitable and trading at prices that do not exaggerate their growth potential. This strategy sidesteps speculative trends and instead puts fundamental strength first, making it especially attractive for investors looking for growth at a fair price (GARP).

Meeting the Lynch Criteria

OneSpan fits well with several important filters in the Lynch screening methodology. The company’s financial metrics show a balance of growth, profitability, and careful management, core parts of Lynch’s strategy.

- Earnings Growth: Lynch preferred companies with earnings per share (EPS) growth between 15% and 30% over five years, thinking that very high growth is not lasting. OneSpan’s EPS has increased at an average yearly rate of 19.39% over this time, putting it directly within Lynch’s desired range and pointing to consistent, controlled increase.

- Valuation Relative to Growth: The PEG ratio, which changes the price-to-earnings ratio for growth, is a central part of Lynch’s valuation method. A PEG below 1 indicates a stock could be priced low given its growth path. OneSpan’s PEG ratio of 0.58 shows that its present share price does not completely account for its past earnings growth, providing a possible safety buffer.

- Financial Health: Lynch stressed sound balance sheets, with little debt and good liquidity. OneSpan has zero debt, greatly passing Lynch’s chosen debt-to-equity level of below 0.25. Its current ratio of 1.77 shows good short-term financial steadiness, lowering business risk.

- Profitability: Return on equity (ROE) is another key measure for Lynch, who looked for companies creating high returns on shareholder money. OneSpan’s ROE of 24.70% not only goes beyond the 15% minimum Lynch supported but also places with the best in its field.

Fundamental Strengths and Considerations

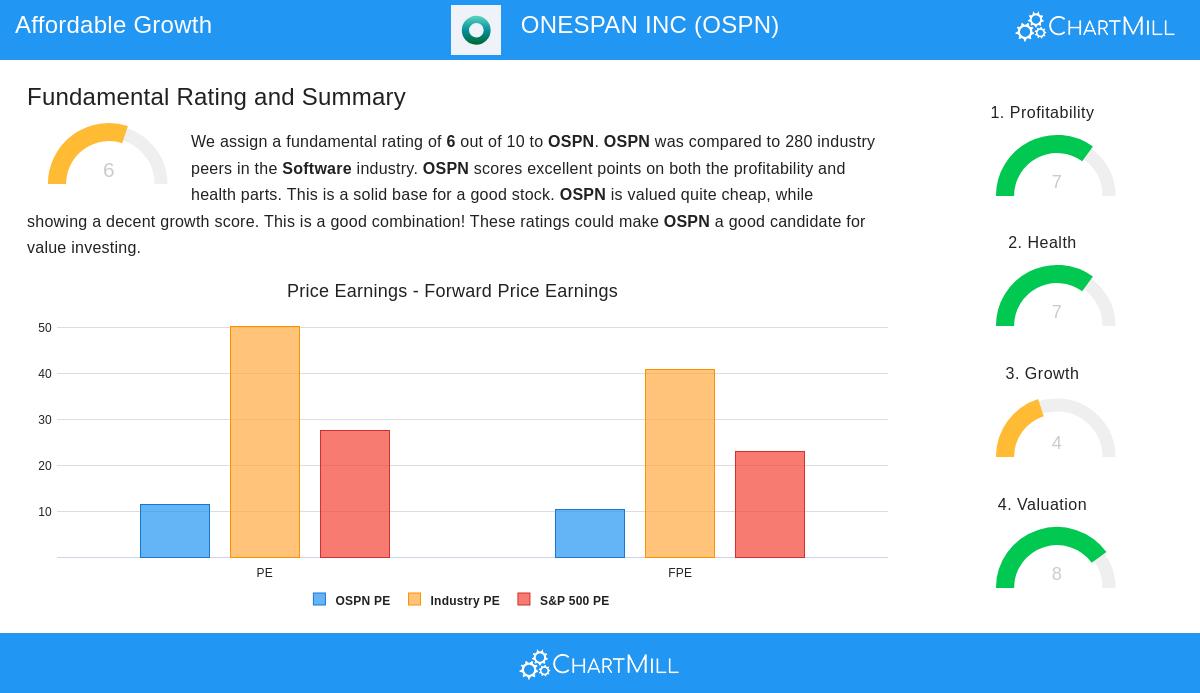

A look at OneSpan’s wider fundamental profile backs its attraction as a GARP candidate. The company works in the software industry, offering security solutions for digital transactions, a market with long-term importance as digitalization grows. According to Chartmill’s fundamental analysis report, OneSpan gets an overall rating of 6 out of 10, with very high marks in profitability and financial condition. Its profit margins and returns on capital are top in the industry, while its valuation numbers imply the stock is priced cautiously next to both sector competitors and the wider market.

However, growth has been uneven. While earnings have increased solidly, revenue has had small reduction over recent years, though analysts forecast a return to slight growth soon. This situation highlights the need for more investigation, as Lynch recommended, to grasp the business model and industry setting. For a complete summary, readers can see the full fundamental analysis report here.

Conclusion

OneSpan presents a strong case for investors using Peter Lynch’s ideas. It joins good profitability, a solid balance sheet, and fair valuation with a believable growth history, all signs of a Lynch-type investment. While previous revenue patterns deserve notice, the company’s solid operational measures and place in an increasing field suggest it could benefit patient, long-term owners.

For those wanting to look into other companies that match this strategy, more screening results can be found using the Peter Lynch Stock Screener.

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.