For investors looking to balance the search for growth with fiscal care, the "Growth at a Reasonable Price" (GARP) method provides a practical middle path. This tactic works to find companies that are increasing their operations and earnings faster than average but are also priced at levels that do not require flawless future performance. It is a way to bypass the speculation of expensive, unprofitable growth stocks while also avoiding stagnant value investments. Filtering for stocks with good growth basics, consistent earnings, sound financial statements, and fair prices can reveal candidates that match this careful investment approach.

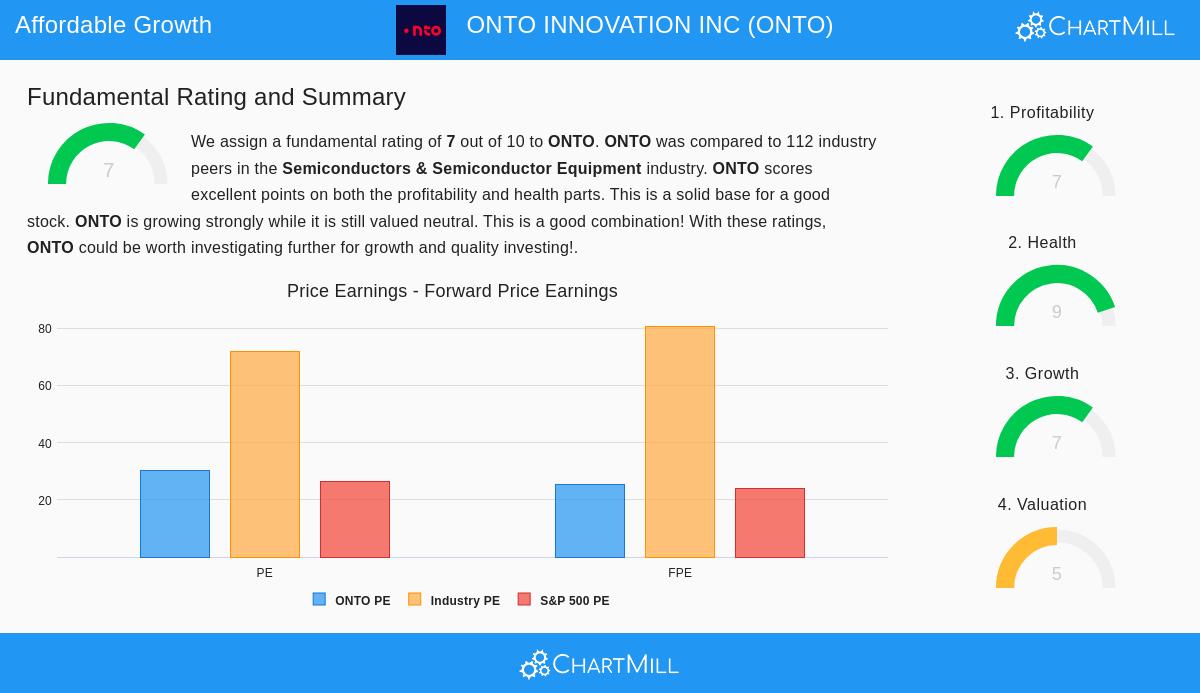

One company that recently appeared through an "Affordable Growth" filter is ONTO INNOVATION INC (NYSE:ONTO), an important business in the semiconductor equipment field. The company creates and builds precise measurement and inspection tools, which are essential for chipmakers working to make smaller and more advanced semiconductors. As the industry tests the limits of physics, the need for accurate measurement and flaw finding has become critical, placing companies like Onto Innovation at a key spot in the production chain.

Growth Path and Future Outlook

The central idea of any GARP tactic is finding lasting growth, and Onto Innovation's basic financials show force here. The company is not only forecasting future increase, it has a history of achieving it. According to a detailed fundamental analysis, Onto's sales have increased by an average of 26.41% each year recently, a pace called "very strong." While the latest year showed a more modest sales rise of 6.38%, the long-term path stays notable.

More key for shareholders, this sales increase has turned into solid profit growth. The company's earnings per share (EPS) have risen at an average yearly pace of almost 37% over the past several years. For the future, analysts forecast continued good growth, with expectations for EPS to rise by more than 16% yearly and sales to increase by about 13.5% per year. While these forward estimates point to a slowdown from the high past rates, a typical event as companies get larger, they still represent a "quite strong" view that is central to its attraction as a growth pick.

Price Assessment in Perspective

A stock with good growth can still be a bad investment if the cost is too steep. This is where the "reasonable price" part of the GARP method is vital. Onto Innovation's price assessment shows a varied but finally practical view when compared to its industry and its own growth story.

- Price-to-Earnings (P/E): Onto sells at a P/E ratio near 30. While this is higher than the current S&P 500 average, it is much less expensive than the wider semiconductor equipment industry, where the average P/E is above 70. In fact, almost 78% of its industry peers sell at a higher P/E.

- Forward P/E and Cash Flow: The price view gets better when looking ahead. The company's Price/Forward Earnings ratio of 25.3 is about equal to the wider market and less expensive than nearly 74% of its industry. Also, its Price/Free Cash Flow ratio is especially appealing, ranking as less expensive than 83% of industry rivals.

- Growth Consideration: The analysis states that Onto's "decent profitability may justify a higher PE ratio," and that a higher price could be acceptable given its expected earnings growth. This relationship is exactly what GARP investors examine: is the current price a fair point of entry for the growth and quality available? In Onto's situation, the numbers suggest the market may not be completely valuing its stability and growth potential compared to its sector.

Foundational Force: Earnings and Financial Soundness

Lasting growth at a fair price must be built on a stable base. For Onto Innovation, high marks in earnings and financial soundness supply that stability, lowering the risk for investors.

The company receives a strong Earnings rating of 7 out of 10. Main advantages include:

- Better Margins: Onto has an operating margin of 21.25%, doing better than over 80% of its industry. Its profit margin of 17.46% and gross margin near 55% also rank in the top group of peers.

- Steady Returns: The company has reported positive earnings and operating cash flow for each of the past five years, with returns on assets, equity, and invested capital (ROIC) all ranking well above industry averages.

Perhaps even more significant is Onto's outstanding Financial Soundness rating of 9 out of 10. The financial statement is a major source of strength:

- Operation Without Debt: The company has no interest-bearing debt, putting it with the most cautiously managed firms in its capital-heavy sector.

- Strong Liquidity: With a current ratio of 9.5 and a quick ratio of 7.9, Onto has great short-term financial room, doing better than over 90% of its peers on these measures.

- Low Failure Risk: An Altman-Z score of 26.5 firmly points to financial health and very little near-term default risk.

This pairing of high earnings and a very strong financial statement means the company is well-placed to fund its growth plans from within and handle any industry slowdowns, making its growth forecasts more believable.

Summary

Onto Innovation shows an example of the kind of company GARP tactics aim to find. It works in a steadily growing market key to technological progress and has shown a capacity to turn that need into strong, profitable expansion. While its price is not "low" in a simple sense, it seems fair, and in some measures, quite appealing, when judged against its high-growth industry peers and its own solid basic financials. The outstanding financial soundness and better-than-average earnings provide a buffer of safety and quality that many pure growth narratives often miss.

For investors curious about finding other companies that match this profile of affordable growth, more filtering can be done using tools that search for these specific basic traits. You can find more possible candidates by using the Affordable Growth stock screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any securities. Investing involves risk, including the potential loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.