NOVO-NORDISK A/S-SPONS ADR (NYSE:NVO) was identified as a decent value stock by our stock screener. The company demonstrates solid fundamentals across valuation, profitability, financial health, and growth, making it an attractive option for investors seeking undervalued opportunities.

Valuation

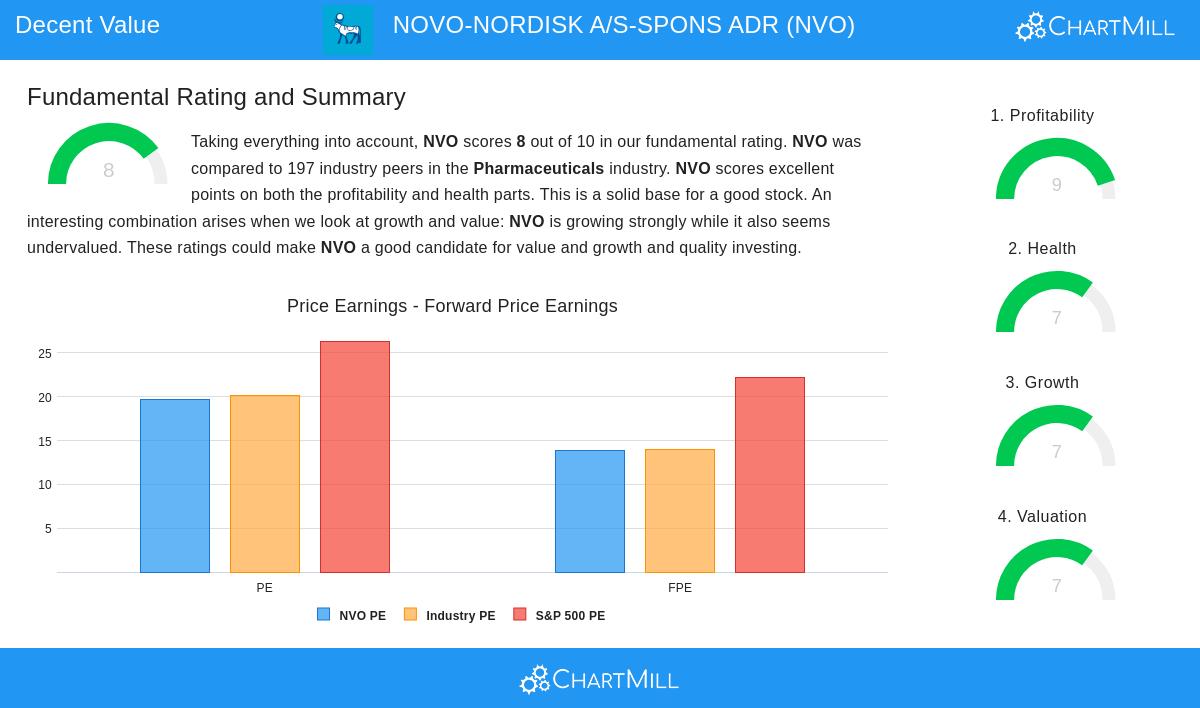

NVO’s valuation metrics suggest it is reasonably priced compared to industry peers and the broader market:

- P/E Ratio: At 19.68, it is below the industry average of 20.16 and significantly lower than the S&P 500 average of 26.35.

- Forward P/E: 13.91, indicating expectations of continued earnings growth.

- Enterprise Value/EBITDA: The ratio is favorable, with NVO cheaper than 80.7% of its pharmaceutical peers.

- PEG Ratio: A low PEG ratio suggests the stock is undervalued relative to its growth prospects.

Profitability

The company excels in profitability, with key strengths including:

- Return on Equity (ROE): An impressive 70.38%, outperforming 98.5% of industry competitors.

- Operating Margin: 46.16%, ranking in the top 3% of pharmaceutical firms.

- Profit Margin: 34.78%, reflecting strong earnings efficiency.

Financial Health

Despite some liquidity concerns, NVO maintains a solid financial position:

- Altman-Z Score: 5.68, indicating low bankruptcy risk.

- Debt/FCF Ratio: A healthy 1.48, meaning it could repay debt quickly if needed.

- Debt/Equity: 0.62, slightly higher than ideal but manageable given strong cash flows.

Growth

NVO shows consistent growth, supported by:

- Revenue Growth: 25% year-over-year, well above historical averages.

- EPS Growth: Expected to rise by 13.97% annually in the coming years.

- Dividend Growth: A 16.56% average annual increase over the past years.

Our Decent Value Stocks screener lists more stocks with strong fundamentals and reasonable valuations.

For a deeper analysis, review the full fundamental report for NVO.

Disclaimer

This is not investment advice. The observations here are based on current data, but investors should conduct their own research before making decisions.