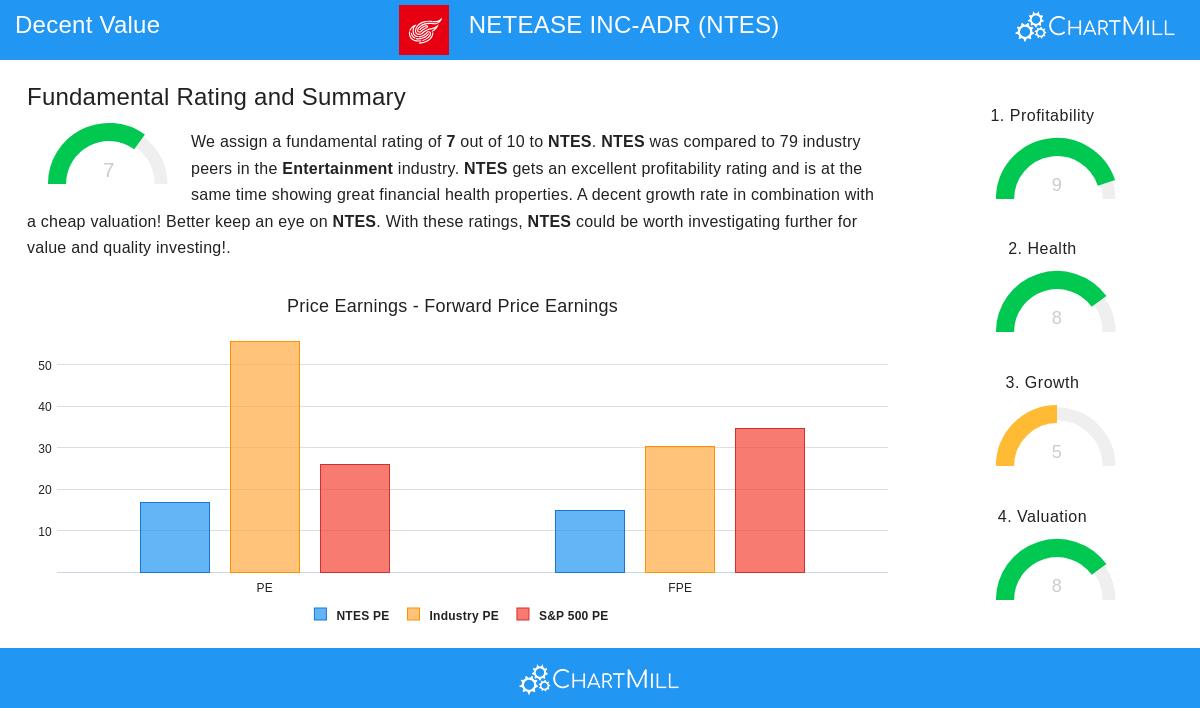

NetEase Inc (NASDAQ:NTES) represents a strong case study in value investing, a strategy centered on finding companies trading below their intrinsic worth. The selection process for this analysis used a "Decent Value" screen, which focuses on stocks displaying solid valuation metrics, scoring above 7 out of 10, while also holding acceptable scores in profitability, financial health, and growth. This multi-layered method helps to filter out potential value traps and find companies that are not only inexpensive but fundamentally healthy. The aim is to locate stocks where the market price may not completely represent the underlying business quality, providing a potential safety buffer for investors.

Valuation Analysis

The central idea of value investing is buying a dollar's worth of assets for fifty cents, and NetEase's valuation metrics suggest it may fit this description. The company's valuation rating of 8/10 is supported by several key factors that indicate it is priced conservatively relative to its earnings and cash flow.

- Attractive Earnings Multiples: NetEase's Price-to-Earnings (P/E) ratio of 16.84 is notably lower than both the S&P 500 average (25.89) and the broader entertainment industry average (55.71). It is valued more affordably than 85% of its industry peers on this metric.

- Positive Forward-Looking Valuation: The outlook stays favorable when looking ahead. The Price-to-Forward Earnings ratio of 14.80 is considerably below the S&P 500 average and is more appealing than nearly 89% of companies in its sector.

- Strong Cash Flow Generation: The company's valuation is further confirmed by its Price-to-Free Cash Flow ratio, which is better than 88.6% of the industry, suggesting the market may be underestimating the strong cash the business generates.

For a value investor, these metrics are the initial filtering tools. A low P/E ratio by itself could indicate problems, but when combined with solid fundamentals, it can indicate a real undervaluation opportunity.

Financial Health and Profitability

An inexpensive stock is only a good investment if the company is financially stable and able to generate profits. This is where NetEase truly performs well, achieving high scores in both financial health (8/10) and profitability (9/10). These foundations are vital for a value strategy, as they lessen the risk of permanent capital loss—a primary concern when purchasing seemingly undervalued assets.

The company's financial strength is visible in its clean balance sheet:

- Minimal Debt Burden: NetEase has a very low Debt-to-Equity ratio of 0.08 and a Debt-to-Free-Cash-Flow ratio of 0.25, meaning it could pay off all its debts in a quarter using its current cash flow. This degree of solvency is better than most of its peers.

- Exceptional Liquidity: With a Current Ratio and Quick Ratio both above 3.2, the company has more than enough short-term assets to cover its immediate liabilities, offering a significant cushion against economic slowdowns.

From a profitability standpoint, NetEase operates with high-level efficiency:

- High Returns on Capital: The company's Return on Invested Capital (ROIC) of 17.40% and Return on Equity (ROE) of 22.87% are in the top group of its industry, showing its ability to generate solid profits from the capital it uses.

- Strong Margins: NetEase's Profit Margin of 31.19% and Operating Margin of 31.43% outperform over 97% of its competitors, confirming a powerful and profitable business model.

Growth Trajectory

While value investing often concentrates on current statistics, future growth cannot be overlooked, as it is a key part of a company's intrinsic value. NetEase's growth rating is a more moderate 5/10, presenting a mixed but detailed picture. The company has a solid historical record, with Earnings Per Share (EPS) growing at an average annual rate of 17.51% and Revenue growing at 12.19% over recent years. However, analyst forecasts point to a possible slowdown in EPS growth in the near future, which may partly account for the stock's lower valuation. In spite of this, revenue is still expected to grow at a healthy rate of nearly 10% annually. For a value investor, this creates a potential situation where the market has become too negative about future earnings while ignoring the company's established ability to grow revenue and its exceptional profitability.

Conclusion

NetEase Inc presents a strong profile for investors using a value-based methodology. It trades at a discount to the market and its industry based on standard valuation metrics, yet it is supported by a very strong balance sheet and top-tier profitability. This mix of a low price and high-quality fundamentals is exactly what value screens are meant to find. While future earnings growth presents some uncertainty, the company's solid financial health gives it the stability to handle challenges and its high cash flow generation offers significant flexibility.

If you are interested in finding other companies that fit this profile of solid valuation and fundamental strength, you can explore more results using the Decent Value Stocks screen on ChartMill.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on current data and may change. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.