NETEASE INC-ADR (NASDAQ:NTES) surfaced in our Peter Lynch-inspired screen, presenting a compelling case for long-term investors seeking growth at a reasonable price. The company operates in China’s entertainment sector, with a diversified portfolio spanning gaming, online music, and education services. Its financial health, profitability, and valuation metrics align well with the principles of GARP investing.

Why NTES Fits the Peter Lynch Strategy

- Sustainable Growth: NTES has delivered a 5-year average EPS growth of 17.5%, comfortably within Lynch’s preferred range of 15-30%. This indicates steady, manageable expansion rather than overheated growth.

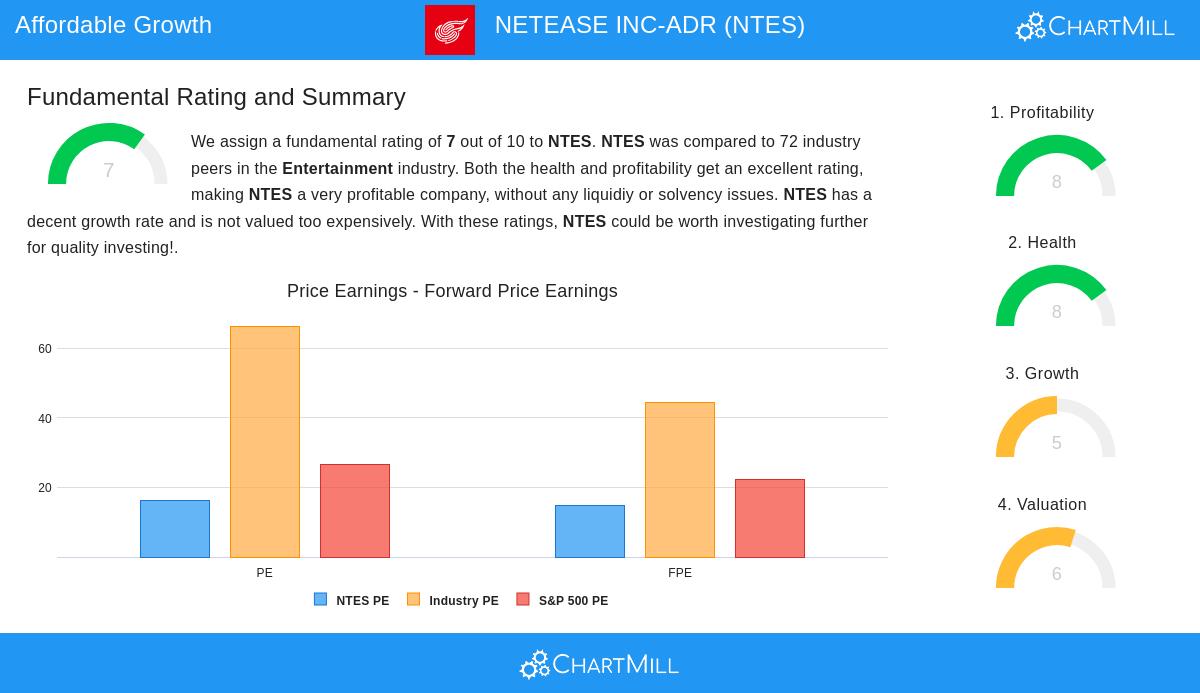

- Attractive Valuation: With a PEG ratio of 0.92 (below Lynch’s threshold of 1), the stock appears reasonably priced relative to its earnings growth. The P/E ratio of 16.1 also compares favorably against industry peers.

- Strong Financial Health: A debt-to-equity ratio of 0.07 reflects minimal reliance on borrowing, well below Lynch’s suggested 0.6 limit. The current ratio of 3.21 further underscores ample liquidity to cover short-term obligations.

- High Profitability: NTES boasts a return on equity (ROE) of 22.5%, exceeding Lynch’s 15% benchmark and ranking in the top tier of its industry.

Fundamental Highlights

Our full analysis rates NTES a 7/10, with standout scores in profitability (8/10) and financial health (8/10). Key strengths include industry-leading operating margins (30.2%) and robust free cash flow. While near-term EPS growth projections are muted, the company’s diversified revenue streams and disciplined balance sheet provide stability.

For investors building a long-term portfolio, NTES represents a balanced mix of growth potential and prudent valuation.

Our Peter Lynch Strategy screener offers more companies meeting these criteria, updated daily.

Disclaimer

This is not investing advice. The observations here are based on current data, but thorough research and personal due diligence are essential before making investment decisions.