With a strategy that emphasized steady earnings growth and a strong market position, Peter Lynch sought out long-term winners. We put NETEASE INC-ADR (NASDAQ:NTES) to the test against his stock-picking rules.

Checking the Peter Lynch growth stock criteria for NETEASE INC-ADR (NASDAQ:NTES)

- The Return on Equity(ROE) of NTES is 21.41%, which is a strong number. This indicates the company's ability to generate favorable returns for shareholders and reflects its effective management of resources.

- Maintaining a Debt-to-Equity ratio of 0.09, NTES demonstrates a conservative financial approach. This signifies the company's focus on minimizing debt burdens while preserving a solid equity position.

- NTES has achieved 17.51 growth in EPS over the past 5 years, reflecting a sustained improvement in earnings performance.

- With a PEG ratio of 0.8, NTES is valued very reasonably for the growth it experiences.

- A Current Ratio of 3.09 suggests that NTES has sufficient assets to cover its short-term liabilities.

Fundamental Analysis Observations

ChartMill assigns a proprietary Fundamental Rating to each stock. The score is computed daily by evaluating various fundamental indicators and properties. The score ranges from 0 to 10.

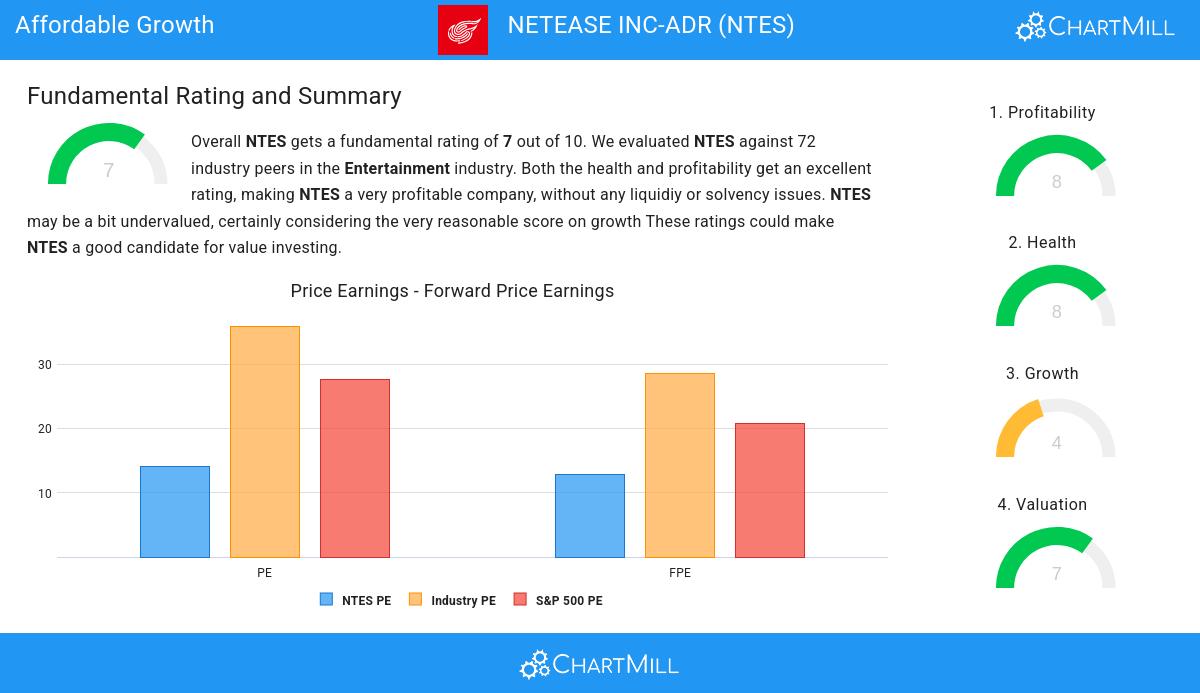

NTES gets a fundamental rating of 7 out of 10. The analysis compared the fundamentals against 72 industry peers in the Entertainment industry. Both the health and profitability get an excellent rating, making NTES a very profitable company, without any liquidiy or solvency issues. A decent growth rate in combination with a cheap valuation! Better keep an eye on NTES. This makes NTES very considerable for value investing!

Our latest full fundamental report of NTES contains the most current fundamental analsysis.

Our Peter Lynch screener lists more Affordable Growth stocks and is updated daily.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.