For investors looking to find undervalued chances, a systematic screening method can be a useful beginning. One example is the "Decent Value" screen, which tries to sort the market for stocks that seem fundamentally inexpensive without being poor investments. The heart of this method is to locate companies where the valuation numbers point to a large discount, while also checking the basic business is sound, earning money, and improving. This pairing is key; a low price by itself can be misleading if the company is weakening. By demanding good scores in financial soundness, earnings, and improvement next to a high valuation score, the screen works to find stocks where the market may be misjudging a strong company, a basic idea of value investing.

A Detailed View of the Basics

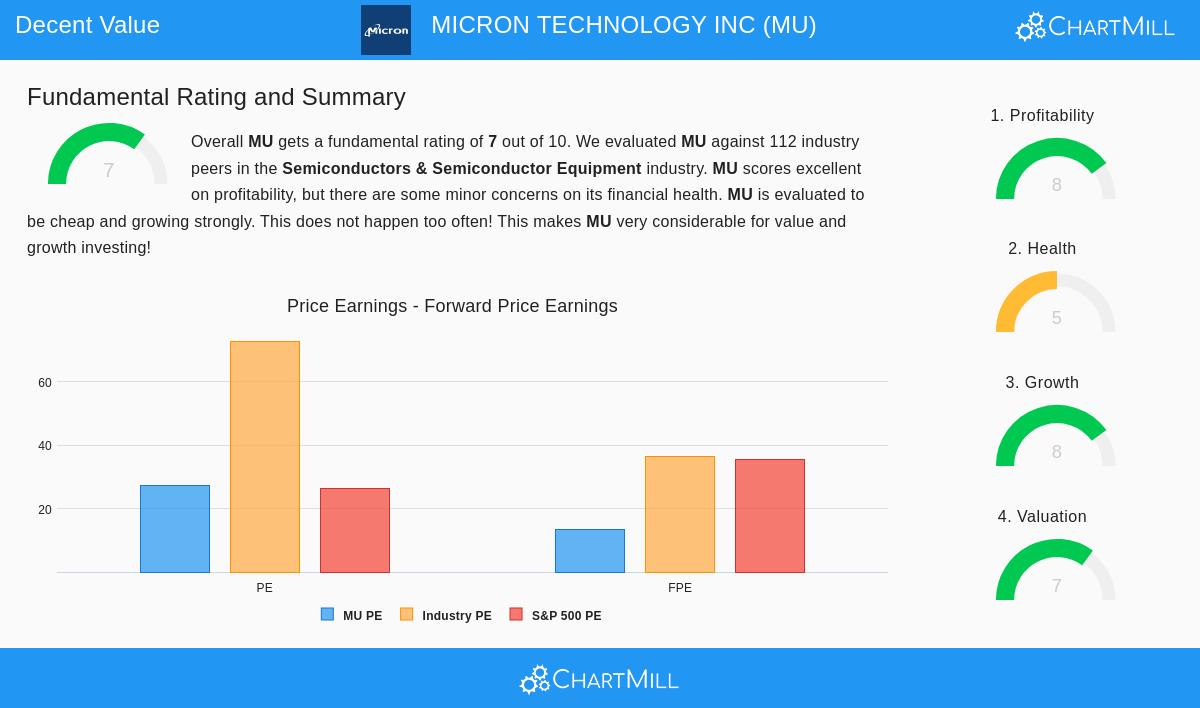

A full fundamental analysis report for Micron Technology Inc. (NASDAQ:MU) shows why it recently passed such a screen. The company, a top provider of memory and storage solutions needed for data centers, AI, and consumer electronics, displays an interesting profile where good operational results meet what seems to be a fair stock price.

Valuation: The Base of the Argument

The main draw for a value-focused screen is, expectedly, the valuation. Micron receives a solid Valuation Score of 7 out of 10. While its standard Price-to-Earnings (P/E) ratio of 27.34 matches the wider S&P 500, the view shifts when seen next to its industry and future-looking numbers.

- Industry View: Compared to similar companies in the Semiconductors & Semiconductor Equipment industry, which has an average P/E above 72, Micron is notably less expensive, doing better than 81% of the sector.

- Future-Looking Numbers: The Price/Forward Earnings ratio of 13.26 is especially meaningful, showing a much lower valuation based on anticipated profits. This ratio is less than 95% of industry rivals and sits under the S&P 500 average.

- Growth Adjustment: The low PEG ratio, which changes the P/E for expected earnings improvement, further hints that the stock's price may not completely account for its future possibility.

For a value investor, these numbers imply the market is valuing Micron cautiously compared to both its industry and its own improvement path, forming a possible buffer.

Earnings and Improvement: The Driver Behind the Value

An inexpensive stock is only a sound purchase if the company is fundamentally healthy and getting larger. Micron scores well here, with an Earnings Score of 8 and an Improvement Score of 8. This means the low valuation is not because of a declining business but could be a chance.

- High Margins: The company has a Profit Margin of 22.84% and an Operating Margin of 26.40%, putting it in the best 15% of its industry. These margins have improved in recent years.

- Good Returns: Returns on Assets, Equity, and Invested Capital are all above 10%, beating over 80% of industry counterparts, which points to effective management and a solid market position.

- Rapid and Steady Improvement: The last year has shown fast improvement, with Earnings Per Share (EPS) rising over 550% and Revenue up almost 49%. Also, the long-term path is positive, with an average yearly EPS improvement of nearly 24% over recent years. Experts forecast continued good revenue and earnings improvement ahead.

This pairing is uncommon and vital for the screening method: it verifies that the company is not only numerically inexpensive but is also a superior, improving business. The value argument is supported by real business power.

Financial Soundness: A Smaller Point to Watch

The screening rules also call for acceptable financial soundness, and here Micron shows a more varied, but okay, view with a Soundness Score of 5. The company is not in trouble, with a strong Altman-Z score showing low failure risk and a workable Debt-to-Equity ratio of 0.26.

- Cash Flow Points: Some cash flow numbers, like the Quick Ratio, are not as strong as many industry peers, and the Debt-to-Free-Cash-Flow ratio is high, meaning it would require time to clear all debt from current cash flow.

- Share Increase: A point for value investors to see is that the count of shares available has grown in the past year and five years, which can lessen current owners' stake.

While these items stop a top soundness score, they are offset by strong stability indicators. For the screen's goal, they are points for an investor to watch instead of clear reasons to avoid, particularly when considered with the company's excellent earnings and improvement.

End Summary

Micron Technology shows the kind of chance a "Decent Value" screen is made to find. It presents a situation where the market's valuation, especially next to its own fast-improving, high-margin industry, seems separate from the company's basic results. The stock seems priced with a buffer, while the basic business shows the earnings and improvement needed to possibly support a higher valuation later. This match of price and quality is the main goal of value investing.

For investors wanting to see other stocks that fit similar rules of acceptable valuation, soundness, earnings, and improvement, you can see the complete list of results from this screening method here.

Disclaimer: This article is for information only and is not financial advice, a suggestion, or an offer or request to buy or sell any securities. The study uses given data and screening methods that may adjust. Investing has risk, including the chance of losing the original amount. You should do your own study and talk with a qualified financial advisor before making any investment choices.