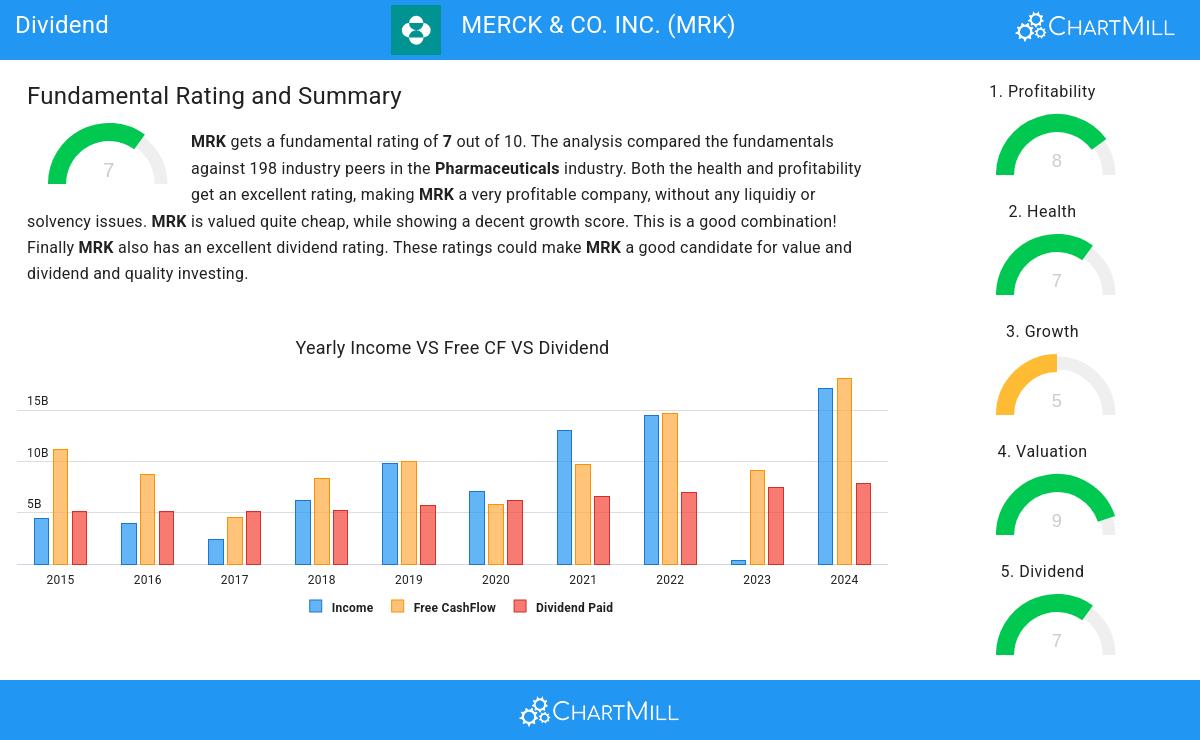

Discover MERCK & CO. INC. (NYSE:MRK)—a stock that our stock screener has recognized as a solid dividend pick with strong fundamentals. MRK showcases decent financial health and profitability while providing a sustainable dividend. We'll explore the specifics further.

Evaluating Dividend: MRK

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. MRK has achieved a 7 out of 10:

- Compared to an average industry Dividend Yield of 4.18, MRK pays a better dividend. On top of this MRK pays more dividend than 94.95% of the companies listed in the same industry.

- MRK's Dividend Yield is rather good when compared to the S&P500 average which is at 2.43.

- On average, the dividend of MRK grows each year by 6.90%, which is quite nice.

- MRK has paid a dividend for at least 10 years, which is a reliable track record.

- MRK has not decreased their dividend for at least 10 years, which is a reliable track record.

Understanding MRK's Health

ChartMill employs its own Health Rating for stock assessment. This rating, ranging from 0 to 10, is calculated by examining various liquidity and solvency ratios. In the case of MRK, the assigned 7 reflects its health status:

- MRK has an Altman-Z score of 3.80. This indicates that MRK is financially healthy and has little risk of bankruptcy at the moment.

- Looking at the Altman-Z score, with a value of 3.80, MRK is in the better half of the industry, outperforming 78.79% of the companies in the same industry.

- MRK has a debt to FCF ratio of 2.05. This is a good value and a sign of high solvency as MRK would need 2.05 years to pay back of all of its debts.

- MRK has a Debt to FCF ratio of 2.05. This is amongst the best in the industry. MRK outperforms 93.43% of its industry peers.

- Even though the debt/equity ratio score it not favorable for MRK, it has very limited outstanding debt, so we won't put too much weight on the DE evaluation.

- MRK does not score too well on the current and quick ratio evaluation. However, as it has excellent solvency and profitability, these ratios do not necessarly indicate liquidity issues and need to be evaluated against the specifics of the business.

Understanding MRK's Profitability

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. MRK scores a 8 out of 10:

- With an excellent Return On Assets value of 14.62%, MRK belongs to the best of the industry, outperforming 96.46% of the companies in the same industry.

- MRK has a better Return On Equity (36.96%) than 96.46% of its industry peers.

- MRK's Return On Invested Capital of 19.77% is amongst the best of the industry. MRK outperforms 93.94% of its industry peers.

- Looking at the Profit Margin, with a value of 26.68%, MRK belongs to the top of the industry, outperforming 95.96% of the companies in the same industry.

- The Operating Margin of MRK (34.59%) is better than 95.45% of its industry peers.

- In the last couple of years the Operating Margin of MRK has grown nicely.

- With an excellent Gross Margin value of 78.19%, MRK belongs to the best of the industry, outperforming 84.85% of the companies in the same industry.

- In the last couple of years the Gross Margin of MRK has grown nicely.

More Best Dividend stocks can be found in our Best Dividend screener.

Our latest full fundamental report of MRK contains the most current fundamental analsysis.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.