MONOLITHIC POWER SYSTEMS INC (NASDAQ:MPWR) was identified by our screener as a strong growth stock with a favorable technical setup. The company combines solid fundamentals with a promising chart pattern, making it worth a closer look.

Strong Fundamentals Support Growth

MPWR stands out with high ratings in key fundamental areas:

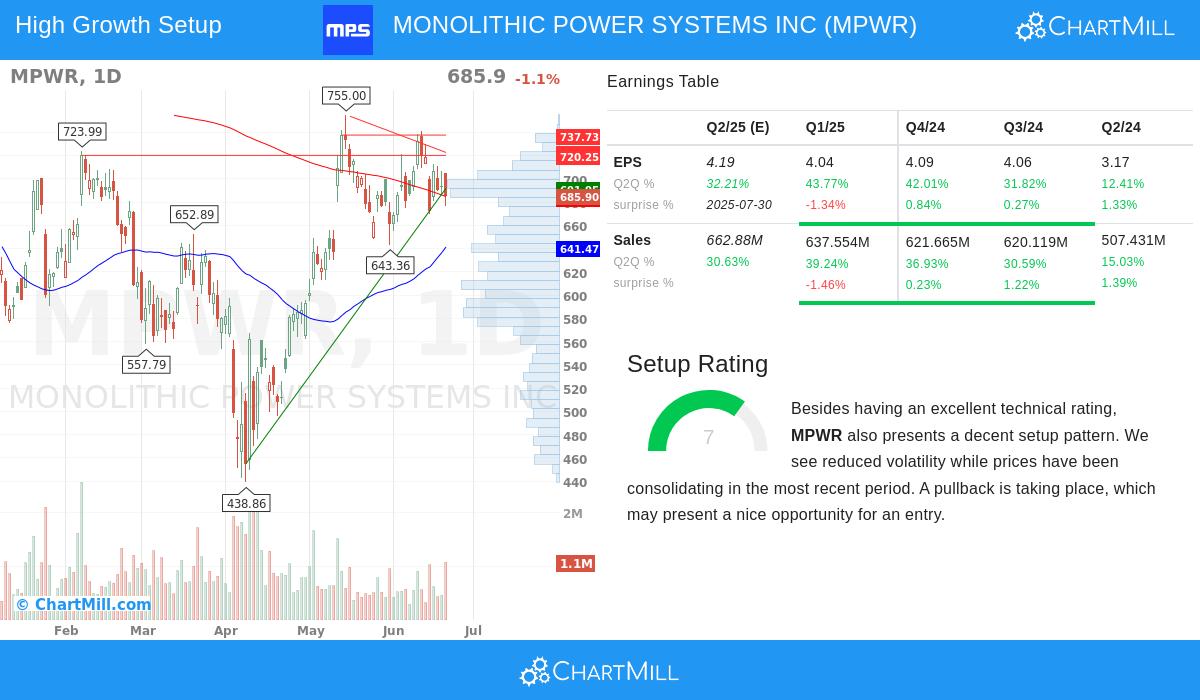

- Growth (8/10): The company has delivered impressive revenue and earnings growth, with past EPS growth averaging 29.5% annually and revenue expanding at 28.6% over recent years. Future growth expectations remain strong, with EPS projected to rise by 18.7% yearly.

- Profitability (9/10): MPWR boasts a 55.95% Return on Equity and a 25.67% Operating Margin, outperforming most peers in the semiconductor industry.

- Financial Health (9/10): The company has no debt and maintains strong liquidity, with a Current Ratio of 4.92 and a Quick Ratio of 3.67, well above industry averages.

While the stock trades at a premium valuation (P/E of 44.65), its high profitability and consistent growth justify the price for investors seeking quality growth stocks.

Technical Setup Suggests Breakout Potential

The technical analysis highlights a constructive setup:

- Consolidation Phase: MPWR has been trading in a range between $643 and $740, showing reduced volatility and potential for a breakout.

- Support & Resistance Levels: Key support sits near $679, while resistance is found around $701. A move above resistance could signal further upside.

- Trend Strength: The long-term trend remains positive, while short-term action is neutral, suggesting a possible continuation or reversal setup.

For traders, a break above $701.43 could serve as an entry point, with a stop-loss near $679.41 to manage risk.

Our Strong Growth Stocks with Good Technical Setup Ratings screener lists more stocks with similar characteristics.

For a deeper dive, review the full fundamental report and technical analysis.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should always conduct your own analysis before making investment decisions.