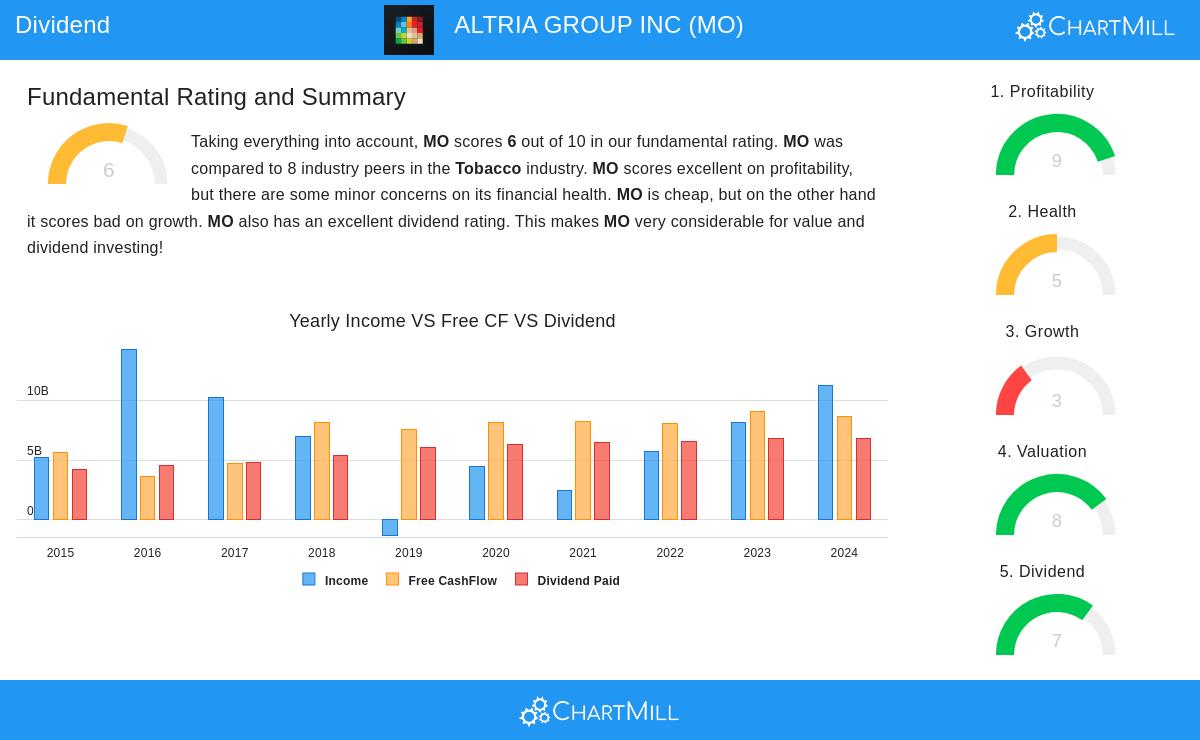

ALTRIA GROUP INC (NYSE:MO) stands out as a compelling choice for dividend investors, according to our Best Dividend Stocks screener. The company combines an attractive dividend yield with solid profitability and reasonable financial health, making it a candidate for income-focused portfolios.

Key Strengths for Dividend Investors

High Dividend Yield

- MO offers a 7.04% dividend yield, well above the industry average of 3.83% and the S&P500 average of 2.35%.

- The company has paid dividends for at least 10 consecutive years without reductions, demonstrating reliability.

Profitability Supports Payouts

- MO earns a ChartMill Profitability Rating of 9/10, reflecting strong margins and returns.

- Its Return on Invested Capital (ROIC) of 36.74% outperforms all industry peers.

- Profit margins (42.97% net, 49.62% operating) are among the best in the tobacco sector.

Reasonable Valuation

- With a P/E ratio of 11.14, MO trades at a discount to both the S&P500 (27.54) and industry peers (17.76).

- The forward P/E of 10.18 suggests further upside potential.

Financial Health Considerations

- MO’s ChartMill Health Rating of 5/10 reflects mixed conditions.

- While its Altman-Z score (4.45) indicates low bankruptcy risk, liquidity metrics (Current Ratio: 0.57) are weak.

- Debt levels are manageable, with a Debt-to-FCF ratio of 3.08, better than 87.5% of peers.

Areas to Monitor

- Payout Ratio (67.18%): High but sustainable given stable earnings.

- Slow Growth: Revenue and EPS growth are modest, but dividend growth (4.03% annually) remains steady.

For a deeper dive, review the full fundamental analysis of MO.

Our Best Dividend Stocks screener provides more high-quality dividend ideas.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.